WASHINGTON — The Federal Home Loan banks are facing large losses on their holdings of private-label mortgage-backed securities — declines that could threaten the value of stock held by the thousands of banks and thrifts that belong to the Home Loan Bank System.

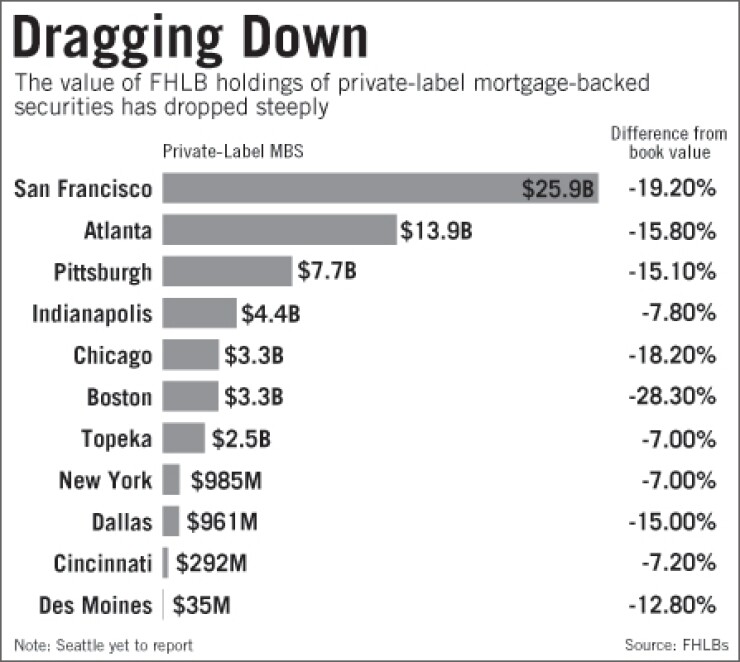

At least 11 of the banks said the value of their private-label securities dropped during the third quarter. The Home Loan Bank of Seattle delayed its earnings report as it tried to value its securities.

The value of mortgage-backed securities at the Home Loan Bank of San Francisco, for example, dropped to $25.5 billion, more than 19% off the original book value.

Some fear that if the banks are forced to recognize losses on their portfolios, one or more of them could run through available retained earnings and be forced to lower the value of its par-value stock.

Such a reduction, dubbed "breaking the buck," would be unprecedented in the system's 75-year history. Some said the Federal Housing Finance Agency could raise retained earnings at several banks to prevent such an occurrence.

"Declines in market value relative to book values could conceivably get to where the financial strength of the bank would appear to be so impaired that its viability would be suspect," said a source close to the Home Loan banks. "If you're the regulator, and that occurs, you become increasingly concerned."

A spokeswoman for the Finance Agency did not discuss the prospect of a Home Loan bank breaking the buck. Such a drop, in which the bank's stock would fall below the $100 par value members pay, would have earnings implications for community bank members.

The possibility of breaking the buck is "not within any rule of reason," said Richard Dorfman, the president of the Home Loan Bank of Atlanta.

"You can always speculate on what if a meteor hit the earth, but there is no reasonable interpretation and no reasonable anticipation of what could happen to the Home Loan Bank System that would support breaking the buck," he said. "When you look at asset quality and retained earnings, all of that tells you that all of us banks take these issues of providing capital cushioning very seriously."

Though mark-to-market accounting rules have hit virtually every institution with exposure to mortgages, the problem is particularly challenging at the Home Loan banks, which are unlikely to face a sudden liquidation.

Most of the securities held at the Home Loan banks are rated triple-A, and the system typically holds the securities until they mature — meaning that over time, their value could be regained.

Still, the Atlanta bank recorded an $87.3 million other-than-temporary impairment loss related to three private-label mortgage-backed assets.

"We know this portfolio is high in quality," Mr. Dorfman said. "This particular instrument is based on the potential of a long-distance cash-flow disturbance of such a minimal amount that I do not see the ingredients here to become excessively concerned."

He also said he is well aware of the seriousness of the situation. "I don't want to give any implication that this is a toss-away issue. We take it seriously, because one ought to manage well, but truly the focus here has got to be on how few securities have been cited."

The Home Loan Bank of Chicago posted a $9 million other-than-temporary impairment charge related to its private-label securities during the third quarter.

The concerns over the private-label securities are a rare sign of weakness in the system's otherwise robust performance during the financial crisis.

Earnings rose at five of the 11 Home Loan banks that have reported third-quarter results. Reflecting the continued demand for liquidity, not a single bank said advances dropped during the quarter.