-

The bank has little choice but to shrink itself through asset sales and layoffs, but the process is slow, demoralizing and no answer to future growth.

October 18 -

Dimon calls market volatility a fact of life, discusses cost-cutting efforts, says no major layoff is planned and supports protestors outside his home in conference call Thursday.

October 13

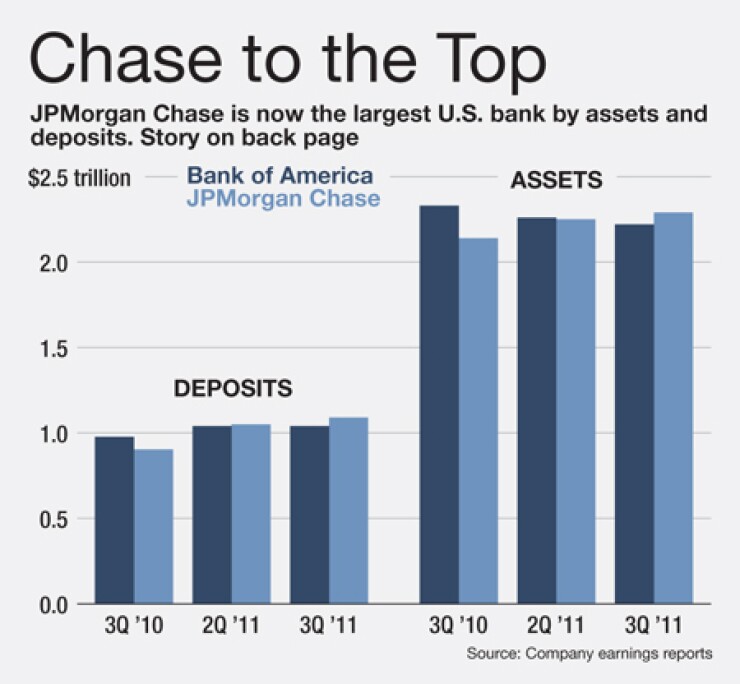

JPMorgan Chase & Co. has surpassed Bank of America Corp. as the largest U.S.-based banking company by both assets and deposits.

According to third-quarter earnings reports, JPMorgan Chase's total assets increased by 1.8% between June 30 and Sept. 30, to nearly $2.29 trillion, while B of A's totals assets fell 1.8% over the same period, to $2.22 trillion. Since Sept. 30, 2010, JPMorgan Chase's assets have grown by nearly 7%, while B of A's have declined by more than 5%.

Citigroup Inc. remains the third-largest banking company, with $2 trillion of assets and Wells Fargo & Co. held on to the No. 4 spot, with $1.3 trillion of assets.

The shift at the top of the bank rankings largely reflects B of A's efforts to shed non-core assets in an effort to improve its performance and beef up its capital levels. Over the last two quarters the Charlotte-based company has unloaded its Balboa insurance subsidiary and sold off much of its stake in China Construction Bank. The company also recently announced that it is exiting the correspondent lending business.

"Our focus [in the third quarter] was on strengthening the balance sheet by selling non-core assets and building capital to position the company for future growth," Chief Financial Officer Bruce Thompson said in a news release Tuesday. "In that regard, we accomplished a great deal. We reduced the size of our balance sheet by $42 billion from the second quarter of 2011 [and] nearly doubled our Tier 1 common equity ratio since early 2009."

While deposits are increasing at both companies, they are rising far more rapidly at JPMorgan Chase. At Sept. 30, JPMorgan Chase reported total deposits of $1.09 trillion, up 20% from the same period last year, and B of A had $1.04 trillion of deposits, an increase of 6.5% year over year.

JPMorgan Chase and B of A are the only U.S.-based banking companies with more than $1 trillion of deposits.