WASHINGTON — Though banks surveyed by the Federal Reserve have reported a gradual loosening of credit standards in recent quarters, it may be a while before lending standards return to normal.

Large banks were primarily responsible for the easing reported in July, the central bank said Monday in its third-quarter Senior Loan Officer Opinion Survey on Bank Lending Practices.

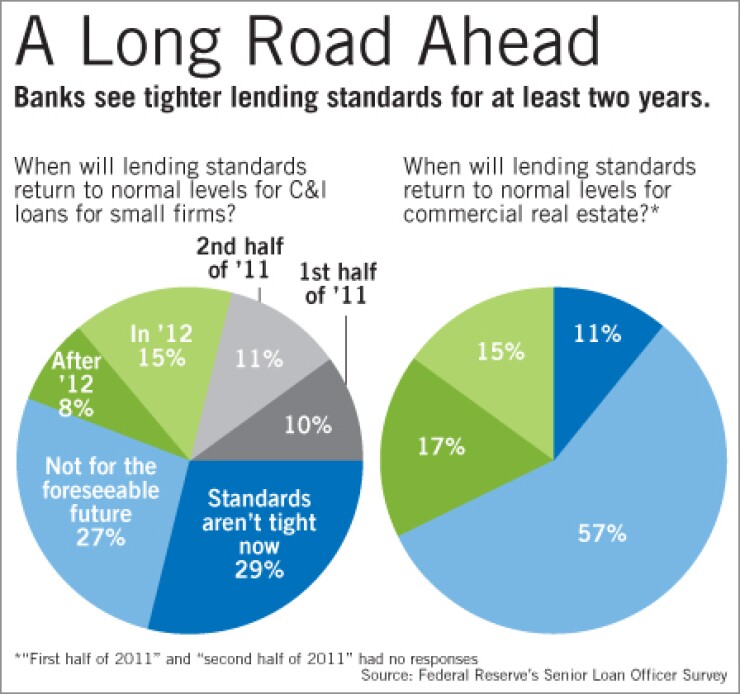

But substantial fractions of the banking industry said they do not expect standards for many lending categories to return to their longer-run averages in the foreseeable future.

According to the October report, 10 out of 52 banks, or 19.2% of the respondents, anticipated that loan standards would remain tight in the foreseeable future when it comes to commercial and industrial lending to large and middle-market companies that have annual sales of $50 million or more.

Other banks in the survey divided on when an easing might occur. Eight banks each anticipated this would happen in the first half of 2011 or in 2012. An additional three banks said lending conditions would not improve until after 2012.

But five banks predicted that C&I lending standards would return to normal in the first half of 2011 for smaller companies, those with annual sales of less than $50 million. Of the remaining banks surveyed, a substantial number said they anticipated an improvement in the second half of 2011 or in 2012.

Fourteen respondents said they expected standards to remain tight for the foreseeable future, and 15 said standards are at their average level now.

For loans secured by commercial real estate, a number of respondents expected no improvement earlier than 2012, and most anticipated a slower recovery.

Asked whether lending standards would remain tight for the foreseeable future, 56.6% of respondents said they would. Nine others said standards would not return to normal until after 2012, and eight said they expect credit standards to normalize during that year. None said they foresaw normal standards for commercial real estate loans for construction and land development purposes at any point in 2011.

For multifamily residential properties and nonfarm nonresidential properties, five banks believed there would be improvement in the second half of 2011, and 16 banks saw an easing of standards by 2012, or thereafter.

Still, 21 banks, or 40.4% of the respondents, said they expected standards to remain tighter for the foreseeable future.

Overall, the Fed's survey showed that domestic respondents had eased standards on C&I loans to large and middle-market firms and to small firms during the previous three months.

Similar to the April and July surveys, most banks saw a more favorable or less uncertain economic outlook and increased competition from other banks and nonbank lenders.

Of the small number of banks that did tighten standards, most cited a reduced tolerance for risk, less favorable or uncertain economic outlook or bigger concerns about the effects of legislative changes, according to the survey.

On lending to households, seven banks reported tighter standards for prime loans, and two said they had tightened standards on nontraditional mortgages. This was a change from the slight easing reported in the July survey for prime loans.

The tightening of standards on prime mortgage loans was largely accounted for by smaller banks, according to the survey. Both large and other banks reported a net tightening of standards on nontraditional mortgages. Continuing a pattern seen since the start of the financial crisis, fewer than half of the respondents reported having made such loans.

Consumer lending saw some improvement; 18.2% of banks reported an increased willingness to make consumer installment loans than in the previous quarter; about 80% were unchanged.

Five banks also reported having eased credit standards for approving credit card applications by individuals or households. Large banks, according to the Fed survey, accounted for all of this easing.

Still, some banks saw a weakening in demand for consumer loans of all types; nine reported either moderately weaker or substantially weaker demand.