-

Lured by growth opportunities and low M&A prices, mid-cap banks in neighboring states are pushing deeper into the failure-ravaged Southeast and remapping the region's competitive landscape.

August 1 -

The California company received the FDIC's blessing to sell 11 loans covered by loss-sharing arrangements. Industry observers believe more sales could take place now that this deal has been cleared to take place.

July 20 -

FDIC loss-sharing deals are significantly down this year as failures get smaller, bidders become more competitive and the economic situation improves.

July 2

Failed-bank acquisitions have been cheap, but they certainly haven't been easy.

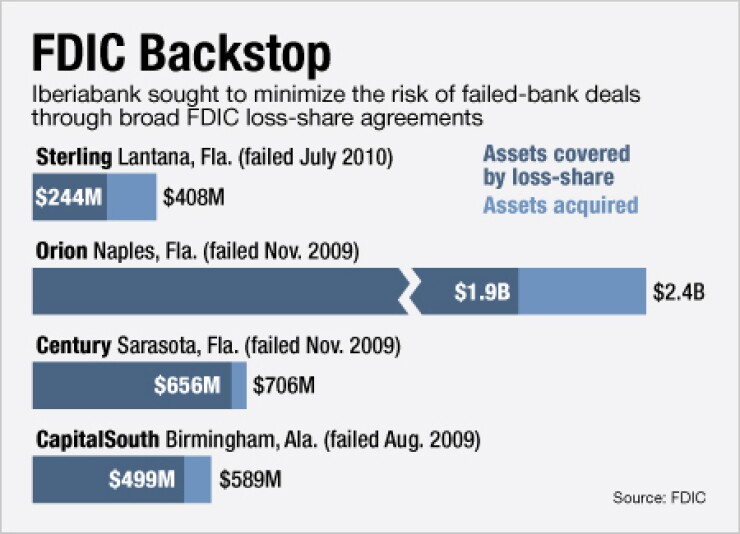

Iberiabank (IBKC) in Lafayette, La., announced Monday that its first quarter results would include a $32 million impairment charge related to its acquisitions of four failed banks in the Southeast in 2009 and 2010.

It is revaluing its indemnification asset, the pot of cash it expects to recoup from the Federal Deposit Insurance Corp. to cover losses on loans made by the failed banks. With its impairment charge, Iberiabank is saying that it expects to receive less money from the FDIC.

The impairment, along with a restructuring of the $13 billion-asset company's amortization table for the loss-share agreements to comply with new accounting rules, are the latest wrinkle in a complicated process to resolve failed banks and keep their assets in the banking sector.

The deals have made money for the acquirers. Iberiabank, for instance, has reported $243 million of up-front gains from the bargain-priced acquisitions. Meanwhile, the deals have taken institutions into new markets and

"These highly accretive acquisitions provided us tremendous franchises in Florida and Alabama with favorable prospects for future growth and significant downside protection," Daryl Byrd, chief executive of Iberiabank, said in a conference call with analysts on Monday. "While there are huge benefits for having been in the FDIC-assisted deal process,

One of the drawbacks is the timeline. The agreements allow buyers to file loss claims on commercial loans within five years. That five-year deadline is quickly approaching for the early takers. Banks spent the first years trying to work out the assets, and observers say their focus has turned to estimating the losses yet to surface and the best way to limit their risk after the deadline passes. That is likely what prompted Iberiabank's adjustment, industry experts say. "There is a lot of concern about how the FDIC is going to approach the end of loss-share," says Pat Jackson, the CEO of Sabal Financial Group, a Newport Beach, Calif., commercial investor and advisory firm. "They want to know how they are going to get these assets off the books and not get stuck holding the bag filled with losses still to come."

"The FDIC expects that each [buyer] will continue to use its best efforts to maximize collections and should not rely on portfolio sales as the primary resolution strategy for shared-loss assets," Pamela J. Farwig, the deputy director of the FDIC's division of receiverships and resolutions, said in a letter to CEOs on Oct. 9. "The FDIC is unlikely to consent to any portfolio sale involving nonperforming assets with limited prior collection activity if the [buyer] cannot document prior best efforts to maximize collections."

Iberiabank cited the inability to do bulk sales as part of the reason for the writedown. Byrd was unavailable for an interview, a company spokeswoman said.

The writedowns offer some good news. When the deals were being structured, the banks were conservative in their expectations on losses, observers say. A decrease to the expected pool is potentially a good thing because it means some

"Think of it like this: you were expecting five dollars from the FDIC, but now you're getting four dollars from them," says Chris Marinac, an analyst at FIG Partners. "You are still likely going to get that other buck from the borrower, you just can't recognize it today — you recognize it over the life of the loan."

Other analysts agreed.

"This changes the value of the indemnification asset, but I don't think it is all bad news," says Terry McEvoy, an analyst at Oppenheimer. "If loans are performing better than expected, these buyers are left with more healthy borrowers, and that is a good thing in this asset-starved environment." Iberiabank acknowledged the improvement in the call, too.

"During March of this year, we updated our timing and credit assumptions based on the most current economic condition in the areas where the covered loans reside," Anthony Restel, the chief financial officer, said on the call. "Overall economic condition in Florida, where the majority of our covered assets reside, continues to improve and that improvement continues to be reflected in an overall improvement in credit quality."