Five months since calling it quits on auto lending, Craig Dahl, CEO of TCF Financial, has provided his clearest picture yet of where he plans to take the Wayzata, Minn., company: deeper into inventory finance.

However, that clarity doesn't mean his vision went unchallenged.

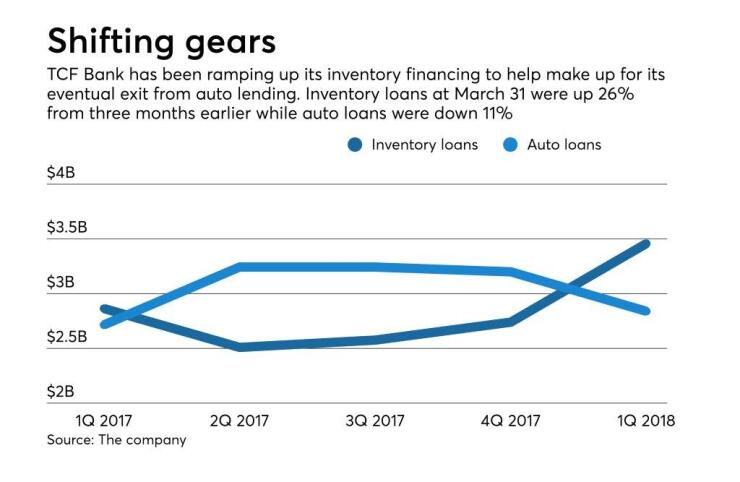

A double-digit jump in the size of TCF’s inventory finance portfolio — which expanded 20% from a year earlier — raised eyebrows Monday when the company reported its first-quarter results.

Investments in the division, as well as an ongoing expansion in equipment leasing, are “improving the quality” and consistency of the company's revenue, Dahl said during a quarterly call full of questions from analysts.

It remains to be seen whether the ramp-up in inventory finance will be enough to put TCF back on solid ground after the company’s now-defunct auto financing unit took a bite out of profits. During the call, analysts peppered TCF executives with queries about the aggressive growth, looking for more details about what kinds of customers TCF is signing on, and whether they have solid credit histories.

TCF’s response? We’ve got it covered.

“These are businesses we’ve been in, so we know the asset class, and we know the industries,” said Jim Costa, chief risk and credit officer. “The overall business, as you can see from the history, has a very low risk profile.”

Within inventory financing, net charge-offs as a percentage of total loans declined 2 basis points from a year earlier to 0.11%. By comparison, net charge-offs in auto loans — a portfolio the company is in the process of whittling down — rose 29 basis points to 1.42%.

Overall, inventory finance loans increased to $3.5 billion, or roughly 18% of the company’s total loan book. In recent months, TCF has signed on new customers in the marine industry, as well other niche commercial sectors, according to the company.

The shift comes as TCF looks to turn the page on a remarkably tough year.

The company in November q

The surprise decision to exit the auto business came after TCF said just months earlier

“We will be able to reduce our operating risk as we exit the more volatile auto business and associated secondary market,” Dahl said Monday during the call.

Perhaps more importantly, the deeper commitment to asset-based finance and commercial leasing shows Dahl, now in his second year at the helm, is beginning to put his own mark on the company.

Over the past three decades, TCF has reinvented itself several times, mostly under the direction of former CEO William Cooper,

By putting a greater emphasis on inventory and equipment finance, Dahl — a former equipment financing executive himself —is returning to a business that he knows well. He is also, in the process, making the $24.3 billion-asset company less dependent on fees, and more reliant on higher-yielding areas of loan growth.

During the first quarter, the average yield in the company’s inventory finance book was 5.93%, the highest among all of TCF’s lending divisions.

Investors welcomed the change, sending shares of the company up 7% during midday trading. They were still up 6.6%, at $24.19, late in the trading day.

“We suspect that ongoing credit costs could come in lower than we forecast currently,” Scott Siefers, an analyst with Sandler O’Neill, said in a note to clients Monday.

Still, TCF executives warned during the call that inventory finance balances vary throughout the year — and typically decline during the second quarter. Analysts pressed executives for details on exactly how much they expect the portfolio to decline, following its strong growth during the first quarter.

“A lot of the increase that happened in Q1 is seasonal,” said Brian Maass, chief financial officer. “So you should see a lot of that coming down.”

Maass added, however, that inventory balances in the second quarter will likely still be between 8% and 10% higher than a year earlier.