For banking companies based in the Midwest, where economic recovery and loan growth have lagged the rest of the country, expanding to other regions has become more urgent.

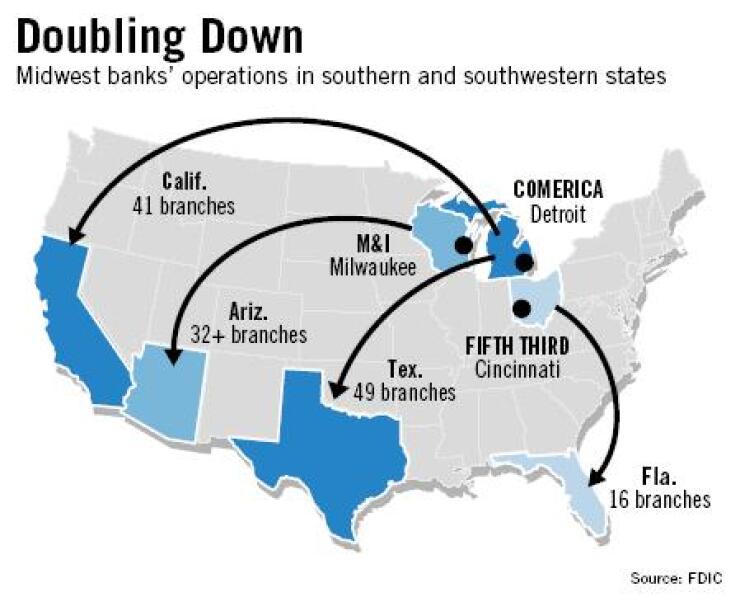

For years, many of the biggest Midwest banks, including Fifth Third Bancorp, Comerica Inc., and Marshall & Ilsley Corp., have staked claims in places like California, Arizona, and Florida because they are places where many of their retail customers flock for the winter.

But the building is intensifying. Comerica, which is based in Detroit and began operating in California and Texas in the late 1980s, plans to make those markets the focus of two-thirds of its 50-branch expansion effort over the next two years. In contrast, only five of the 16 branches it built this year are located in Michigan.

Elizabeth Acton, Comerica's chief financial officer, said that with a high market share (about 60%) in Michigan and growth prospects in California and Texas being greater, she expected the pace of expansion in the Midwest to be slower.

About 43% of Comerica's earnings this year have come from operations outside the Midwest. "Over time we see that heading toward 50%," Ms. Acton said. "We always knew, for a long time," that the California and Texas markets "would grow faster than Michigan."

And she hinted at more to come, saying Arizona is an "intriguing" market. Comerica has an office in Phoenix and offers middle-market lending, wealth management, commercial real estate, and small-business banking services in the area. "Stay tuned," Ms. Acton said.

Meanwhile, executives of Marshall & Ilsley said recently that the Milwaukee company would continue to expand outside its home state by opening as many as 20 branches in Arizona, Minneapolis, and St. Louis.

Most of M&I's 251 branches are in Wisconsin, but more than 25% of its banking profits come from other states, chief executive Dennis Kuester said at an investor conference in November. Most of its out-of-state branches - 32 - are in Arizona, while it has only a handful in Minneapolis, St. Louis, Las Vegas, and Florida, Mr. Kuester said.

Despite recent evidence from National City Corp. and Fifth Third Bancorp that commercial lending improved in the Midwest during the fourth quarter, economists and bankers say that at least part of the commercial lending business may disappear permanently as manufacturers move to lower-cost locations or find more financing options in the capital markets. And, with so many large regional banks headquartered in the region, pricing for deposits has become aggressive and put pressure on midwestern banks' margins.

The usually price-conscious Fifth Third of Cincinnati paid what analysts called top dollar this year to buy First National Bancshares of Florida Inc. and vault itself to 12th in market share in Florida from 41st (it opened its first branch in the state 15 years ago). The $1.6 billion offer was a 41% premium. (On Tuesday, the Federal Reserve approved the deal, which is set to close in the first quarter.)

George Schaefer Jr., Fifth Third's president and CEO, told American Banker in an interview before its First National deal was announced that 250 people a day "leave the state of Ohio to take up residence in Florida. That's what we are chasing down there."

Jeff Davis, an analyst with First Horizon National Corp.'s FTN Midwest Research, said in an interview that "the Midwest banking model is a little different" from those of southern California, Texas, and the Southeast. These banks' Midwest operations, he said, are a "cash cow" and allow them to continue investing in other regions at a much faster pace.

Lawrence Petit, a portfolio manager at A&S Capital Advisors, said banks in slow-growth markets have two choices: take market share away from competitors or go into new markets. Cost cutting and service enhancements "can last a long time, but they have got to take a look at what they are going to do in addition to that," Mr. Petit said.

Cleveland's National City Corp. has stuck to its roots, investing millions earned from its mortgage operations into acquisitions and branch start-ups in the Midwest.

National City has said that its aim is to be in the Midwest and contiguous states. It entered Missouri by buying Allegiant Bancorp, and expanded in Ohio by buying Provident Financial Group Inc. of Cincinnati and Wayne Bancorp.

"National City seems to be hunkering down in the Midwest," Mr. Davis said.

On Thursday, National City Bank announced a definitive agreement to acquire Charter One Vendor Finance LLC, the Lisle, Ill., subsidiary of Charter One Bank, NA, that specializes in providing equipment financing to manufacturers. The price was not disclosed. Charter One's parent, Charter One Financial Corp. of Cleveland, was acquired by Royal Bank of Scotland's Citizens Financial Group in September.

But National City may also be looking beyond the Midwest. Though it has neither confirmed nor denied it National City was said to have shown an interest in buying Riggs National Corp. of Washington. After an auction this summer, Riggs agreed in July to be sold to PNC Financial Services Group Inc. of Pittsburgh.

Huntington Bancshares Inc. of Columbus, Ohio, went in the opposite direction. It was once in Florida, but executives decided the company had to divest to focus resources on the home market. At the end of the first quarter of 2002, Huntington sold its Florida banking operations, which included $2.8 billion of loans and $4.8 billion of deposits, to Atlanta's SunTrust Banks Inc.

Since then Huntington has agreed to buy Unizan Financial Corp. of Canton, Ohio. That deal is being held up while Huntington works out accounting issues with banking regulators.

Some companies said they are determined to enter the Midwest. Citizens Financial, of Providence, R.I., achieved that goal with the acquisition of Charter One for $10.5 billion in cash.

New England has had its own consolidation wave and tends to have slower-growth economies, despite a more affluent base of potential customers. Thomas Hollister, a vice chairman of Midwest banking at Citizens, said the company is "used to operating in a highly competitive, dense market that has slow growth."

"We are respectful of some excellent competition in the region, and these markets are newer to us," Mr. Hollister said. What it aims to do in them is "similar to what we have done in New England and the mid-Atlantic region."