The outlook for the housing market will continue to worsen until foreclosures and defaults decline in California and Florida, where falling housing prices are making it harder to cure problem loans, the Mortgage Bankers Association said Friday.

"We are unlikely to see a national turnaround until we see a turnaround in California and Florida," Jay Brinkmann, the MBA's chief economist, said on a conference call with reporters. "Were the economy to deteriorate more, and if we have issues with job losses, that would also delay an apparent bottom in the housing market."

According to the MBA's quarterly survey released Friday, the nation's overall delinquency rate, which measures loans that are 30 days or more past due but not yet in foreclosure, rose 6 basis points from the first quarter and 129 basis points from a year earlier, to 6.41% in the second quarter — the highest rate in 29 years.

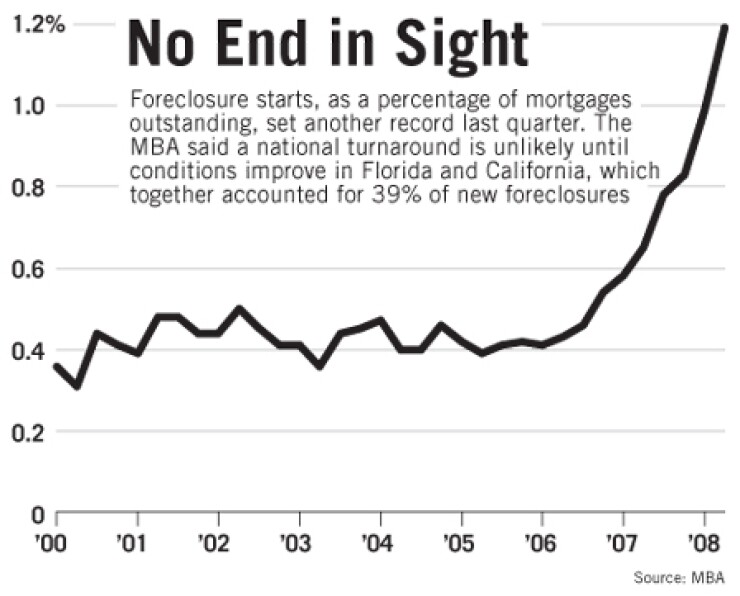

The percentage of loans entering foreclosure also set a record (1.19%), as did the share of loans already in the foreclosure process (2.75%). Taken together, 9.16% of all loans nationally were either delinquent or in foreclosure in the second quarter.

California and Florida accounted for a combined 39% of all new foreclosures or foreclosure starts in the second quarter, the survey found.

Florida had the highest number of loans in the second quarter that were 90 or more days past due, at 6%, followed by Nevada at 4.92%, Ohio at 3.97%, and California at 3.86%.

Mr. Brinkmann said many borrowers overextended themselves to get into expensive housing markets such as California by "making the minimum payment" on option adjustable-rate mortgages.

Now, with housing prices falling and "a mandatory kick-in of the maximum payment," those borrowers are unable either to sell their homes or afford the higher payments, leading to more foreclosures, he said.

Another alarming trend came from higher delinquencies on prime loans, even though delinquency rates for subprime, Federal Housing Administration and Department of Veterans Affairs loans all dropped in the second quarter.

Mr. Brinkmann said the increase in prime ARM foreclosure starts "was greater" than the combined increase in fixed-rate and subprime ARM loans, leading him to conclude that new foreclosures "will likely be increasingly dominated by prime ARM loans."

California and Florida accounted for 58% of all prime ARM foreclosure starts in the second quarter, the survey found.

One bright spot in the otherwise dismal quarterly delinquency survey came from the 30-day delinquency percentage, which remained below 2002 levels. Mr. Brinkmann cautioned that 30-day delinquencies exhibit the highest level of seasonality, so it is difficult to determine if first-payment defaults are slowing.

Many servicers are trying to help borrowers modify delinquent loans, which has resulted in many loans that "may sit in the 90-day [delinquency] bucket for a while, building up inventory," he said. The biggest problem is that delinquent loans in states with declining housing prices such as California are more likely to move into foreclosure, he said.

Though the outlook seems dire, Mr. Brinkmann said that 42 states had foreclosures below the national average. Eight states continue to bear the brunt of problem loans: Nevada, Florida, California, Arizona, Michigan, Rhode Island, Indiana, and Ohio.

Rhode Island is the newest addition to the list of problem states, with a delinquency rate of 6.37% in the second quarter. Mississippi had the nation's highest delinquency rate, 10.44%. Michigan, Georgia, Indiana, and Florida had rates above 7%.