As more banks work with ailing borrowers to relax the terms of their debt, a debate is brewing over how lenders classify restructured loans.

Some categorize modified loans — known in accounting jargon as "troubled debt restructurings" — as nonperforming assets in regulatory filings. Others don't.

The argument is more than just semantics. Banks are starting to whittle down the massive amounts of NPAs accrued during the recession. The more frequently troubled debt restructurings are accounted for as performing assets, the healthier a bank could look compared with its peers.

Hard-liners looking for the truest picture of a bank's health say describing a restructured loan as anything other than nonperforming is a deceptive ploy to minimize the volume of nonperformers. "By not counting it you might be masking the problems at the bank … It's a way to kind of help manage the numbers," said Matthew Clark, an analyst with KBW Inc.'s Keefe, Bruyette & Woods Inc.

Supporters of reporting them separately dismiss that, saying the loans are performing as long as they generate interest.

Either way, the discrepancy is likely to heat up as more banks modify loans, and regulators such as the Securities and Exchange Commission offer little guidance.

For its part, the SEC gives banks broad discretion when it comes to determining what is and isn't a nonperformer. In fact, there really is no fixed definition, though most industry officials consider nonperformers to include nonaccrual loans, loans more than 90 days past due and repossessed property. Though they have to report troubled debt restructurings, it's up to each bank whether they want to include them in their nonperforming assets.

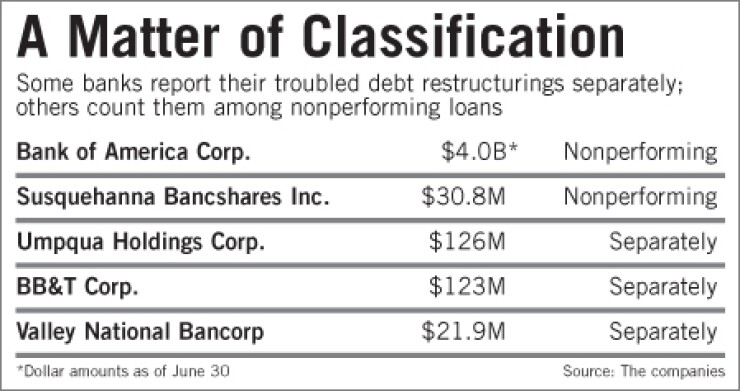

BB&T Corp., Valley National Bancorp and Umpqua Holdings Corp. are among those banks that do not automatically consider their modified loans to be nonperforming. Susquehanna Bancshares Inc., in turn, counts all of its modified loans as nonperformers, even if they are paying interest. Bank of America Corp. reclassifies its troubled debt restructurings as performing only after the borrower makes six payments under the new terms.

All of those companies reported sizable increases in modified loans in the second quarter, as they granted home builders, businesses and individuals lower interest rates, extended maturities and other temporary concessions.

Clark said some banks may be keeping the volume of nonperformers artificially low by excluding modified loans.

"I think you've got to count restructured loans as nonperforming assets. At the end of the day, it is a stressed situation," he said.

Anthony Polini, an analyst with Raymond James & Associates, said he doesn't really care how a company reports its troubled debt restructurings, as they are not as likely as other troubled loans to generate heavy losses. Modifications of commercial credits, for example, are only given to promising businesses that have a shot of pulling through the recession, he said.

That rationale is behind Umpqua's decision to classify its troubled debt restructurings outside of nonperforming assets.

Brad Copeland, the Portland, Ore., company's chief credit officer and senior executive vice president, said it considers nonperformers beyond saving. They are in foreclosure, or nearing it, and slated to be removed from its balance sheet through sales or other means, he said.

"We don't restructure loans that we feel have the strong potential to go nonperforming," he said.

Umpqua had $126 million of restructured loans at the end of the second quarter, up from $23.5 million at yearend. Most are tied to troubled housing projects that the developer is committed to completing. Terms are relaxed for no more than a year, and loans are taken off troubled debt status when they return to their initial terms. Copeland said it has tough standards for troubled debt restructurings, as these loans must be backed by collateral equal to the loan balance. The borrower also must prefund interest reserves or prove that it has the cash flow to make payments.

Susquehanna Bancshares, in Lititz, Pa., takes a different tack.

Michael Quick, an executive vice president at Susquehanna and its chief credit officer, said its $30.8 million of restructured loans are classified as nonperforming on the advice of its accountants. The restructured debt portfolio — up from $2.6 million at the end of 2008 — includes fewer than 10 loans to Pennsylvania-area businesses, including a brick maker, a rubber tire manufacturer and a contractor of steel products, he said. Though all of its modified loans are generating interest, Quick said they are technically nonperforming because they are not operating under their initial terms. They will be taken off troubled debt status when the borrower reverts to the initial terms and makes six months of payments.

"I can't speak for other banks," he said. "This is what we do."