Are Jamie Dimon and Brian Moynihan looking at the same economy?

Moynihan said Wednesday that he and fellow Bank of America executives see “no problems on the near-term horizon,” and he downplayed market fears of an economic downturn.

That upbeat view contrasted with remarks a day earlier from Dimon, who discussed in detail on JPMorgan Chase's quarterly conference call how his bank is taking careful steps in underwriting and elsewhere in the event of a slowdown. “Sometimes … you’re better off telling your sales force to play golf rather than to make new loans," Dimon said. "We’re not going to be stupid.”

Most everyone agrees that the proximity (or not) of a recession is the question of the hour.

“Trade wars, the government shutdown, China slowdown, EU slowdown, Brexit — you name it both here and abroad impacts people's economic growth outlook,” Moynihan said. “We are mindful of these potential impacts, but we see in the U.S. strong indications of continued growth. The slowdown predicted does not enervate us, it invigorates us. We look forward to continue to produce strong results in 2019 by driving responsible growth.”

Chief Financial Officer Paul Donofrio put a finer point on it in a conversation with reporters: Bank of America sees “nothing in our business to suggest a slowdown is imminent. We feel really good about the future.”

Bank leaders' near-term economic predictions and assessments of operating environments have run the gamut this earnings season, said Brian Foran, a partner in the universal and regional banks division at Autonomous Research. But “in general the bank CEOs have been a little more upbeat than expected,” Foran said. “They acknowledged risks, especially trade wars, but the overall comments were surprisingly upbeat.”

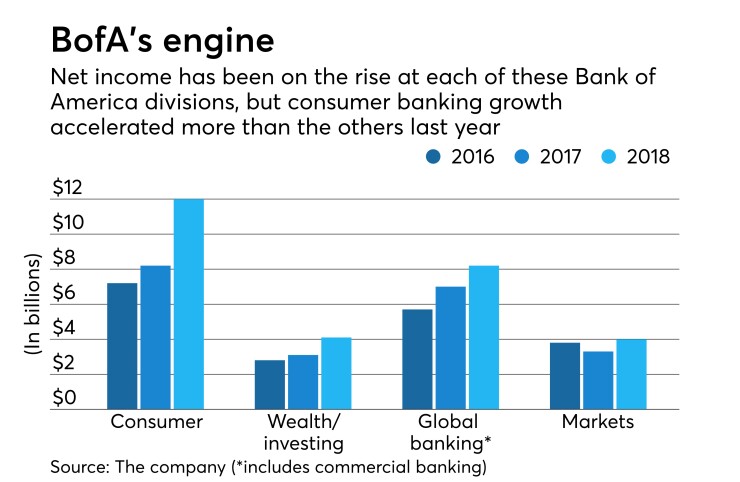

Bank of America's consumer banking operations drove profits in the fourth quarter. The company reported deposit growth of 3% and loan growth of 5% in its retail-banking business. When asked how BofA had achieved the solid deposit growth amid heavy competition on rates, Donofrio said only that BofA has a consumer-focused strategy that it plans to stick with in the new year.

“We have a great nationwide network of financial centers, leading mobile and digital capabilities and [we offer a] tremendous amount of value to depositors nationwide,” he said.

At this point the focus for investors is on what’s going to sustain earnings growth, said Steven Chubak, an analyst at Wolfe Research.

"The sensitivity is on rates and credit more so than other areas just given late-cycle fears that are brewing," Chubak said.

A stronger spread and loan growth were also major contributors to Bank of America’s fourth-quarter earnings. Even if the Federal Reserve pauses interest rate hikes as expected, Moynihan said he feels confident that net interest income can keep rising through the right mix of loan growth and deposit pricing.

Margins have not been “solely driven by higher rates," Moynihan said. "It’s driven by our business model ... which drives strong core deposit growth coupled with strong pricing discipline. ... [It] takes good core loan growth as well.”

Managing long-term debt costs could also help the bank weather stagnant interest rates, Foran said.

"People forget how expensive long-term debt is relative to other funding — their quarterly long-term-debt expense is actually higher than the cost of their entire deposit base," Foran said.

Moynihan expects charge-offs to remain around $1 billion for the rest of 2019, and the bank anticipates that expenses will remain relatively flat. Fourth-quarter noninterest expenses fell 1% from a year earlier to $13.1 billion.

These factors are "all soothing comments for investors who had been spooked by recession fears,” Foran wrote in an investor note.

The Charlotte, N.C., company sees room for expense cutting if revenue is weaker than expected later in the year, Foran added. However, bank executives noted that it does not make sense to cut items like technology investments.

The company has invested $12 billion in new technology initiatives over the last four years, Moynihan said.

"The technology investments allow us to take long-term expenses down," he said.