A dispute between JPMorgan Chase & Co. and Freddie Mac suggests that the continuing consolidation in banking may complicate the government-sponsored enterprises' growing efforts to make lenders buy back faulty loans.

Freddie disclosed Friday that JPMorgan Chase may refuse to repurchase troubled home loans that Washington Mutual Inc. sold to the GSE.

But should the New York banking company follow through on its threat, Freddie holds a hammer — it said it would not let JPMorgan Chase service a portfolio of loans inherited in its Sept. 25 purchase of Wamu's banking operations. (Freddie did not disclose the size of this portfolio, but it said Wamu accounted for 7% of its mortgage purchases in the first nine months of the year.)

Neither company would discuss the matter Friday. Industry lawyers familiar with the dispute, speaking on condition of anonymity because they do work for the companies, said that whether it goes to court could depend on the legal language used by regulators in the rushed deal to rescue Wamu.

Theoretically, Freddie could terminate Wamu's servicing rights or seize the portfolio and try to find another servicer. But few companies are willing to accept any portfolio of loans with a high level of repurchase risk, observers said. Freddie also could settle the matter by putting a ceiling on its repurchase demands.

The conflict shows how the GSEs are caught between "a rock and a hard place," as one lawyer put it. Though they want to be repaid for defective-loan sales, they also need financially strong servicers to take over the portfolios of increasingly troubled originators.

The dispute was revealed in Freddie's third-quarter report to the Securities and Exchange Commission, filed Friday. It got more attention for the $25 billion net loss the GSE reported and the disclosure that it had asked the Treasury for $13.8 billion after the record quarterly loss pushed its net worth below zero.

The filing said JPMorgan's Chase Home Finance LLC accounted for 9% of Freddie's about $316 billion of mortgage purchases in the first nine months of the year.

It also pointed out that GMAC LLC's Residential Capital LLC, which had a 3.5% share, "has recently made several announcements about its weakened financial condition and concern regarding its ability to continue operations in the short term." Wells Fargo & Co., which Freddie said had a 20% share of its purchases, has agreed to buy the wobbly Wachovia Corp., which had 2%.

Freddie also said it is owed $558 million by the bankrupt Lehman Brothers and $726 million by IndyMac Bancorp Inc., whose thrift has been taken over by the Federal Deposit Insurance Corp. These exposures include repurchase obligations, the GSE said.

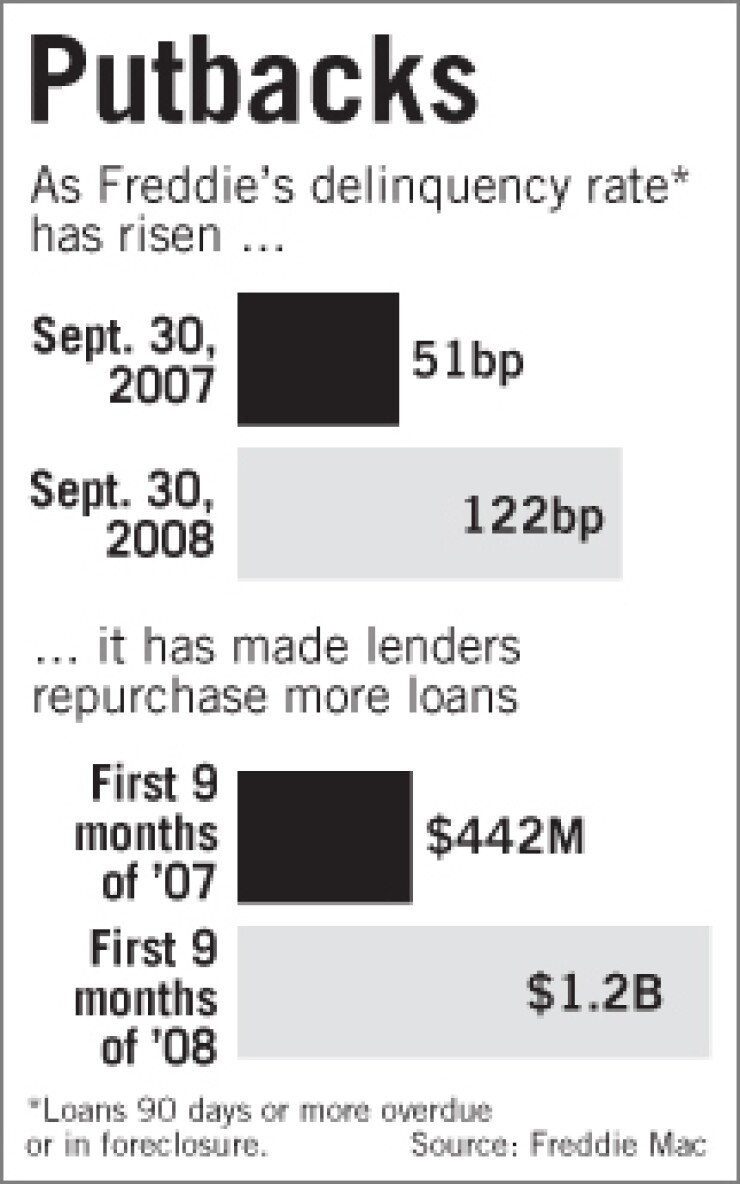

In recent months Fannie Mae and Freddie have increased loan putbacks because of mounting delinquencies. Putbacks by Freddie nearly tripled from a year earlier, to $1.2 billion for the first nine months of this year.

At the time of its Wamu deal, JPMorgan said that it had acquired "all deposits, assets, and certain liabilities" of the Seattle thrift's banking operations from the FDIC. However, the FDIC said at the time that JPMorgan had "acquired the assets and most of the liabilities, including covered bonds and other secured debt, of Washington Mutual."

And the agreement between the agency and JPMorgan Chase, posted on the FDIC's Web site, says: "The Assuming Bank specifically assumes all mortgage servicing rights and obligations of the Failed Bank."

"Historically, it's been hard to argue with Fannie and Freddie on repurchase demands because if you didn't do what they said, they could yank the servicing portfolios," said one industry lawyer. "Fannie and Freddie are experiencing what happened to the private investment banks last year, which made hundreds of millions of repurchase demands on subprime companies that they were never able to realize."

Several lawyers cited the case of American Home Mortgage Corp., which filed for bankruptcy last year and whose servicing rights were transferred to another servicer that did not accept responsibility for repurchases.

But lawyers said a fundamental difference exists between transfers of servicing rights involving private mortgage-backed securities versus the GSEs.

"Fannie and Freddie forever have had in their guidelines that, as a condition to accepting the transfer of servicing, the purchaser must assume the original reps and warranties," said a lawyer who represents both JPMorgan Chase and Freddie. "Chase, as an active buyer and seller of Fannie and Freddie servicing, is well aware of that. What they're saying here is that, because it's coming out of the functional equivalent of bankruptcy, they should be relieved of the repurchase liabilities."

Another lawyer said JPMorgan Chase included "some language to protect themselves" in its agreement with the FDIC to buy Wamu but that in the rush to put the deal together the government was never given immunity from lawsuits by borrowers. A spokesman for the FDIC had no immediate comment Friday.

The lawyer called the issue of putbacks involving government-controlled companies like Fannie, Freddie, and IndyMac "a hot potato. If it ends up in anybody's hands, it will be the government's, which means the American taxpayer."