Higher expenses and several one-time items took a bite out of M&T Bank's second-quarter profits.

Chief Financial Officer Darren King said the Buffalo, N.Y., bank would be “examining our spending as we look forward,” but also defended some of that spending — including hiring of new tech staff — as a necessary cost of doing business.

“We've got to spend to keep in the game, to stay competitive and to react to the changes that are happening in all of our businesses,” he said on a conference call with analysts Thursday.

He also said, during a discussion about macroeconomic pressures on margins: “We’re also not going to shortchange the investments we need to make in the business for the sake of a couple quarters of positive operating leverage.”

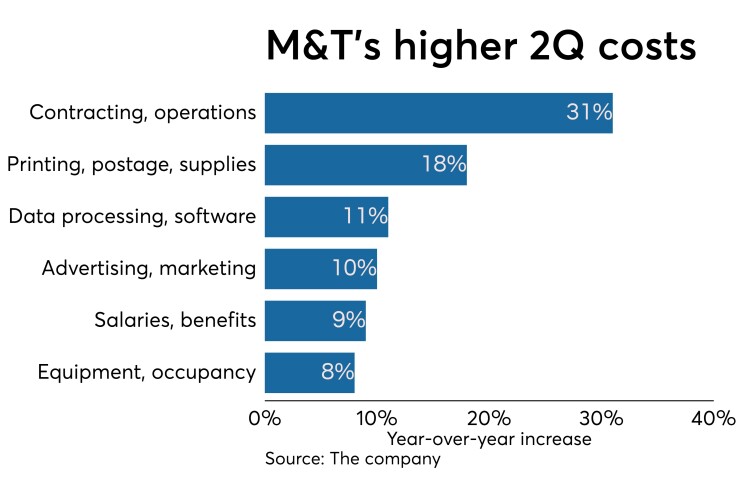

Noninterest expenses rose 12% from a year earlier to $894 million, including a 9% increase in salaries and employee benefits to $456 million. King said that salaries rose primarily because M&T has been adding to its tech staff. It favors in-house personnel for these key jobs, he said, because they are more likely to stick around than contract workers.

“As technology continues to become a bigger part of banking, then you want to control that resource and not have it walk out the door into someone else's operations the next day because they're an outside contractor,” he said.

The higher costs contributed to a 4% decline in quarterly profits at the $121.6 billion-asset bank, to $473 million. Earnings per share of $3.34 missed by 35 cents the consensus estimate of analysts tracked by FactSet Research Systems.

Another big contributor was M&T's agreement this month to sell its interest in an asset manager it acquired along with Wilmington Trust Corp. in 2011. M&T said the method of accounting for the sale ultimately reduced net income by $36 million, or 27 cents per share. M&T also had a $9 million valuation reserve on some mortgage servicing rights that reduced its net income.

Meanwhile, King discussed

There were some upbeat sides to M&T's results, too.

Net interest income increased 3% to $10.5 billion, and its net interest margin widened 8 basis points from the second quarter of last year. Loans grew about 2% to $89.9 billion. Consumer lending rose 8% to $14.5 billion, and commercial-and-industrial lending expanded 7% to $23.4 billion.

Noninterest income expanded 12% to $512 million, lifted by stronger mortgage banking revenues, trading account and foreign exchange gains, and trust income.

M&T increased its total deposits 2.7% to $91.7 billion.

King said that management anticipates loans to rise at a low-single-digit rate through the end of the year and for fee income to grow at mid-single-digit rates.

However, he also said that M&T anticipates each 25-basis-point rate cut by the Federal Reserve could shrink the bank's margins by 5 to 8 basis points over the following 12 months. The potential for future rate cuts complicates the picture for 2020, King said in declining to set firm targets for next year.

The bank also boosted its provision for credit losses to $55 million, compared with $22 million a year earlier and $35 million in the first quarter. Net charge-offs doubled to $44 million compared with the same period last year and represented 0.20% of average annualized loans. King said the rise in net charge-offs brought the bank closer to normal levels, rather than indicating any credit quality problems. He said the increased provision for credit losses was needed to cover loan growth.

At 56%, M&T’s efficiency ratio worsened compared with a year earlier, but improved 16 basis points from the prior quarter, when it recorded an additional $50 million in legal reserves.