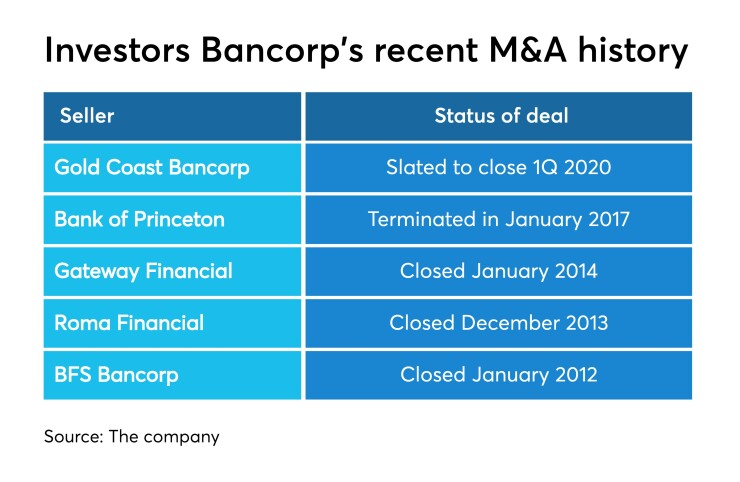

Investor Bancorp’s first acquisition in years sends a message that the Short Hills, N.J., company isn’t looking to sell itself.

The $27 billion-asset Investors

The going had been rough since the Gateway deal closed.

Investors was hit with

Agreeing to buy the $563 million-asset Gold Coast shows that Investors is “going on the offensive,” said Christopher Marinac, an analyst at Janney Montgomery Scott.

While Investors has a duty to entertain offers, Kevin Cummings, the company’s chairman and CEO, said in an interview that his management team is marshaling its employees to push forward to reach $40 billion in assets.

“With deposit and loan growth, we need to generate more, and the [Gold Coast] deal is an important step,” Cummings said. “It’s a rallying cry for our teams.”

Gold Coast, which has an established lending operation in affluent areas of Long Island, N.Y., has $460 million in loans and $480 million in deposits. Investors, which expects the deal to be 2.5% accretive to earnings per share, is eager to offer more commercial loans on Long Island to diversify away from commercial real estate.

C&I would also generate higher-yielding loans at a time when interest rates are falling, Cummings said. He also discussed an interest in more acquisitions.

Here is an edited transcript of the conversation.

Why Gold Coast? Why now?

KEVIN CUMMINGS: The markets that they operate in, Suffolk and Nassau counties, are strong. This doubles our presence there. It’s an area we’ve been looking to expand in, and it complements our strategy to grow business loans, C&I, and bring in more of the low-cost deposits you get with those [clients] and shift more into higher-yielding loans.

We like the management team, the franchise. There is tremendous potential with our larger balance sheet and their ability to now make larger loans. And the math worked. It’s a good low-risk transaction. They have a strong balance sheet with zero nonperforming loans.

There had been speculation Investors would be a seller. But many people now believe the deal addresses that speculation. How do you view the situation?

Coming out of the BSA order, this deal is a message to our customers, to our employees that BSA is behind us and we’re pushing ahead. We have always said we will do what’s in the best interest of shareholders. So you can be a buyer and a seller on the same day, depending on what happens in the marketplace.

It is a difficult operating environment for banks likes us, because of the shape of the yield curve. That said, we think becoming a larger organization is important because we can leverage the cost base [with added scale] to become more profitable.

This deal came at roughly the same time as the Federal Reserve’s first rate cut in years. How does that impact Investors?

If the cost of our funding goes down significantly then our multifamily is a great business because it is low risk and has a low charge-off history. The same is true for the residential portfolio. We have a $22 billion portfolio, and about $14 billion is in multifamily and residential loans. But we can’t count on just that. So the focus is to grow the business portfolio, and [Gold Coast] is important for that.

Is loan demand strong and steady?

Our pipeline is strong, and that’s a positive. But it is very competitive. Everyone’s looking for business assets. Because of the CRE concentration of the Northeast banks, people are looking to diversify their portfolios and get more of that core middle-market [commercial] client. The larger banks have certainly upped their game, with the investments in technology platforms.

We have to continue to raise our game, too. We have to embrace change and be on a road of continuous improvement. If we think the things we did to grow from $5 billion to $18 billion [in assets] are the same things we need to do grow to $40 billion, we’re kidding ourselves. So, we’re looking at everything from improving our products and technology platforms to our marketing and HR.

Are you seeing more compromise with pricing or terms?

I don’t see that much irrationality going on. You always hear about some of it on pricing, but the competition is fierce and sometimes you have to do what you have to do to protect and keep important customers. Sometimes you see too much given away on terms, more than our credit people would do. But all in, there’s not too much irrationality.

Any reason to be concerned about credit quality?

I’m reading a lot about the consumer, and some concern with student debt and the general leverage of the consumer. But it’s not 2007, 2008. It certainly has a different feel now. Back then, there was just too much debt, too much leverage. When you think about how leveraged Bear Stearns, Lehman Brothers and Merrill Lynch were at the time, there were big problems. But the capital position of the banking system now is much stronger, so I think certainly the U.S. banks are [helping] to build up the strength of the economy.

How do you think about M&A going forward? What’s your appetite?

We look at deals all the time. Our stock price, the valuation, is not strong right now so that puts a limit on things for us. We won’t do something just for the sake of doing a transaction, but we do evaluate opportunities, and if the math works and the franchise brings value to our shareholders, we’ll certainly take a close look at it.

There are a lot of discussions going on out there. The smaller banks are generally liability sensitive, so they’re struggling [with high deposit costs]. Buyers are there, but they’re cautious. Institutional shareholders and analysts are saying the math has to work for buyers.

What size bank are you interested in?

I’d say $500 million, $600 million on up [in assets], with a sweet spot being around a $2 billion bank. A nice bolt-on-type franchise and ideally one with a great low-cost base of funding. But we also look at purchases of assets or branches or lift-outs of [lending] teams.

What are you seeing in terms of client optimism in New Jersey and New York?

I think of all the gyrations we see and hear about in Washington and in Trenton and in Albany, and it’s amazing the resiliency of the economy and how well it’s done. People are looking out and saying that the next 12 months look good.

After the next election, who knows? But right now, the general sentiment I’m hearing is that people are positive despite all the noise [in state and federal government]. People are cautiously optimistic.