KBW Inc. is expanding its investment banking, research, trading and sales businesses in Europe and Asia.

The specialty firm focuses on the financial services industry, including small and midcap banks, insurance companies, broker-dealers, mortgage banks and real estate and asset management firms.

"The opportunity is huge. It's just a question of how much of that opportunity can we capture," said KBW Chief Executive John Duffy, a Bronx, N.Y., native who paid his way through college in the 1970s driving a cab. "While KBW is not yet well known in Asia, I think we can change that in pretty short fashion."

The 48-year-old bank boasts that it was the No. 1 lead or co-lead manager of financial institutions group IPOs and follow-ons from 2004 to 2010 and the No. 1 adviser on mergers and acquisitions for U.S. financial institutions from 2004 to 2009, based on Dealogic and SNL Financial data.

From 2004 through May 10 of this year, KBW advised financial institutions on 276 M&A transactions worth more than $108 billion.

Transactions it has been involved with include a $550 million follow-on offering for Radian Group, a $345 million follow-on offering for Iberiabank and advisory work for Financial Federal Corp., which was purchased by People's United Financial.

U.S. financial firms make up about 20% of the total market capitalization, and that percentage is higher in Europe and Asia. Financial services firms make up 57% of the Hang Seng Index, and the industry has the third-highest number of companies (178) in the Tokyo Stock Price Index, according to KBW Research and Bloomberg data.

KBW's managers say they see an opportunity, essentially, to take over serving banks, insurers and other financial firms in China, Japan, Korea, India, Indonesia and the rest of Asia. The Asian operation would also work with clients in Australia, although the firm does not have plans to open offices in that country.

Last year KBW started scouting locations in Hong Kong, and by January it had hired a Fox-Pitt Kelton analyst team with expertise in Asia's financial sector. The team, led by David Threadgold, immediately started working on financial sector research, and it now has research materials tracking 57 of the 91 Asian companies the firm has targeted for coverage.

The Hong Kong office was licensed and ready to go in March, and once managers were sure the operation was running smoothly, the firm went public last month with the news of opening the office. Threadgold is KBW's head of research in Asia.

And the firm continues to add professionals. Last week it announced it had hired Bill Stacey from the Asian cash equities boutique Aviate as the head of Hong Kong equities and a research strategist for Asia outside Japan.

KBW also has added salespeople who are focused on Asia but based in New York and London; these professionals support its research products and work with U.S. and European clients.

The firm says it does not expect Asian operations to generate a sizable percentage of its overall revenue in the first couple of years, and that it is using a business model that proved successful in London and Europe.

"Once we launch with research and establish ourselves as a thought leader in the space, we usually follow with our other businesses, which include capital raising, certainly trading … and merger advisory," Vice Chairman Thomas Michaud said.

From an investment banking point of view, managers at the firm said KBW hopes to help Asian banks raise capital, much of which they expect will come from U.S. and European investors.

"There are enormous capital needs in that part of the world, particularly in the financial sector," Duffy said. "I think the overwhelming focus for KBW is on how we capitalize on the opportunity to help those institutions that are already public raise capital and then also focus on the institutions that are not yet public that want to access the public markets."

The firm continues to build out its European investment banking platform. In 2004, when it opened its London office with research, sales and trading capabilities, it developed plans to expand its investment banking. The 2008 financial crisis delayed those plans, but KBW says they are now back on track. The European investment banking operation headed by Stephen Howard, who joined in 2004 after 16 years at Dresdner Kleinwort Wasserstein, has 10 professionals and is working to double that.

"We have an opportunity to attract some good talent at a reasonable price," said Duffy, who joined KBW in 1978 and has been with the firm ever since. In his senior year at City College of New York he quit working as a cabbie because of a string of robberies and took a part-time accounting job at Merrill Lynch. "Even though the storm is not completely over, we clearly feel a lot better than a year ago in March in terms of where the market is."

To have a truly global product, KBW will eventually need to establish a foothold in Latin America, but it says it wants to be sure its efforts in Europe and Asia are successful and stable before striking out into another region.

"Normally speaking, the way we look at these markets is: Is there sufficient sales, trading and research business, in other words, cash equities business that can more or less justify a presence to the degree that we can do better than break even?" said Andrew Senchak, another vice chairman. "And then we try to say: Is there a sufficient investment banking opportunity that can permit us, given the cash equities business, to earn an appropriate rate of return on the equity?"

Although the firm is committed to global expansion, it is getting plenty of work in the United States. Recapitalizations in the traditional bank space make up a significant portion of its U.S. work and have kept the firm particularly busy over the past year. With approximately 230 bank failures since 2007, the firm has been working with the Federal Deposit Insurance Corp. and the buyers of failed banks' assets. When a buyer puts the assets on its balance sheet, it usually needs to raise capital to meet regulatory requirements.

And with more than 700 institutions still on the troubled-bank list, managers say KBW will not be lacking work in the near future.

When working with buyers, "[w]e get paid a little bit of money to do the analysis and help them with the bid," Duffy said. "The big payday is if they actually win" the bid on the assets "and have to go out and raise a couple hundred million dollars of equity or whatever the number is," he said.

Other business lines where the firm is expanding include real estate investment banking and coverage of traditional property and mortgage real estate investment trusts. In February it hired Michael Errichetti as head of real estate investment banking, and it says it wants to make that operation a more significant contributor to the bottom line. Errichetti spent more than 25 years at JPMorgan Chase before making his move to KBW.

The real estate research effort is led by Sheila McGrath, who specializes in real estate firms, and Bose George, who covers the mortgage and home builder sectors.

"Our real estate investment banking is going to be, in my opinion, the biggest contributor to margin as we move forward in terms of growth opportunity," Senchak said.

In March the firm bolstered its convertible securities efforts by hiring Rick Jeffrey as the senior vice president in charge of that business. He had been head of convertible bonds at Knight Libertas and previously was co-head of convertible bonds at Bear Stearns.

In addition, KBW wants to build up its coverage of financial sponsors and large-cap institutions. It is not exactly new to private equity; in 2007 it started raising a $45 million fund from friends and family members. The idea was to establish a track record that would allow it to raise a second fund of $250 million to $300 million.

But the financial crisis slowed those plans. KBW has not yet put all of the first fund's money to work. Also, a financial services long-short hedge fund that it runs has had a hard time attracting money over the past several years.

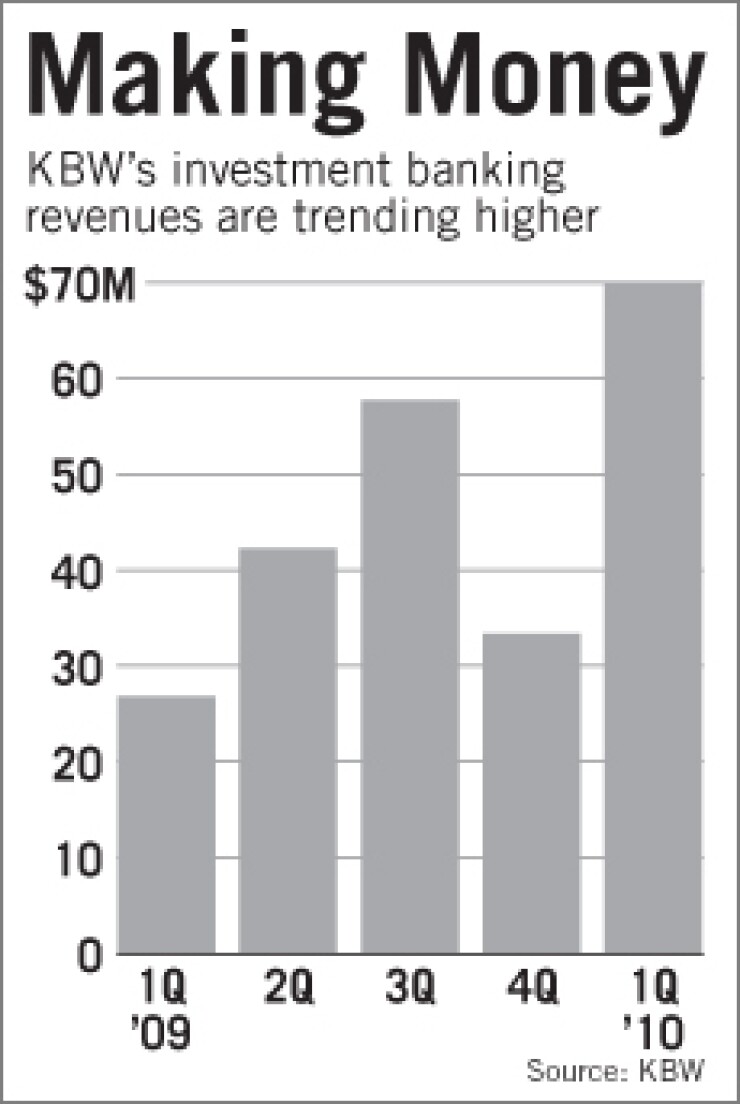

For the first quarter, KBW posted net income of $13.1 million, and the publicly traded company's investment banking revenue more than doubled from a year earlier, to a record $70 million.

The firm says keeping a lean balance sheet helped it through a crisis that hobbled many larger firms.

"We have always been conservative, so we have 1.4 times leverage, which is practically none. We have no long-term debt in the company. It helped us weather the storm well," Michaud said. "Never once did I ever hear any question or concern about Keefe's viability during the crisis. I think it has a lot to do with the fact that we've always had a really clean and simple balance sheet,"

Steve Stelmach, an analyst at FBR Capital Markets who tracks KBW, wrote in a report that its first-quarter results hint at its potential.

"KBW has significant leverage to an improving investment banking environment, which was on display in 1Q10. To the extent that improving equity market conditions continue, and bank capital raising improves (which we expect to be the case) KBW should continue to enjoy strong results," wrote Stelmach, who has a "market perform" rating on the firm's stock.