-

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

May 29 -

The new accounting standard meant to prevent another financial crisis could actually trigger one.

January 31 Ludwig Advisors

Ludwig Advisors -

Many large lenders pointed regulatory restrictions on their balance sheets and reduced risk appetite to explain why they stood on the sidelines during the September spike in overnight funding rates, according to a Federal Reserve survey of senior credit officers.

December 19 -

Shares in the lender fell after it reported lower third-quarter profits, said nonperforming assets rose and cautioned that it had lost multifamily loan deals to competitors offering easier terms.

October 30 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

Only one CU in West Virginia wants to enter the pot banking space, but they're going against the grain not just of the state's credit union league but an industry where fewer than 1% of institutions are serving that market.

July 3 -

Biz2Credit is offering its Biz2X platform to all banks after gaining HSBC and Popular Bank as clients.

May 21 -

John Ciulla, one year in as CEO of Webster Financial, discusses how he is preparing for the next downturn, picking his spots in tech spending, and remaining cautious about M&A.

January 27 -

Bank of America CEO Brian Moynihan and his fellow executives said they see nothing to suggest a slowdown is imminent. Their outlook was far more upbeat than that of JPMorgan chief Jamie Dimon.

January 16 -

The amount of debt owed by businesses and the valuations of corporations are elevated, creating a growing source of concern, the Federal Reserve said Wednesday.

November 28 -

“Who’s to know when the economy may turn?” the head of the Alabama bank said in describing its weak business-loan growth as the byproduct of cautious pricing and underwriting.

September 13 -

Bankers should be careful in their push to deregulate, as efforts to roll back some crisis-era rules will likely add new risks to the financial system.

March 12

-

The sale of firearms is becoming a flashpoint for millennials. That could put individual banks in the position of having to take a stand on gun control — or risk reputational damage.

March 5

-

The sale of firearms is becoming a flashpoint for millennials. That could put individual banks in the position of having to take a stand on gun control — or risk reputational damage.

February 23

-

A U.S. alcohol maker's $191 million investment in Canadian cannabis could raise difficult questions for the banks that have lent big sums of money to the company.

November 21 -

A U.S. alcohol maker's $191 million investment in Canadian cannabis could raise difficult questions for the banks that have lent big sums of money to the company.

November 20 -

An artificial intelligence model predicted creditworthiness more accurately than traditional models in an experiment conducted by the auto lender. The technology someday could be used to find hidden gems among loan applicants — emphasis on the someday.

August 31 -

The Office of the Comptroller of the Currency told a somewhat familiar story Friday about the industry's risk environment.

July 7 -

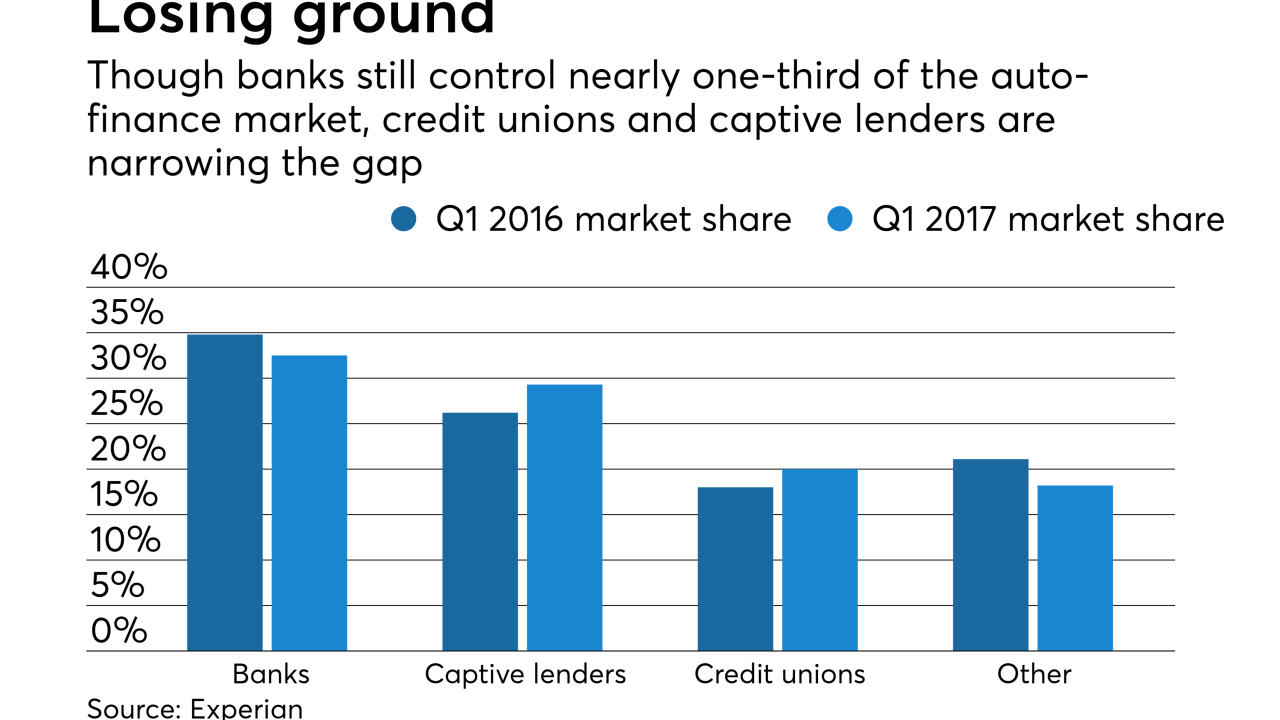

Large banks have scaled back lending as competition has intensified and credit unions and financing arms of car manufacturers are picking up the slack.

June 8