Bankers are becoming increasingly concerned that they will end up

Lenders have made

The Small Business Administration and Treasury Department, the agencies running the program, have yet to provide complete guidance on forgiveness as mandated by the law. One key yardstick in the program — a requirement that borrowers use 75% of the funds for payroll — wasn’t specified in the legislation.

Lenders are worried that many borrowers will fall short of the standards necessary for forgiveness, leaving them with two-year loans with nominal 1% interest rates — along with jaded and irate customers.

“I am fearful that the original intent of Congress is being lost and small businesses … are confused and no longer willing or able to comply with the program’s requirements,” said Clem Rosenberger, CEO of the $1.4 billion-asset NexTier Bank in Kittanning, Pa., which has originated about $100 million PPP loans.

“Forgiveness must be as simplified and assured as possible,” Rosenberger added.

Some industry advocates are pressing Congress to step in after the SBA’s inspector general

While banks are in line to bring in origination fees ranging from 1% to 5% of a loan's value, few lenders thought they would have to service significant portions of the loans over the next 24 months. They may also have to shoulder the reputation risk as some borrowers realize they must repay some of their loans.

Valley National Bancorp said in its recent quarterly filing with the Securities and Exchange Commission that 15% to 20% of the loans it had made under the program may not be forgiven. The $39 billion-asset company had 5,000 loans, totaling $1.6 billion, approved during the initial PPP round.

“We’re definitely concerned about this,” said Chris Nichols, chief strategy officer at the $18.6 billion-asset CenterState Bank in Winter Haven, Fla., which has originated about $1.3 billion in Paycheck Protection loans.

“We know it’s going to be hard for a lot of our small businesses to hire back all their people and qualify” for forgiveness, Nichols added.

“Everyone just dove into this, assuming the forgiveness,” said Jon Winick, CEO of the bank consultant Clark Street Capital in Chicago. “It was good for customers and the banks got the upfront fees. But there were not a lot of serious discussions about whether these loans actually made sense under any other circumstances.”

Efforts to reach the SBA and Treasury were not immediately successful.

Treasury Secretary Steven Mnuchin told CNBC on Monday that the payroll threshold requires a legislative fix, adding that he would work with Congress if there was bipartisan support.

The Independent Community Bankers of America, the Consumer Bankers Association and the American Bankers Association are calling on the SBA and Treasury to lower hurdles for forgiveness.

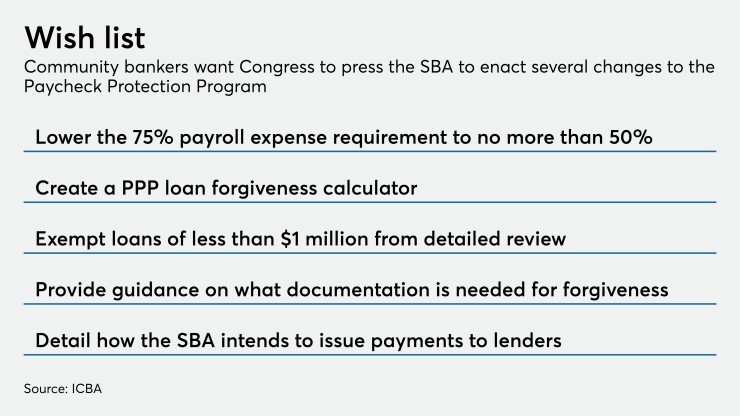

The ICBA is also pushing its members to directly lobby Congress to intervene. They want lawmakers to lower the payroll threshold to 50%, require the SBA to create a forgiveness calculator and exempt small-dollar loans from detailed review, among other things.

“Why torment these small businesses just as they’re coming out of these shutdowns and trying to get people back to work?” said Paul Merski, the ICBA's head of congressional relations and strategy. “We just need some realistic adjustments and some clarity.”

Taking on the task of servicing and collecting on scores of low-rate loans would come at a time when banks are already grappling with national unemployment that hit 14.7% in April, broader margin pressure and higher credit costs tied to the coronavirus pandemic.

The Federal Reserve noted in a

“Current market valuations are already incorporating another 20 basis points of net interest margin contraction over the next year,” Marty Mosby, an analyst at Vining Sparks, wrote in a recent note to clients.

“Credit is going to be a big issue,” Winick said. “And I don’t think anybody knows how severe this is going to get. What we know is that we still have a long way to go to get past this thing.”

There is also a growing belief that small businesses that haven’t applied for PPP loans have cooled on the program. While the initial $349 billion in funding ran out in 13 days, the $320 billion authorized for the second round is only 60% depleted after two weeks.

While he said the slowdown is likely because lenders have met demand, Nichols said “there are some borrowers who have rethought their positions” on PPP given their uncertainty on forgiveness.

Paul Davis contributed to this report.