It seems that no matter what New York Community Bancorp does to clarify its balance sheet positioning, it winds up with the opposite result.

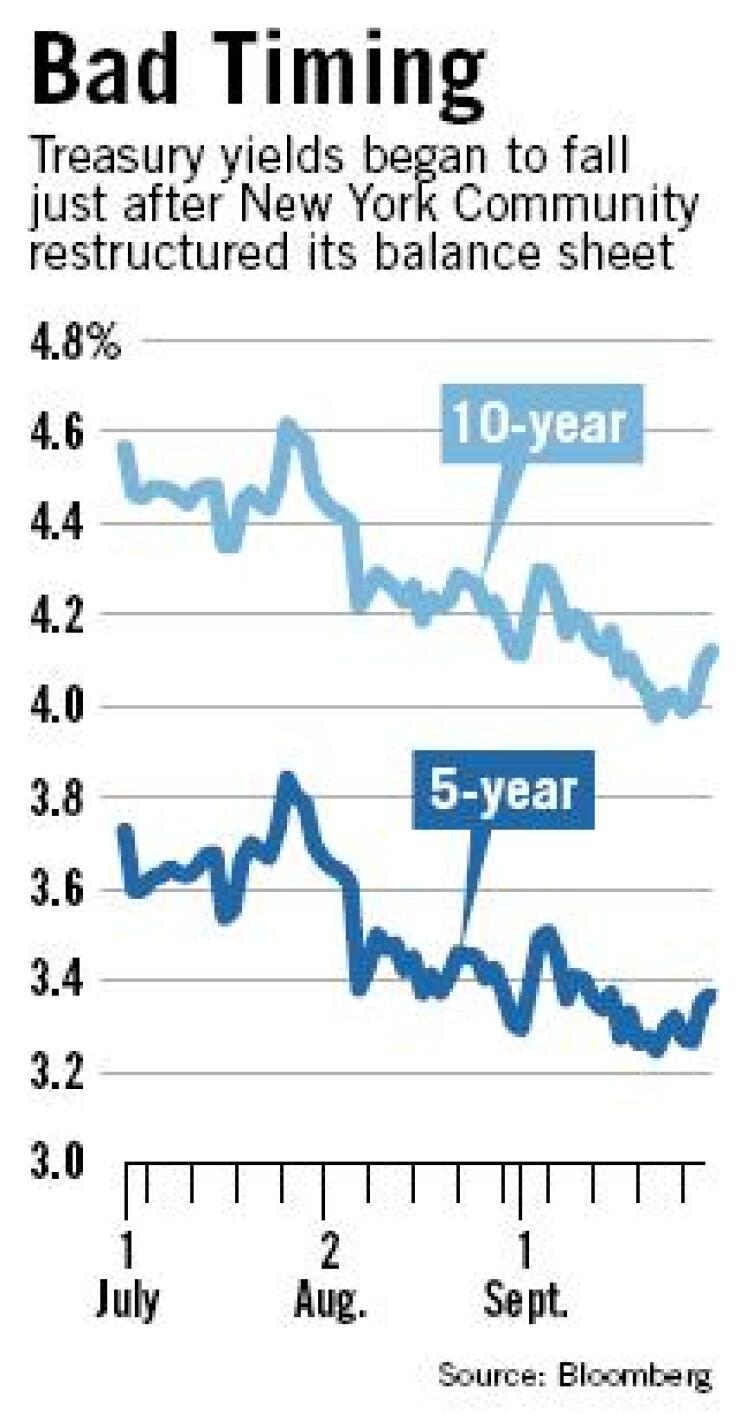

Having failed to draw a buyer, it initiated a massive sale of investment securities in the second quarter to prepare its balance sheet for rising interest rates. In an ironic twist, rates started falling in June just as New York Community was dumping $5 billion of securities at a loss of $95 million.

Now the Westbury, N.Y., thrift company could be looking at unrealized gains from what remains of its investment portfolio, and cash flow from the remaining securities is increasing as they mature more rapidly.

Joseph R. Ficalora, its president and chief executive officer, said in an interview last week that he has not changed his mind about having a smaller securities portfolio. Nor does he regret his July pledge to rely less on cash flow from the investment securities and wholesale borrowings and more on deposit growth to make loans.

However, Mr. Ficalora conceded, "Do I feel better that rates are down? No."

Several analysts say lower interest rates are hurting net interest margins. In the second quarter New York Community's margins shrank 18 basis points from a year earlier, to 3.83%.

On Sept. 21, Mark Fitzgibbon, the director of research at Sandler O'Neill & Partners LP, cut his full-year earnings per share estimate for New York Community by 3 cents, to $1.41. He cited the lower rate environment.

Two days later Peter J. Winter of Axa SA's Advest Inc. reduced his estimate by 4 cents, to $1.78, for the same reason.

The average estimate for full-year earnings per share is $1.79, according to Thomson First Call.

Shares of New York Community fell by just over half from a 52-week high on March 1 to a 52-week low of $17.62 on July 2. Since then they have risen 4.2%.

New York Community is not the only company that could feel some pain should rates stay low. Matthew D. O'Connor, an analyst at Citigroup Inc.'s Smith Barney, wrote in a research note Monday that bank earnings could fall 2% to 3% next year if rates do not go up.

Mr. Ficalora said he could not discuss third-quarter earnings, which his company will report in the coming weeks. But in the interview he repeatedly expressed confidence that rising loan volumes could temper margin shrinkage.

The yield of the five-year Treasury note, the benchmark for much of New York Community's loan book, has dropped 34 basis points since the restructuring was announced July 1, to 3.39%, after rising 48 basis points between Jan. 1 and July 1.

Mr. Ficalora told investors at a conference on Martha's Vineyard this week that he expects his company's loan portfolio to increase 25%. Loan originations in the first half more than doubled from a year earlier, to $3.2 billion.

With low rates, "the cash flow that comes as a result of mortgage-backed securities paying off during periods when rates are at this level are greater," so there could be more money to satisfy loan demand, he said in the interview.

Falling rates also would improve the quarterly mark-to-market of the portfolio. New York Community posted an unrealized loss of $84.4 million for the second quarter to adjust the value of its $8.5 billion of securities, but it may be able to post a gain for the third, Mr. Ficalora said.

Also, tangible capital levels "will be much more favorable, and our capital position" will improve as a result of the near-term rate change, he said.

New York Community has already stepped up its efforts to finance more of its loans with deposits. Last year it gave away two Cadillacs to big-ticket depositors, and this year it is giving away three Pontiacs. He did not say what size deposit would be enough to receive a car, or how much the campaign has raised in deposits thus far.

Asked whether New York Community is aggressive in pricing deposits, Mr. Ficalora said the rates he will pay are in line with those of other Long Island banks.

Still, because New York Community now has a smaller securities portfolio (and thus perhaps a smaller cash flow) and conducts less wholesale borrowing, some analysts fear it may have to curtail its loan growth.

"Deposits may not be the best thing to rely on," because banks will probably lose them once the economy improves, said Richard D. Weiss of Janney Montgomery Scott LLC. Mr. Weiss owns New York Community shares.

Before the company decided to slash its securities portfolio, it tried to sell itself. Rumors about possible buyers still abound, and Mr. Ficalora did not deny that New York Community could sell itself, but he said it could also end up as a buyer again.

"We were probably one of the most attractive companies in the market, except that the process we were involved in was exceedingly unattractive," he said. "This environment is only more and more likely ... to make us a participant in the consolidation of the sector, and that could be in a multitude of directions."