-

Porter Bancorp (PBIB) in Louisville, Ky., will replace its chairman and chief executive at the end of this month.

July 23 -

Porter Bancorp (PBIB) of Louisville, Ky., did not have to look far to find the new leader for its struggling bank.

July 19 -

Porter Bancorp (PBIB) in Louisville, Ky., has turned to Sandler O'Neill to help it recapitalize after another quarterly loss.

January 30 -

Porter Bancorp Inc. was able to avoid trouble during the darkest days of the recession, only to show up on its regulator's radar screen as many other banks are recovering.

June 21 -

A Kentucky jury has awarded $7 million to a developer who claimed that Porter Bancorp (PBIB) committed fraud when it backed out of planned loan sale.

July 22

Porter Bancorp is trying to convince private investors that things have changed, but it is unclear if the struggling Louisville, Ky., company has what it takes to remain independent.

Its hopes for a much-needed recapitalization are pinned on a management shake-up set to take effect next week.

Maria Bouvette, a co-founder and chief executive,

Patriot Financial Partners in Philadelphia, which in 2010 led a $27 million recapitalization at Porter, welcomed the leadership change after watching deteriorating credit and depleted capital sink the company. Bouvette and J. Chester Porter, the chairman emeritus, are closely associated with the downward spiral.

The change "is good for the company because we have a team in place that people will want to invest in when they meet them," says W. Kirk Wycoff, a managing partner at Patriot who represents the investor on Porter's board. "The former team didn't have the credibility and confidence of the market or the board."

It "remains to be determined" whether Porter can raise capital and avoid selling to another bank, Wycoff says. Patriot, which owns roughly 10% of Porter's common stock,

"We stand behind the company and we're ready to participate, but we can't do it by ourselves," he says.

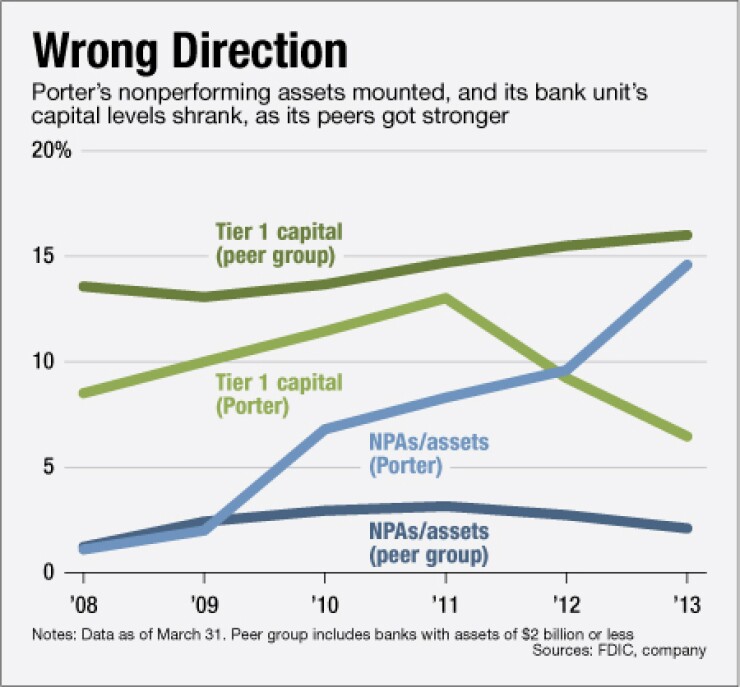

Porter dodged trouble during the darkest days of the recession and made a profit in 2008 and 2009. But its

The bank unit's Tier 1 capital ratio was 6.5% at March 31, compared with 13% two years earlier. Its peers increased their capital ratios to 16% from 14.7% during the same period.

Management is constrained by a written agreement with the Federal Reserve Board and a consent order from the Federal Deposit Insurance Corp. Porter still has to repay $35 million of Troubled Asset Relief Program funds, and it also owes the Treasury Department more than $3 million in unpaid dividends on that money.

A Kentucky jury on Monday

Taylor, who was president and chief executive at the $381 million-asset American Founders Bancorp in Lexington, Ky., before Porter hired him last year, was unavailable for comment, his office said Wednesday.

Wycoff says he believes the new management team can rescue the company. "The turnaround is happening … though there are a lot of nonperforming assets," he says. Reducing classified and nonperforming assets is the "biggest obstacle" to raising new capital, Wycoff says.

Porter faces other challenges, including the lingering influence of its soon-to-be ex-management team. Bouvette and J. Chester Porter collectively own half of the company's common stock, according to regulatory filings. Bouvette "remains an incredibly large shareholder," notes Anton Schutz, president of Mendon Capital, which holds more than 750,000 Porter shares.

"We've seen a lot of companies with poor prospects emerge alive," adds Schutz, though he still prefers to refer to his Porter holdings as "a lottery ticket" — meaning a payoff is a long shot.

Patriot continues to monitor the situation at Porter, which is one of its 16 bank investments. "Porter looks like a typical turnaround story," Wycoff says. "The company hasn't performed as expected. I wish it hadn't come to that."