-

Capital One Financial Corp.'s deal to buy ING Group NV's U.S. online banking business for $9 billion is a "game-changing" transaction that will vault the McLean, Va., company into the top tier of banks, Capital One Chief Executive Richard Fairbank said in a conference call Thursday.

June 16 -

Capital One Financial Corp.'s shares rose as much as 1.2% in pre-market trading Friday morning, a day after it announced a deal to acquire ING Group NV's U.S. online banking unit for $9 billion.

June 17

For Capital One Financial Corp.'s planned acquisition of ING Direct to pay off, the lender will have to follow quickly with another deal, and the economy must not falter.

Though the McLean, Va., company insists that the $9 billion deal will provide a big boost, many market watchers say it will have real value only if Capital One uses it to finance another acquisition.

ING assets "are low-risk assets so they're low-yielding," said John Stilmar, an analyst at SunTrust Robinson Humphrey. "If I turn around and rotate those investments into higher-yielding investments — card assets — that's where my earnings pick up."

It is a risky strategy.

"Let's say they buy [a credit card portfolio] and we go into a double-dip recession," said Scott Valentin, an analyst at FBR Capital Markets. "There are risks anytime you're buying assets. … But it also depends on your outlook on the recovery. An improving economy will drive down losses and delinquencies. It makes a lot of strategic sense long term, but it depends on your outlook and the macro perspective."

The word on the street is that Capital One is considering purchasing HSBC Holdings PLC's credit card portfolio, the prospects of which Richard D. Fairbank, Capital One's chairman and chief executive, has downplayed.

"This deal stands on its own," Fairbank said Thursday during a conference call with analysts. "It does not require additional acquisitions to make it financially compelling."

But Fairbank was also quick to add that the purchase of ING "only enhances the potential economics" of other future deals if the company takes that route.

"We've said for a long time now that asset acquisitions are an opportunity that's right in our power alley," he said. "We know consumer assets very well. That's what we do."

Viewpoints differ 180 degrees as to whether Capital One is in the driver's seat.

ING most certainly gives Capital One the upper hand in any future acquisitions, Stilmar said.

"Now that Capital One has ING, they now have the liquidity to dictate the terms of a transaction," he said. "The presence of that liquidity lowers the risk that Capital One would be forced into doing a deal. … Now they have the ability to pay cash for a transaction. That's a very important negotiating tool in order to get the purchase price that Capital One can get."

Many other analysts say that Capital One will be under extreme pressure to complete a second acquisition to justify the ING deal.

"It's hard for us to get excited on this particular deal as we don't believe it was an area of need for the company nor is it significantly financially compelling from an earnings accretion standpoint for the associate risk being assumed," wrote Sanjay Sakhrani, an analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., in a research note Friday. "We think the key to this deal really is if the company can turn around and be more proactive on other activities such as acquisitions or capital management."

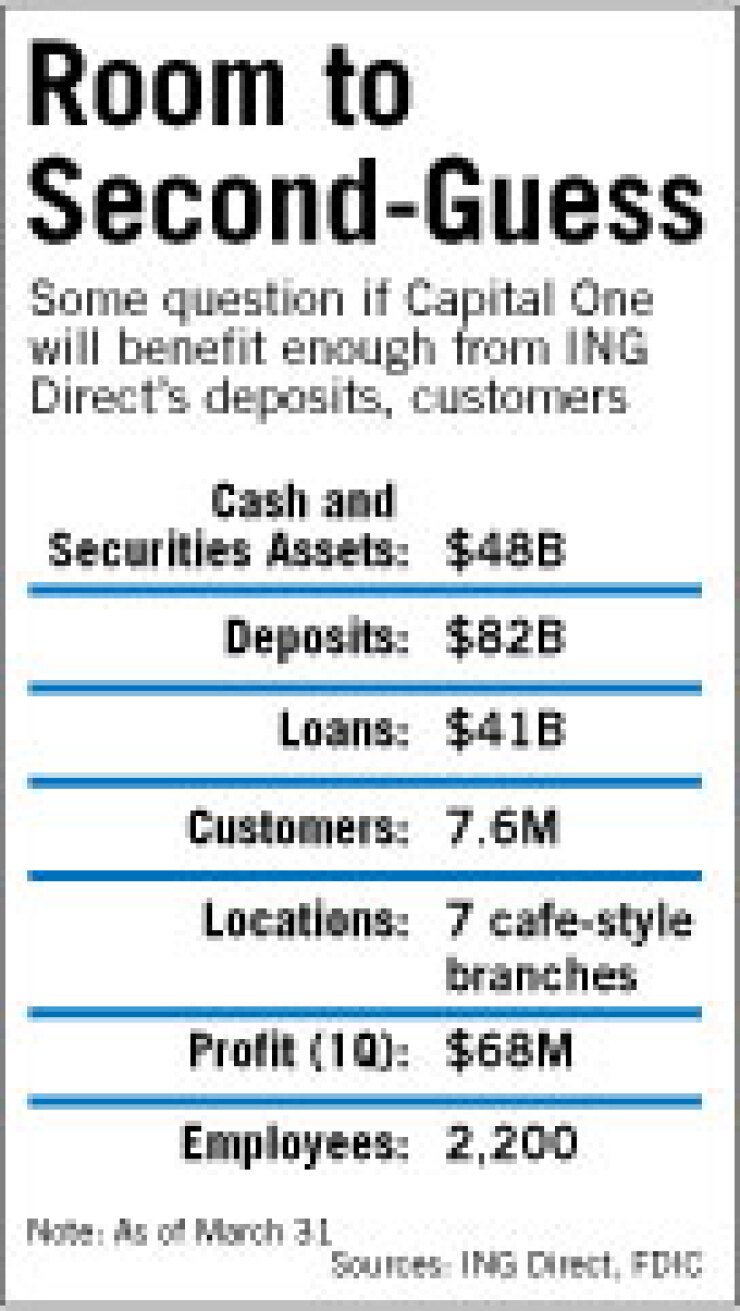

Otherwise, gathering a bunch of deposits — $80 billion to be exact — does not make much sense, analysts said.

"It just strikes me as somewhat strange that Capital One would be purchasing an online deposit franchise of that size," said Michael Taiano, an analyst at Sandler O'Neill. "I don't think they've had any trouble raising deposits. … The deposits themselves aren't cheap deposits. [They're] high-yielding savings deposits, cost north of 1%."

Fairbank acknowledged that deposit costs at ING are a bit higher than at other branch-based competitors, "but because it's a direct model, ING's noninterest expense is significantly lower than any predominantly brick-and-mortar deposit business," he said. "So the all-in cost of ING Direct deposits is low."

Interest expense for liquid deposits (which includes noninterest deposits, money market and savings) at ING in 2010 was 1.11%, according to slides used during a presentation by Capital One on Thursday. Comparatively, the interest expense at Capital One is 0.70%; at JPMorgan Chase & Co., it's 0.12%.

Capital One said the deal was particularly attractive because of the additional cross-selling opportunities it presents.

Still, Taiano is skeptical.

"When you see these types of deals, that's one of the things that management always cite — the potential to cross-sell," he said. "What does bringing that deposit relationship into the picture do? Do the ING customers not have credit cards? You're making a bet that you can make them a better offer than they currently have. They are people who are probably pretty savvy when it comes to rate sensitivity. Are those the type of people who are going to buy into paying 15% to 16% on a credit card?"

Some analysts also expressed concern over the $41 billion mortgage portfolio Capital One is also inheriting in the deal. Though the company said it plans to let most of that portfolio wind down, "it's not totally risk-free," Sakhrani said.

"It's not like this deal doesn't come without risks on the asset side," he said. "These are mortgage assets."

On the flip side, though, there may be less risk overall in integrating and building upon ING than in turning around and making another acquisition, some analysts said.

"It's accretive from the get-go. You're getting mid-single-digit-type earnings accretion," Valentin said. "Cap One operates the No. 3 online bank, so it's not like they're stepping into the online banking platform for the first time. … They have a pretty good handle on what to expect. The integration risk is pretty low."

It also could be considered a good time to buy deposits, he said."In an environment where banks are flush with deposits, you're buying them when deposits are cheap," Valentin said. "It's a little bit of a value play there, buying when no one else is looking."

What's more, buying a credit card portfolio right now, especially a distressed one, could be more trouble than it's worth, Valentin said, if that's the route Capital One ultimately took.

The chargeoff rate of HSBC's portfolio is higher than at other top issuers, he noted.

But then again, "there are no bad assets, only badly priced assets," Valentin said. "If you can buy at the right price and build enough cushion in, they might buy these at a discount." And pull off a brilliant play after all.