![DSC_0142[1].JPG](https://arizent.brightspotcdn.com/dims4/default/9b9367f/2147483647/strip/true/crop/6000x4000+0+0/resize/740x493!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F2c%2F3e%2F785d353e4320a75ce6e3f29895a2%2Fdsc-01421.JPG)

BALTIMORE — The Waverly Ace Hardware store in northeast Baltimore is abuzz with activity — paint being mixed and sealed, its smell blending with the scents of fertilizer and lumber that mark every hardware store. Employees listen to customers explain their extraordinarily specific home improvement problems, parents steer their kids away from the toys and lollipops as they approach the checkout — only to come back later to buy them as stocking stuffers.

There's something enticing about the hardware store — it's a place where visions become reality, where you can buy not only wrenches and caulk, but the satisfaction of a job well done (though individual results may vary). It's a store, but it's not just a store.

And in this case, Waverly Ace Hardware is a different kind of not-just-a-store — it's employee owned, meaning each of the store's employees own a piece of it. And it's one of many, many similar small businesses around the country that are turning to employee ownership not only as a means of attracting and retaining talent, but also to keep those businesses financially healthy for years to come.

In Waverly Ace's case, that transition to employee ownership started in 2021, when the store's owners decided to sell their stores to their employees with something called an employee stock ownership plan, or ESOP. Pat Berberich, the store's manager, said that shift makes a real difference in how workers view their jobs.

"I have a larger stake in my work. I'm happy coming to work. I'm into it, I think it's cool," Berberich said. "Prior to [being] employee owned, there was profit-share, but this is much better. The longer you work here, the more vested in company stock you get. It turns it into … it's not just a paycheck. It's retirement, basically."

'A company of peers'

While most people may not feel this same sense of excitement about hardware stores, most people probably do feel that way about some kind of business or store — maybe it's a coffee shop, a bookstore or a bar. And in the last couple of years, more and more businesses of all kinds are deciding that the best way for their company to continue to function is to transition to employee ownership.

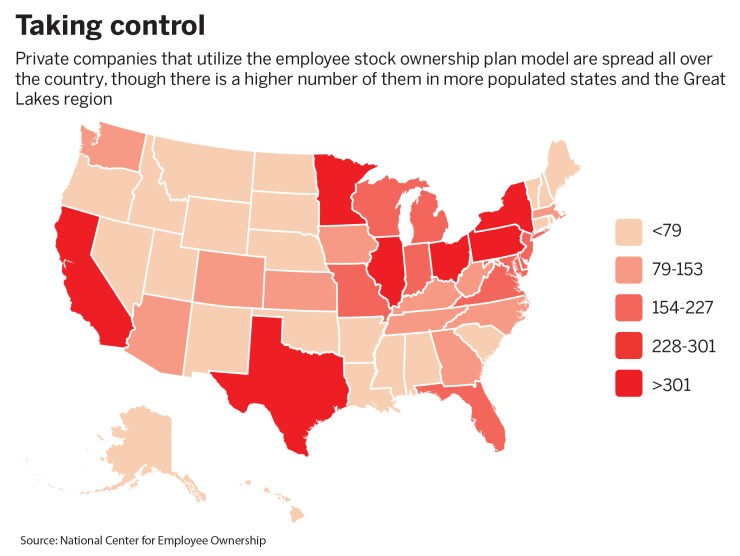

The overall volume of employee-owned businesses is still relatively small — they number in the thousands, and

But there is at least anecdotal evidence that that number has already started to rise because of the COVID pandemic and as more and more baby boomers look to retire and sell their businesses.

This trend is also not limited to brick-and-mortar retail operations. Josh Golden, founder and chair of TXI, a boutique software consultancy based in Chicago, said he opted to undertake an ESOP model in large part because it was a way to actualize a sense of egalitarianism that the company has always strived for since its incorporation.

"Right from the get-go, the company was a company of peers," Golden said. "Like any young founder, I made mistakes about giving this person equity when I shouldn't have, then trying to figure it out — it wasn't systematic."

"Employee owned" is a term that requires a little unpacking. There are a couple of different ways that a company can become employee owned, but the main varieties we're talking about here are ESOPs and co-ops.

The end result for both a co-op and an ESOP are the same: If you work at John's Hardware Store, you are a part owner in that store, and when profits are up, it is your profits that are up. And when profits are down, your profits — and the value of your share of the store — are down. But there are some important differences.

Co-ops, as a general matter, tend to be smaller, with maybe 10 to 20 employee-owners, like a coffee shop or a bookstore. Co-ops are often established as cooperatives, and the employee-owners often put up the capital to create the business. ESOPs, by contrast, tend to be bigger — say 100 or more employee-owners — and generally are converted from traditional business models to ESOPs. And the process of undertaking an ESOP is quite involved.

If I am selling John's Hardware Store to my employees, someone — often a commercial or investment bank, sometimes a nonbank firm — puts up capital to buy the store from me, and then divides it into and disburses shares to the prospective employee-owners.

Over some defined period — say, five years — the profits of the store will go to paying back whoever put up the capital, and at the end of that period the owners' shares will be vested and profits will then go to them. But actual ESOPs are much, much more complicated than that. Matt Nels, a managing director with Menke and Associates, a firm that specializes in ESOP transitions, said specific transitions can be highly variable from one to another in terms of how much of the business is being distributed to employees, how convertible the shares are and how long it takes for them to vest. But that variability is actually a feature, not a bug, he said.

"It's not an all-or-none proposition — you could sell 5, 10, 30% to the ESOP if you want to — which is hard to do [through other means]," Nels said. "It's hard to find someone that's willing to come in as a minority shareholder in a business. And an ESOP is willing to do that."

But there are some things that are not negotiable in an ESOP. One is that the ESOP share price has to be based on a fair-market valuation of the business. That means the owner likely has to accept lower proceeds from the sale than they might otherwise get on the open market — in an outright sale to a competitor, for example. Another is that every aspect of the process for setting the terms of the ESOP and the trust have to be arms-length negotiations.

"I experienced the negotiation as a much more bona fide negotiation than I expected it to be," Golden said. "I was not prepared for how thoroughly and how directly this negotiation occurred. It actually left me feeling like a good tennis match — we really left it out there. We did our thing, we played for real. It wasn't making a show of it."

But there are considerable benefits to the ESOP model as well, most notably that owners who sell to an ESOP defer any capital gains taxes they might otherwise have to pay, and the post-ESOP business is also exempt from paying virtually all federal taxes.

"For S corporations, if the ESOP is the sole shareholder, it doesn't have any tax obligations, and quite a few states recognize that as well, so there isn't any state tax either," Nels said.

"That's a significant amount of cash flow that would be going to Uncle Sam every year that stays in the business. It can be used to pay down debt, make acquisitions, expand service or product offerings. It's really a tremendous benefit to go that route," he added.

But while there are considerable financial benefits and flexibility offered to business owners who want to pursue an ESOP, the specifics of those benefits can vary, and employee ownership is not necessarily synonymous with giving employees more of a say in how the business is run.

Julian McKinley, co-executive director of the Democracy at Work Institute — a think tank centered on promoting employee empowerment — said that element is far more prevalent in cooperative business models than in ESOPs, and those differences can be felt in a myriad of different ways.

"Participation can look like many different things," McKinley said. "It could look like having representation of your employees on the board. It could also look like having your employees contribute to policies within a company, such as pay, such as annual raises, such as workplace safety. And so all of those things aren't necessarily guaranteed with an ESOP. There are ESOPs who incorporate those pieces, but again, not guaranteed."

But while the co-op model is more democratic and the employees' voices more essential to the functioning of the business, there are drawbacks as well.

For one, just as there are certain conditions necessary for an ESOP to work, there are critical conditions for a cooperative model to work as well — co-ops tend to be smaller and require a workforce that is sufficiently engaged. Co-ops also don't have the same tax advantages as ESOPs and also don't have the same ease of access to capital that ESOPs enjoy.

"ESOPs generally have far less issue accessing loans from banks to support your business growth or what have you," McKinley said. "Worker cooperatives are a little bit different, because of the emphasis on shared ownership and the personal guarantees that are required to access business loans, either for startup or growth. There was a bill passed in 2018, the Main Street Employee Ownership Act, which reduced the bar of entry for small businesses to be able to access SBA loans, specifically ESOPs and worker cooperatives.

"Still, we're finding that with banks in particular, it's a little bit of a challenge, providing loans to worker cooperatives," McKinley continued. "Basically, they're looking at a group of five individuals and saying, 'Hey, I need one person to be the owner here so we can administer this loan' — as opposed to there being five people. What I would encourage banks to do is take a look at, like, some of the track record of lending that is currently taking place."

That is increasingly important, because the number of employee-owned businesses is growing, and very likely will continue to grow into the future. Steve Kuhn, a veteran banker who runs the ESOP finance group at Fifth Third Bank, said that a combination of increased awareness of employee ownership and the expected retirement of millions of baby boomers from the workforce is creating the conditions for a wave of ESOP transitions over the next several years.

"If you're a business owner today, your choices are I can sell it to a strategic, I can sell it to a private equity firm, I can sell to my management team, or I can sell it to an ESOP," Kuhn said. "And what drives the sale to an ESOP for the most part is if an owner of a business wants to reward the employees. Typically, if an owner is not looking to get all of his money upfront in the sale — that's really what drives ESOPs. It's usually an owner that wants a liquidity event, maybe wants to stay involved for a while, but really wants to reward his employees," he added.

Pat Stoltz, an ESOP finance specialist with Wintrust, said as more and more businesses pursue ESOP sales, the more other businesses become aware of the possibility and there are more professional managers available to help them decide if employee ownership will work for them.

"Thirteen, 14 years ago, it wasn't as robust," Stoltz said. "The quality of the education from all professionals over the last 15 years has stepped up to the point where I think business owners can really more quickly gauge whether or not this is the right alternative for them. And I think there's been some momentum with that — there certainly are drivers in the population, the age of the population, the baby boomer population, certainly, the data behind all of that is really great.

"We've seen a very steady level of activity and new implementation, new ESOP implementation activity, and also some mature ESOPs that just continue to have financing needs," Stoltz added. "We've seen a very, very consistent activity level within our practice."

'A niche type of lending'

One of the critical pieces to the ESOP puzzle is capital, and in many cases that capital is put up by banks. Menke, for example, is an investment bank, whereas Fifth Third is a midsize regional bank and Wintrust is a holding company that runs a portfolio of community banks. But it's not something that everybody does — it's a niche market, and is likely to remain so.

"I think most banks are probably aware of ESOPs, [but] it really is a niche type of lending," Kuhn said. "At the bank level, we're not experts on tax and the structure and all those types of things. We're really more experts on loan structuring and that type of thing. From a bank perspective, you really have to engage an advisor early, because there's so many different nuances and structure ways for an ESOP. And the advisors can do the feasibility study and figure out what's the best way to proceed."

Those relationships with experts in the ESOP trenches have secondary benefits as well, namely by allowing small-business clients to stay as their needs and business model changes.

"Where banks are getting more involved, as they're seeing their clients sell, and they're typically getting a phone call saying, 'Hey, we're going to pay your loan off,' and the banker ends up saying, 'What are you doing? Are you going to another bank?' And they say, 'We're selling our business to either a strategic buyer or private equity.' And the bank oftentimes doesn't even know that their client was entertaining transitioning the business. I think the banks that are doing this successfully are bringing this as a value-add. How can we help you if this is something that is important to you to transition your business efficiently, and how can we help bridge the gap? If you're going to sell your business one time in your life, you should really be astute on all of the options available to you."

In other words, part of the point of facilitating companies toward employee ownership is because it allows a bank to continue to have a relationship with the business. But that's not the only reason: ESOP conversions are also pretty low-risk for the bank. The National Center for Employee Ownership

"It's a really strong level of commitment from the employee base," Stoltz said. "An ESOP is a really great rewarding tool, a really great retention tool. I think there's just a lot of accountability with the employee base to make things work better tomorrow than they did today. And the other piece is, there's just not a lot of interruption in the business model."

The other intangible benefit to employee ownership is to the communities that the businesses serve by allowing them to continue to operate efficiently by making the business itself a worthwhile investment of time and labor for the people who run it. What results is, in most cases, a business that continues to thrive — and for many retiring business owners, that's worth more than money.

"At the community level, when you have businesses that are in danger of closing, the employee ownership, again, provides an opportunity for that business to stay in a community to continue to provide those services," McKinley said. "We know that this in particular is a critical need. More than 80% of business owners

"There's also an equity component here," McKinley continued. "That is creating opportunities for people who otherwise would not have them to build wealth, to afford things like sending their kids to college, like putting a down payment on a home, creating more stable lives for themselves. And frankly, it's a, you know, it's a benefit that they deserve, based on the value that they create for a business through their labor.