Community bank investors appear to be getting more sophisticated, relying on more data than financial statements.

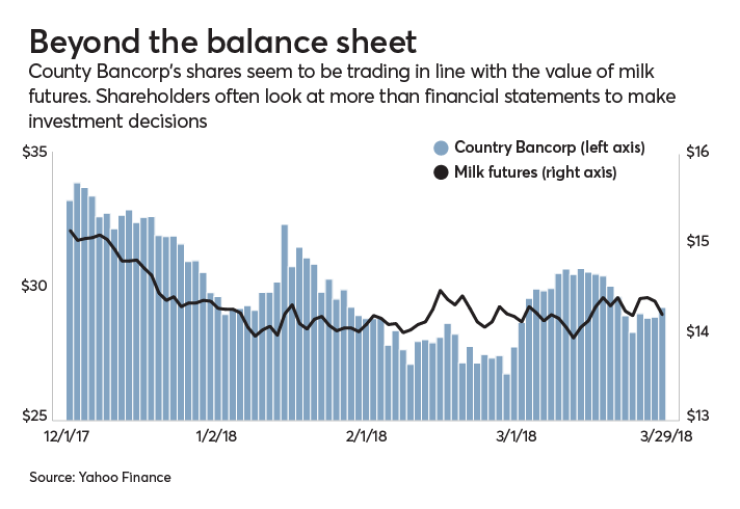

Take County Bancorp in Manitowoc, Wis., for example. The $1.4 billion-asset company's stock has been on a wild ride since late last year, plummeting by 18% between early December and late February before bouncing back by nearly 14% in recent weeks.

While it is still a hypothesis, Joseph Fenech at Hovde Group recently argued that a correlation exists between County's stock price and the volatility in milk prices. (County primarily lends to Wisconsin’s agriculture businesses, especially dairy farms.)

Banks with a focus on oil-producing areas are also familiar with the ups and downs that their stocks have endured as oil prices fluctuate.

“More institutional investors are returning to the small-bank space and are thinking about the geographic risks that exist,” said Anton Schutz, a portfolio manager at RMB Capital.

“If you're in an agriculture place ... or an energy-producing region, there are different opportunities and risks," Schutz added. "If you're in a high-tax state, there are different risks. In a low-tax state, there are different opportunities.”

More experienced firms, including institutional investors, are interested in the community banks now compared to before the financial crisis, when the area largely consisted of retail investors. Regional economics and trends are critical factors for sophisticated firms looking to place their money, said Chris Marinac, an analyst at FIG Partners.

“Banks are mirrors of the communities they serve,” Marinac said. “When you're a bank in a single region or town, how that town goes is how the bank goes. We saw that all over the place in the [last] recession. It still happens. If a plant closes or something unusual occurs, it really does matter.”

A larger number of hedge funds are also investing in community banks, said Bob Wagner, a managing member of Three Rivers Fund Advisors. Consolidation among smaller banks is shrinking the number of potential investments, creating more competition on a national basis to find good opportunities, he added.

“It wouldn’t surprise me if they’re looking at a lot of different metrics to try to justify an investment,” Wagner said.

Beyond economic data and research, some investors keep other non-financial factors in mind, including the ages of executive leadership, said Charles Crowley, a managing director with Boenning & Scattergood. A CEO nearing retirement could present opportunities — or uncertainty and elevated risk — for a community bank.

Greater access to information allows investors to consider several data points and angles while researching potential investments, industry experts said.

“I think investors have a better handle on what's going on and [can spot] the things that impact the valuations of the community banks,” said Jeffery Smith, a partner at Vorys, a law firm in Columbus, Ohio.

As a result, management teams are sharing more details and information in public disclosures today compared to 25 years ago, Marinac said. Executives are also spending more time coaching investors on the nuances of their business models, especially if it appears as though the bank has an outsize exposure to one region or industry.

For instance, County mentioned the word "dairy" about 30 times in its latest annual report.

“Although we attempt to maintain a diversified customer base and a diversified loan portfolio, we are more heavily dependent upon the agricultural economy than a typical commercial bank,” the bank said in its March 15 filing.

County has been through many cycles in the agricultural sector, which accounts for about 60% of its loans, said Timothy Schneider, the company's president and CEO. The company is transparent with investors and frequently shares updates on the agriculture climate in filings and releases, he added.

"I've been clear that the agriculture climate, especially from a dairy perspective, has had challenges," Schneider said. "We are working through those with clients, as we have through other cycles."

Banks are really thinking about the impact of their business models and how to properly communicate with shareholders, Marinac said. “It’s nice, because even if [analysts] don’t agree, we understand where the bank is coming from and it becomes a basis for further conversation,” he said.

County’s milk predicament also serves as a reminder that banks with high loan concentrations or exposures in particular industries are more at risk to be impacted by relevant macroeconomic conditions, said Tony Plath, a finance professor at the University of North Carolina at Charlotte.

“That's one reason why community banks pay a great deal of attention to their loan concentrations and exposures, and bank boards monitor this information for regulatory compliance and risk management purposes all the time,” Plath said.