The battle for control of Green Dot Corp. has taken enough ugly turns to resemble a street brawl.

A San Francisco-based hedge fund is trying to oust Chairman and Chief Executive Steve Streit, arguing that he is untrustworthy and poorly suited to lead a large, complex company.

In response, Streit is aggressively defending his job and reputation. The prepaid card empire that Streit founded has weathered several years of tough competition and is now poised for stronger profitability, he maintains.

-

Green Dot agreed to split the roles of chairman and chief executive officer. Steven Streit is the current CEO, while an independent chairman will be named after the 2016 annual meeting, the prepaid debit-card company said Monday in a statement.

May 16 -

Steve Streit, who founded the prepaid card pioneer in 1999, is taking fire from an investment firm that owns 6.2% of the company.

January 25 -

Green Dot has named three new directors, ignoring the slate of nominees recently proposed by activist investor Harvest Capital Strategies.

April 12 -

The public spat between Green Dot and one of its largest shareholders is escalating even as the shareholder raises its stake in the prepaid card company.

April 13

The fracas spilled into public view in January, when the hedge fund, Harvest Capital Strategies, which currently describes itself as Green Dot's largest shareholder, demanded the removal of Streit as CEO. The company's board refused to comply. Since then, punches have been thrown in such rapid succession — some of them arguably low blows — that both combatants seem diminished.

At age 54, Streit finds himself in a bind that many successful entrepreneurs face eventually. He created something new, made it big, and became the firm's ever-quotable public face. "And it reflects him, to a great degree," said Larry Berlin, an analyst with First Analyst who covers Green Dot. Now, as others seek to wrest away control of the company Streit built, he no longer controls his own fate.

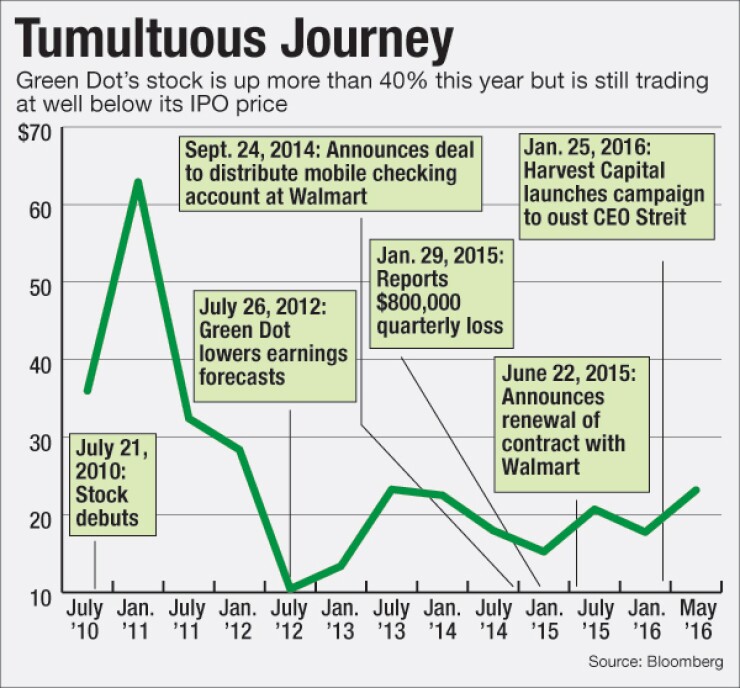

Streit is often credited with inventing the prepaid card — the initial idea was to give teenagers a way to make cashless purchases, but the cards caught on with low-income Americans who do not have checking accounts. Thanks partly to a key partnership with Walmart, Streit turned Green Dot into the nation's top seller of prepaid cards. The firm went public in 2010 and entered the financial sector's mainstream when it obtained a bank charter the following year.

But after American Express Co. launched a price-cutting foray into prepaid cards, Green Dot's stock price plunged. Since then, the share price has slowly rebounded, but the company's performance has failed to satisfy Harvest, which is led by a former buy-side analyst named Jeffrey Osher.

Over the last several months, the fight has become bitterly personal. Harvest has repeatedly questioned Streit's integrity, and Green Dot has responded with attacks on two board candidates supported by Harvest.

The dispute is expected to come to a head on May 23, when Green Dot holds its annual meeting in suburban Los Angeles. Harvest is urging shareholders to oust Streit as the firm's chairman, but its bigger goal remains to get him removed as CEO.

In a recent interview, Streit said that he does not need the money he earns as CEO, pointing out that his shares in Green Dot are worth approximately $100 million. Nevertheless, he sounded determined to keep control of the firm he built.

"I understand that Harvest doesn't like my leadership, and probably doesn't like me personally, I suppose, based on what I've read. I get that," Streit said. "I think that as long as I'm able to do a good job, and as long as I'm able to drive value, then I should be the CEO."

Business Model Questioned

On the afternoon of July 26, 2012, Green Dot released its quarterly results. The picture was ominous.

Just three months earlier, Green Dot had projected full-year earnings of $1.65 to $1.70 per share. Now it was lowering that guidance to $1.29 to $1.32 per share — a decline of about 21%. On a conference call with analysts, Green Dot said that more of its retail partners were going to start selling competitors' products.

At the time, Walmart accounted for 62% of Green Dot's total operating revenue. But the Bentonville, Ark.-based retailer and American Express Co. had begun testing a new prepaid card, known as Bluebird, which was nearly free of fees. Soon, Green Dot would have competition from a much larger company that was pricing its product aggressively and also had space on the shelves of the world's largest retailer.

During the earnings call, a Morgan Stanley analyst noted that since its IPO, Green Dot had been touting its exclusive contracts with retailers. "Are you worried that … the entire foundation of your business is possibly breaking down?" the analyst asked.

Streit responded: "I don't think there's any product category, from cereals to hairbrushes, that has only one brand on the shelf for a decade, or in our case 12 years. No, I don't think it's a crumbing of anything. I think what it is, is the evolution of an industry where a lot of big players like Amex and others believe there's a lot of fruit to be had on the tree."

When the stock market opened the next morning, Green Dot shares were selling for almost 60% less than at the previous day's close.

Harvest, which invests in technology and financial services stocks, among other sectors, sensed an opportunity. "It's not every day you see a stock go down 60%," said Osher, the firm's portfolio manager.

Osher believed that Green Dot's management had been blindsided by the change in the competitive environment. But he also thought the market had overreacted. So in late 2012, Harvest made its initial investment in Green Dot.

"We believed that the ultimate impact from Bluebird would not be as severe as the stock indicated," Osher said. "There was a very real brand with sustainable cash flow. And we believed there were multiple ways we could ultimately get paid."

Investor Unrest

The contest for control of Green Dot hinges largely on how shareholders judge the firm's performance, as well as Streit's leadership, since the company went public. Investors are being sold two very different stories.

Streit's narrative focuses on the challenges Green Dot has survived, the firm's unwillingness to cut corners for short-term gains, and the promise of a brighter future.

At an industry conference in December, Streit recalled that he was once worried about the heavy volume of TV commercials for prepaid cards from American Express and JPMorgan Chase. American Express, after mounting an aggressive push into prepaid cards,

"I think as you look at the competitive environment now, it's a lot better than it was. And I think we'll actually get even better," Streit told analysts.

More recently, Streit has argued that another large prepaid card issuer, the TSYS-owned NetSpend, stands to lose under forthcoming rules from the Consumer Financial Protection Bureau. Those regulations are expected to restrict the industry's use of overdraft fees.

"We never took the bait to charge all kinds of crazy fees. We never took the bait to get sloppy on compliance. And we run a very, very clean ship," Streit told American Banker. "I think when you actually look at my performance, respectfully, not bad — from where the company could have been, and where so many other companies ended up."

Meanwhile, Harvest is portraying Green Dot as a company that has executed its business poorly, bounced from plan to plan, cycled through high-level executives, and been outmaneuvered by NetSpend, all while awarding excessive pay to executives.

One episode that Harvest has highlighted involves the discontinuation of Green Dot's MoneyPak product, a reloadable prepaid card. MoneyPak was pulled from the shelves because fraudsters were exploiting its numerical codes, which could be used to transfer funds to other prepaid cards. The product was reintroduced more than a year later.

In October 2014, Streit told analysts that MoneyPak was "not really a material driver of revenue." In January 2015, he forecasted that the negative impact on revenue as a result of the product's discontinuation would be $10 million to $40 million. By May 2015, the company's forecast had risen to as much as $65 million in lost revenue.

"Green Dot's decision to discontinue MoneyPak may have been appropriate long-term, but the execution and forecasting have been an unmitigated disaster," Harvest wrote in a January letter to the company's board.

Harvest, which says that it owns approximately 9.3% of Green Dot's common stock, blames Streit for many of the problems it sees. The hedge fund

If the criticism ended there, the fight for control of Green Dot might not have turned so nasty. But it hasn't.

The hedge fund has stated, in what might be interpreted as a cleverly disguised insult, that it "respects" Streit's transformation from his earlier career as a "radio disc jockey." (Following his on-air days, Streit worked as a radio programming executive.)

Harvest has also questioned Streit's integrity, arguing that he has repeatedly made "misleading statements" and "misrepresentations," and withheld important disclosures.

Another incident that Harvest has drawn attention to involves the disclosures related to Green Dot's acquisitions of Achieve Card and AccountNow.

"At the time of the Q4 14 earnings call, neither acquisition had been disclosed," Harvest wrote in a presentation posted online. "Management included their financial contribution from these two material acquisitions in its 2015 guidance, without a single reference to their inclusion or impact."

In a separate incident, Harvest labeled as "fiction" a comment that Streit made during Green Dot's February 2016 earnings call. During that call, Streit was asked whether the company was exploring the possibility of a sale.

As part of his answer, Streit said: "I haven't sold shares since November of 2010, so it's five years."

Harvest notes that Streit did in fact sell Green Dot shares more recently. And the hedge fund argues that the CEO's statement during the earnings call is "symptomatic of Mr. Streit's pervasive disregard for accurate shareholder communication."

When asked to respond, Streit pointed out that he did not benefit from the stock sales in question. He noted that the stock was sold to satisfy the terms of his 2004 divorce decree, and his ex-wife received the benefit, as Green Dot

Battle for Votes

Since Jan. 25, when Harvest called publicly for Streit's ouster as CEO, both sides have been working furiously to win the votes of Green Dot shareholders.

Harvest launched a website called

In March, Harvest announced the three board candidates, who will face off against Streit and two other current board members. They are: Nino Fanlo, the president and chief financial officer of Social Finance Inc.; George Gresham, a former CFO at NetSpend; and Philip Livingston, who has served as CEO or CFO of several companies.

Less than two weeks later, Green Dot sought to appoint Gresham to the board, in what amounted to an effort to cherry-pick one of Harvest's nominees. Green Dot's offer was rebuffed.

In April, Green Dot named three new independent directors to its board, while announcing that one director had stepped down. As a result, the board grew from eight members to 10. One effect of the change is that if the Harvest-backed candidates do get elected, their voice will be diluted.

In response to Harvest's contention that the management's incentives are not sufficiently aligned with the interests of shareholders, Green Dot announced changes to its executive compensation practices. Harvest argued that the changes are insufficient.

Since late January, when the Harvest launched its public campaign, Green Dot's stock price has risen by 34%. Shares closed Thursday at $23.19, which is almost exactly where the stock was just prior to the massive one-day decline four years ago.

Unsurprisingly, both sides are taking credit for the recent improvement. Green Dot points to its new six-step plan to boost earnings as the driver of the stock price boost. Harvest credits its campaign for change at the top of the company.

Berlin, the analyst who covers Green Dot, argued that it does not matter who gets credit for the stock price improvement.

"Harvest has pointed to things that made sense, and Green Dot's reacted in a way that's made sense. And the stock has come up as a result," he said.

But if anything, the contest has become even uglier and more personal in recent weeks, as Green Dot has sought to disparage two of Harvest's board nominees.

On the firm's most recent earnings call, Streit said that Fanlo and Livingston have been deemed "unfit to serve" on Green Dot's board, based on findings from an independent third-party investigative firm.

Those remarks drew a strong retort from Harvest, which called Green Dot's efforts a "hapless and disingenuous smear campaign." Harvest declined to make Fanlo and Livingston available for interviews.

"Unfortunately, since the current Board does not believe it can win on the merits, the Company has recently resorted to highly unprofessional and unethical personal attacks against our director nominees that are clearly based on misleading gimmicks and false information," Harvest stated in a May 9 letter to shareholders.

No Room for Compromise

The public nature of the fight between Harvest and Green Dot makes a negotiated outcome less likely, said Daniel Siciliano, a corporate governance expert at Stanford Law School.

"Once you go down that road, it is pitched battle," he said.

"They either get most or all of what they want, or they don't," Siciliano added, referring to shareholders who adopt a confrontational approach. "There's an unlikely to be an in-between."

In recent months, Harvest has been buying additional shares in Green Dot. The firm says that it owned 6.2% of the common stock in late January and 9.3% by May.

Osher said that Harvest believes that with the right CEO in place, Green Dot "can create significant shareholder value over the long term."

Even if Harvest's board candidates get elected, Streit will still be Green Dot's CEO, unless the reconfigured board decides to get rid of him.

Osher acknowledged that reality but also said that "this vote is a referendum on Steve Streit's leadership." He argued that it would be incumbent on Green Dot's board to take action in the scenario where Streit is ousted as chairman.

Harvest's campaign got a boost on Thursday when the proxy advisory firm Institutional Shareholder Services endorsed its slate of candidates. On Friday, another proxy advisory company, Glass Lewis & Co., endorsed one of Harvest's board candidates, but argued that the election of multiple dissidents is unwarranted. "This is our only activist campaign in our 16-year history, and hopefully our last," Osher said in an interview.

For his part, Streit said that he is motivated to stay on as CEO partly because he is dedicated to the company's mission of providing fair and accessible bank accounts to low-income and moderate-income households. "Reinventing personal banking for the masses" is Green Dot's motto.

"I come to work every day looking to service America with a product I'm passionate about, and a cause that I care about, and to make sure that our investors make more money," Streit said. "I still after all these years work tremendously long days. I still work seven days a week."

When he was asked whether he believes Green Dot's slate of board candidates will emerge victorious, Streit declined to offer a prediction.

"Will we win? How could I possibly answer that? I don't know that any more than you do or Harvest does," he said. "Should we win? You bet. We should win."