Mutual thrifts are quietly courting the Office of the Comptroller of the Currency in their quest to create a new way to raise capital.

Representatives from the American Bankers Association have been meeting with OCC officials to discuss a proposal to create mutual capital certificates, a special instrument that mutuals could offer to investors to raise funds. For now, retained earnings are the only form of capital available to depositor-owned banks.

The meetings come as the Mutual Bank Capital Opportunity Act of 2015, a bill championed by Rep. Keith Rothfus, R-Pa., that would require regulators to count supplemental capital raised by depositor-owned banks as Tier 1 capital, has been unable to clear the House Financial Services Committee.

-

HarborOne Bank, a mutually owned co-operative bank in Brockton, Mass., plans to sell shares to the public.

March 7 -

Kopernik Bank and Liberty Bank of Maryland, both mutual thrifts in Baltimore, have agreed to merge. No money would change hands given the mutual-ownership structures involved in the deal.

February 24 -

Under the direction of Richard Holbrook, Eastern Bank has prepared itself for the next 200 years by embracing a culture innovation, adding scale through acquisitions and advocating for the less fortunate in its community. It's an unusual formula, but it has worked and that's why he is one of American Banker's three Community Bankers of the Year for 2015.

December 16

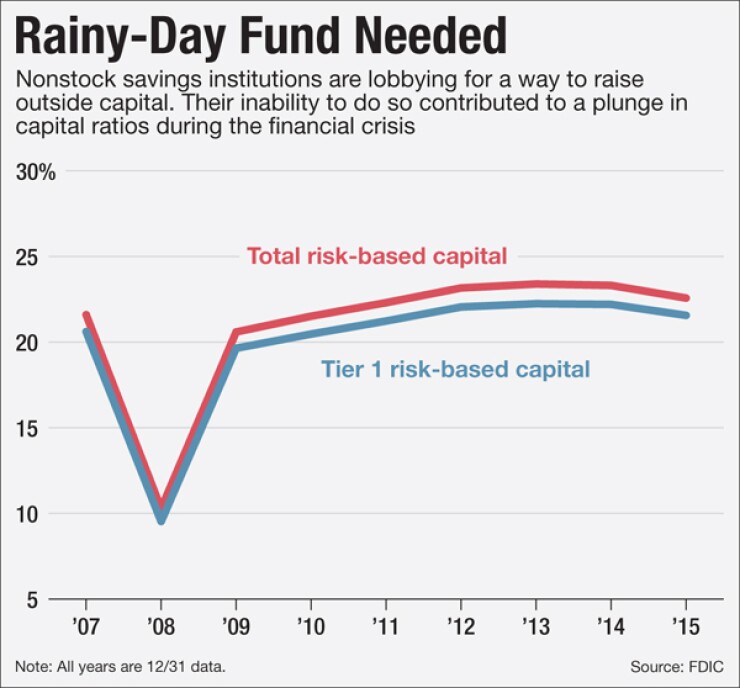

Mutuals, meanwhile, are pushing hard for change, arguing that their limited access to capital restricts growth and could render the sector vulnerable if the economy heads south again.

"Capital is always a concern," said Charles Schmalz, president and chief executive of the $235 million-asset East Wisconsin Savings Bank in Kaukauna. "Right now, the only ways we can boost our ratios are to make money or get smaller, and it takes time to do either."

The mutual bank sector has seen its numbers dwindle in recent years as a steady stream of depositor-owned institutions has converted to partial or full stock ownership. The number of mutual thrifts has decreased by nearly 6% since late 2012, to 549 institutions, according to the American Bankers Association.

Supplemental capital is also an important issue for credit unions. The House Financial Services Committee is also looking at a bill introduced by Reps. Peter King, R-N.Y., and Brad Sherman, D-Calif., that would

The American Bankers Association is taking two separate approaches to the mutual capital issue, said Joe Pigg, the trade group's senior counsel. One approach focuses on getting the Mutual Bank Capital Opportunity Act passed, though the bill's prospects face an "uphill climb," Pigg said.

"Congress does not typically get involved in defining capital," Pigg said.

At the same time, banking regulators have strongly opposed categorizing anything besides retained earnings as Tier 1 capital for mutual, said Dawn Causey, the American Bankers Association's general counsel. "They just don't want to mess with the definition of Tier 1," she said.

The second approach, Pigg said, involves engineering support for some kind of Tier 2 capital instrument, and discussions with the OCC represent the first step along that path. The America Bankers Association also plans to seek support from the Federal Deposit Insurance Corp. and Federal Reserve Board.

Talks with the OCC have yielded some progress, but the sides remain a long way from a resolution.

"There's absolutely no timetable," Causey said. "We've had several cordial, problem-solving discussions, but we haven't solved the problem yet."

A big hurdle involves protecting the ownership rights of depositors.

While the OCC is open to a solution that lets mutual raise supplemental capital, it "will not support an instrument that could have a detrimental effect on the deposit holders' rights or significantly alter the nature of the mutual savings association's ownership," an agency spokesman said in an emailed statement.

Also, the OCC will not support amending the definition of Tier 1 common equity "in ways that would include an instrument that would otherwise not qualify because doing so could weaken an institution's ability to absorb losses," the spokesman said.

Rothfus, for his part, said any plan that would let mutuals raise capital is better than the status quo. He also claimed partial credit for bringing regulators to the table.

Debate over his bill succeeded in "getting regulators comfortable with this concept," Rothfus told attendees at the American Bankers Association's recent Mutual Community Bank Conference. "Any constructive engagement with regulators is encouraging," he said.