Heartland Payment Systems Inc. is offering a service that enables merchants to sell prepaid telephone minutes without using traditional plastic calling cards.

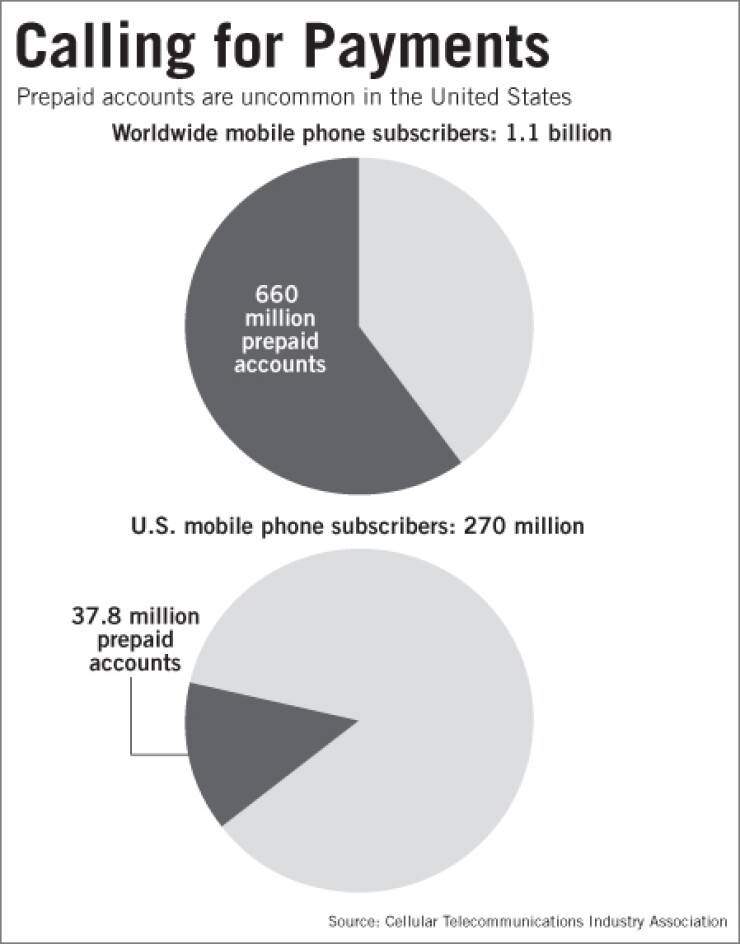

About 60% of the world's 1.1 billion mobile subscribers prepay for their wireless service, according to industry estimates. Most prepaid subscribers are in Europe, but Heartland expects the number to grow in the United States.

Euronet Worldwide Inc.'s Epay unit offers a similar service in Europe, but Heartland claims it is the first processor to offer such a service in this country; the company announced its ePin It service this month.

Heartland's decision to enter the prepaid market for wireless services could help card networks, issuers and merchant acquirers capture a share of these transactions, according to analysts.

Prepaid minutes are now typically purchased by buying a card at a merchant with a code that can be redeemed for airtime.

With Heartland's system, users purchase airtime at a merchant location and receive a receipt with a PIN code. They can redeem the minutes by calling a toll-free number printed on the receipt and entering the PIN.

Consumers pay no service fees for the transaction, and they can purchase time with most major wireless carriers.

To initiate the transaction, cashiers press the prepaid-services button on their payment terminals and enter a cashier identification number, which provides extra security for the merchant, according to Randy Harp, Heartland's senior product sales strategy manager.

The cashier selects the desired provider and the amount. Customers can pay for their minutes with cash or with a credit or debit card.

"In the prepaid wireless arena, the products are pretty much fair-trade," Harp said. "You buy a $10 card, and that card is going to give you $10 worth of value."

The program is ideal for merchants that lack sufficient space to display and store plastic cards, Harp said.

Heartland believes its program is "a very simple way for the merchants to add to their bottom lines," he said.

Merchants can "begin offering products that they might not be offering already and then do it from the same equipment that they're already using for processing payments."

Merchants can download the program software directly to their terminals.

The ePin It application is compatible with VeriFone Holdings Inc.'s Vx500 series of terminals and its Omni 3740/3750 terminals and on Radiant Systems Inc.'s point of sale systems.

About 500 merchants have already signed up for the program, including convenience stores, gas stations, restaurants and dry cleaners, Harp said.

Adil Moussa, an analyst at Boston market research company Aite Group LLC, called Heartland's decision to move into prepaid airtime a "brilliant idea."

"There is a whole segment, and subsegments, of the population that is going into" prepaid wireless and long-distance minutes, he said.

More than 270 million consumers subscribed to wireless service in the United States at the end of 2008, according to the Cellular Telecommunications Industry Association.

Harp estimated that about 14% of those subscribers prepay for their service.

Card networks currently do not have a big share of the wireless service payments market, he said, because most are made through the automated clearing house system.

"You may see other [processors] start to develop applications for this and have them downloaded to a terminal," he said.

Euronet already has a strong presence in other countries. It offers mobile top-up purchases at approximately 421,000 point of sale terminals across approximately 227,000 retailer locations in 20 countries, including Australia, Malaysia and the United Kingdom, according to the company's Web site.

Merchant feedback about Heartland's program has been positive, Harp said.

"It's a broad array of products," he said. "Almost any prepaid wireless user would find their product available at a Heartland merchant that is participating in this program."

Heartland plans to explore other prepaid options but Harp would not provide any details. "The program is very amenable to changes, so we can add products and expand the offerings," he said.