There is a growing perception that the motive behind the Federal Reserve Board's discount rate cut is not coaxing banks to take on unneeded, expensive liquidity.

Rather the central bank may simply be trying to buy some time for markets to return to normal, or barring that, some breathing room before its next rate-setting meeting on Sept. 18.

"The Fed is rolling out a sequence of steps," former Gov. Laurence Meyer said in an interview Thursday. "I think their goal here is to calm the markets, buy time until the next meeting."

The Fed did appear to accomplish the stated goal of bringing borrowers to the discount window, although there is plenty of evidence that eliminating the stigma attached to such a visit is still a work in progress.

On Aug. 17 the Fed cut its discount rate 50 basis points, to 5.75%, lengthened terms from overnight to as long as 30 days, and said it would be a "sign of strength" for a bank to use the discount window.

The Fed

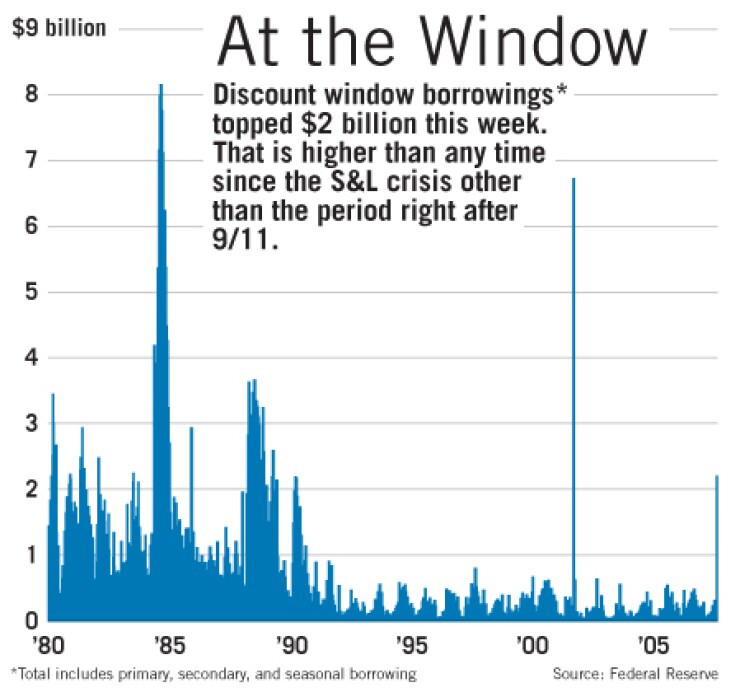

For the week that ended Aug. 22, average daily lending spiked to $1.541 billion, from $271 million the previous week. Of that $1.541 billion, the Fed classified $1.2 billion as "primary" loans, or credit to institutions with solid financials. There was $11 million of such lending the previous week.The Fed classified another $85 million as "secondary" lending, or loans to troubled banks and thrifts, or those with a Camels rating of 4 or 5. There were no such loans the previous week.

(The rest of the lending was classified as "seasonal" loans, which go mainly to banks in rural and resort areas.)

No one, including Fed officials, says the banking industry is hurting for cash. But they do say uncertain times are leading some institutions to hoard liquidity. Perhaps knowing the discount window is open to them will encourage banks to get back to normal business.

In fact, the statement the Fed issued when it made the discount window more attractive nodded in that direction. "These changes are designed to provide depositories with greater assurance about the cost and availability of funding," the Fed said.

Richard Bove, an industry analyst, agreed that's a key problem.

"There is just a huge amount of money around," he said. "It's just who is going to be willing to spend it."

Borrowing from the window traditionally has been reserved for troubled banks with nowhere else to go. So it has been a tough sell for the Fed, so tough that it is widely believed to have asked the nation's four largest U.S. banking companies to borrow, and each said Wednesday that they had taken $500 million from the discount window.

The companies — Citigroup Inc., JPMorgan Chase & Co., Bank of America Corp., and Wachovia Corp. — made it clear they did not need the money but were doing their civic duty and heeding the Fed's call of help.

"The companies believe it is important at this time to take a leadership role in demonstrating the potential value of the Fed's primary credit facility and to encourage its use by other financial institutions," JPMorgan Chase, B of A, and Wachovia said in a joint statement.

While the Fed lowered the rate for primary loans to 5.75%, secondary loans continue to cost 6.25%. Both are still above the fed funds rate, which the Fed has targeted at 5.25% but as of Wednesday was 4.71%, according to the New York Fed.

The New York and Richmond districts generated the biggest demand for discount window loans, notching $1 billion of average daily lending over the week. Only the Boston and Cleveland Feds said they made none of these loans this week.

The discount window historically has catered to companies with liquidity problems, but Countrywide Financial Corp., which got $11.5 billion last week from tapped private-sector creditors, confirmed Thursday that it has not borrowed from the Fed.

Angelo Mozilo, its chairman and CEO, said in a CNBC interview Thursday that Countrywide's thrift, its only unit with access to the window, lacks the necessary collateral.