Is Herald National Bank flying too close to the sun?

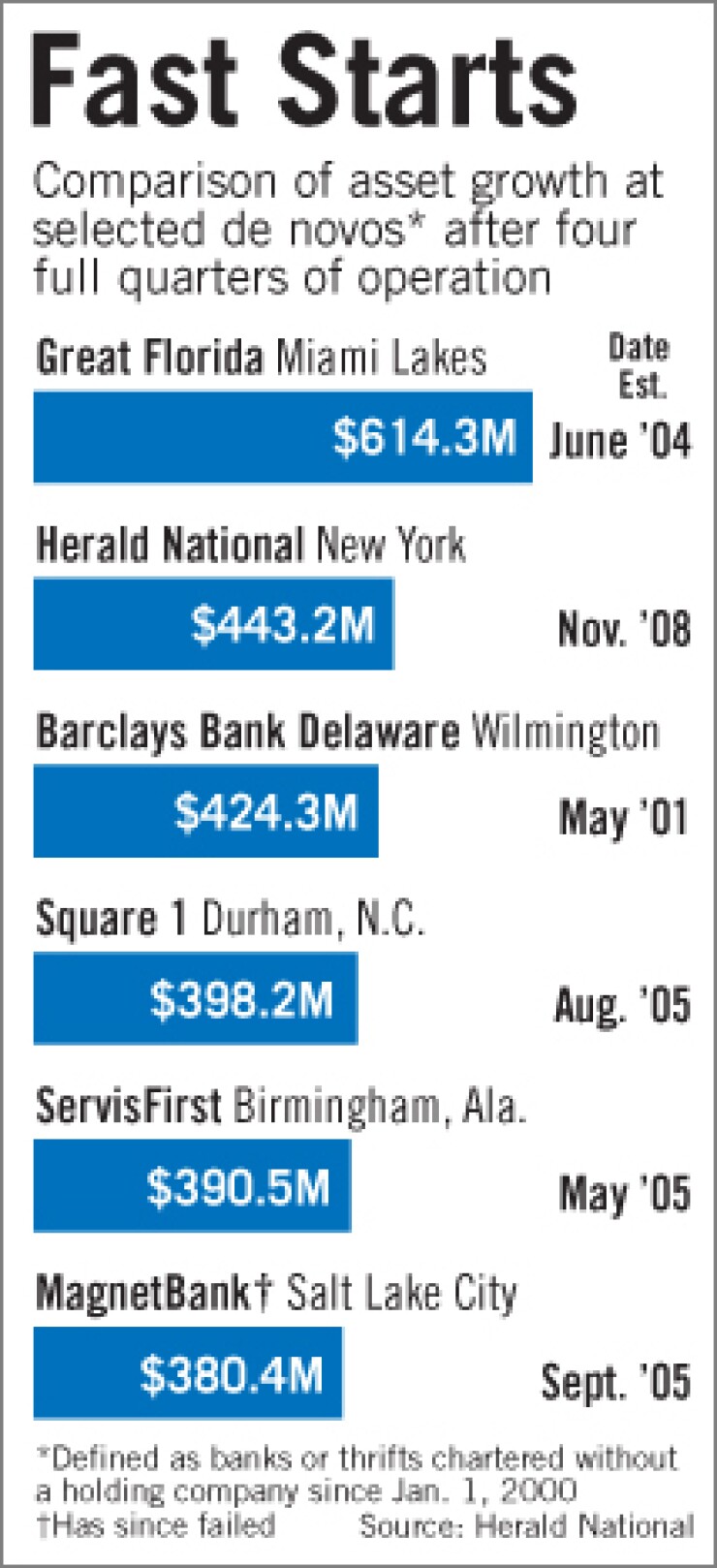

For the New York bank, 2009 — its first year — was one for the record books. While many other community banks were tempering growth or even shrinking, the $433 million-asset start-up grew faster in its first year than had almost any other U.S. bank established over the past decade.

Whether Herald can sustain that pace of growth, and make money, is another matter. Herald opened Nov. 24, 2008, with more than $62 million of capital — just as the financial industry entered one of the worst crises in history. By the end of 2009, Herald had lost $41.4 million, according to the Federal Deposit Insurance Corp.

"They raised a lot of capital, but they are also going through it at a very rapid clip," said Suzanne Moot, a banking consultant with M&M Associates in Milton, Mass. "At the rate they are going, it is going to take some time where they are not experiencing those losses."

David Bagatelle, Herald's president and chief executive, acknowledged in an interview, without giving specific projections, that the torrid pace of growth will not be replicated this year. But he says he still expects profits in 2010.

"Frankly, because of our feeling on the economy right now, we are going to slow our growth down and going to focus on getting to profitability as quickly as possible," he said. "We won't see the same level of growth in 2010 as we did in 2009. The regulatory environment is challenging. We feel more comfortable at a slower clip, but still growing at a pace that would make most banks envious."

Industry watchers said that would be an outstanding accomplishment for a couple of reasons: Most start-ups take roughly three years to reach profitability — even in good economic cycles — and Herald has eaten away quite a bit of its capital in its first year with larger-than-usual losses. The bank, to its credit, has narrowed its losses, for example, to $3.7 million in the fourth quarter from $5.5 million in the third quarter.

John Carusone, the president of Bank Analysis Center Inc., said most start-up banks he works with take longer to reach profitability.

"The traditional break-even point is three years for a start-up bank," he said. "It is unusual to be profitable in year one, and profitability in year one doesn't necessarily mean profitability in year two. The most important factor is the ability of management to negotiate their way through an economic storm and still grow the business."

Moot pointed to Herald's higher-than-typical expenses associated with employee salaries and benefits as one of the big factors behind Herald's latest loss. Herald reported paying its 97 employees $17.4 million in 2009, or an average of about $179,000 per employee annually.

Bagatelle, who helped found Signature Bank in New York, which opened in 2001 and has grown to more than $8 billion of assets, said hiring experienced lending teams from other banking companies is a key component of Herald's growth strategy and has enabled the bank to quickly book the high-quality loans.

"Our model is middle-market private banking," he said. "We grow by lifting out high-quality, top professionals from competitors who have relationships with clients, and we bring them over here and they bring their relationships with them. Our bankers come from most of our competitors in the marketplace."

The strategy is "an expensive proposition" in the start-up phase but the company considers it the "cornerstone to growth, and their long-term compensation as our advertising budget."

Since opening, Herald has hired 10 banking teams, with the average banker bringing 25 years of experience. Those bankers have made it possible to move the best customers in the market, and while the bankers brought in a plethora of loans, bringing in deposits is an important factor in how they are compensated, he said.

"We are not transactional or credit-centric," Bagatelle said. "Our bankers lead with the relationship and lead with deposits."

Carusone said that strategy may lead to quick growth in the near term, but it may be tough to sustain such growth.

"In this economy you gain market share by taking away from someone else because the economy itself is not growing right now," he said. "So buying talent and having talent bring in a book of business is a strategy for the short term, but it doesn't guarantee long-term success. But it is a way to grow fast."

M&M's Moot said it is a good idea for Herald to focus on customers with deposit relationships.

"That's a smart way to do it in my opinion," she said. "Deposits are very valuable, arguably more valuable than loans. It looks like they are being successful in that regard because the profile of these loans is not startlingly risky."

More than half of Herald's $326 million of deposits are held in money market accounts and about a third are held in transactional accounts.

Carusone said the most important factor for any new bank navigating today's economy is an experienced management team.

"Everything turns on the ability of management in this economy and in the start-up banking operation," he said. "If they are experienced and have a lot of capital and know how to underwrite properly, then the world is their oyster."

So far, Herald's loan portfolio is holding up well. The ratio of nonperforming loans to total loans was 0.42% at the end of December.