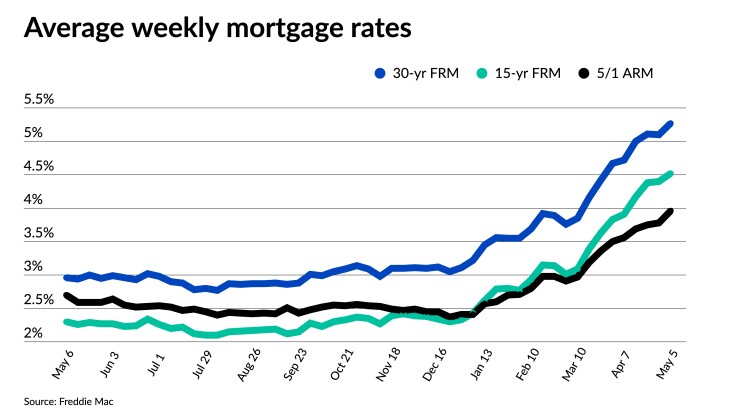

Following a brief one-week lull, mortgage rates surged upward again at a rapid pace, with the 30-year average now at its highest since 2009, Freddie Mac said.

The 30-year fixed-rate mortgage average increased to 5.27% for the weekly period ending May 5, a 17-basis-point jump from 5.1%

Freddie Mac’s latest data comes a day after the Federal Reserve announced it planned to raise the federal funds rate by 50 basis points and passively

“We are starting to see evidence that the Fed’s efforts are having the desired effect, as the white-hot real estate market is showing some early signs of cooling, Marty Green, principal at the mortgage law firm Polunsky Beitel Green, said in a comment to National Mortgage News.

“Sellers are starting to reduce their asking prices some, even in hot markets. While these reductions are not an indication that prices are falling, they do indicate that sellers are facing the reality that the days of the massive run-up in prices from the COVID period may be coming to an end,” he added.

The 50-point hike was even less aggressive than some were predicting. Treasury yields, with which mortgage rates often move in tandem, decreased after release of the Fed’s statement but were headed upward again by Thursday morning.

The larger effect on mortgage rates will likely come from the reduction of

“Whether or not the housing market will be ‘quantitatively uneasy’ with allowing $35 billion in mortgage-backed securities to run off the balance sheet each month will depend on mortgage-backed securities demand, which will dictate whether mortgage rates go up much more,” said Odeta Kushi, deputy chief economist at First American, in an emailed statement.

Michael Fratantoni, chief economist at the Mortgage Bankers Association, emphasized the runoff of mortgage-backed securities and absence of any remarks about the active MBS sales in the Fed’s announcement as a clue to what might lie ahead.

“Musing about active sales has likely increased volatility in the MBS market recently, as investors do not know how to interpret the vague signals that had been given,” he said in a press release. The MBA expected mortgage rates to plateau near current levels, he said.

“The financial markets have attempted to price in the impact of Fed actions over this cycle, and they are likely also pricing in the economic slowdown that will result,” he said.

Along with the jump of the 30-year rate, the 15-year-fixed mortgage average also experienced an upswing, rising to 4.52% from 4.4% one week earlier. One year ago, the 15-year rate stood at 2.3%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage also increased over the past week, climbing to 3.96%, 18 basis points higher than the prior week’s 3.78%. In the same week last year the 5-year ARM came in at 2.7%