The competitive landscape for mortgage insurers, which are under pressure from staggering claims costs, has shifted substantially.

But whether gains in market share will endure, or even what capturing a bigger piece of the pie means, remains unclear. Even with tighter underwriting standards, the profitability of policies being issued today is uncertain.

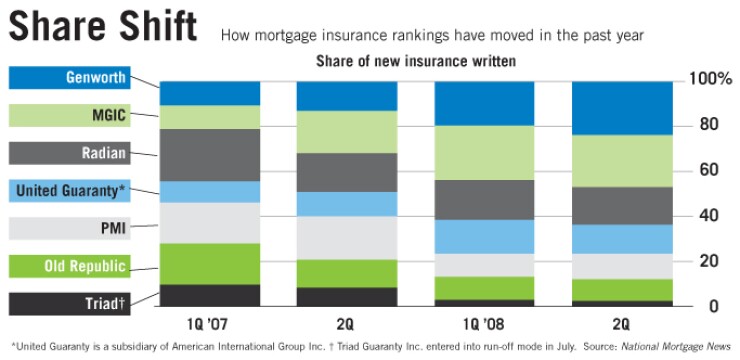

Among the seven largest providers, Genworth Financial Inc. captured the most market share during the 12 months that ended June 30. The Richmond, Va., company's share of new insurance written in the second quarter grew 10.8 percentage points from a year earlier, to 23.9%, according to National Mortgage News.

That gain pushed Genworth ahead of MGIC Investment Corp. in new insurance, though MGIC, long the dominant player, still has a sizable lead in total insurance outstanding — $226.4 billion to Genworth's $145.4 billion.

PMI Group Inc. of Walnut Creek, Calif., posted the biggest drop in market share, losing 8.2 percentage points, to 11%. It placed second in total insurance outstanding, with $179.1 billion.

Triad Guaranty Inc.'s share sank 6.3 percentage points, to 2%. The Winston-Salem, N.C., company, which had $66.3 billion of total insurance in force, began winding down its portfolio in July after Fannie Mae and Freddie Mac, the largest beneficiaries of mortgage insurance, cut it off from new business.

The overall market has contracted sharply as private insurers stiffened standards and prices, driving a dramatic shift in business to the Federal Housing Administration.

James Eck, an analyst with Moody's Investors Service Inc., said in an interview last week that the changes in market share could reflect pricing and underwriting changes implemented by the companies, which in turn reflect choices about risk and capital capacity.

"It also might be that lenders are gravitating more to Genworth, which appears to be pretty well positioned to make it through the cycle," Mr. Eck said.

Genworth and American International Group Inc.'s United Guaranty Corp. are the only two companies that have retained double-A financial strength ratings — until recently the level needed to do unfettered business with the government-sponsored enterprises — from all three major rating agencies.

Genworth has been helped by its other insurance businesses, including its much larger mortgage insurance line outside the United States, though it has been hammered by its losses on subprime and alternative-A mortgage bonds.

"There probably is some flight to quality," James Brender, an analyst at Standard & Poor's Corp., said in an interview last month, with lenders' concerns centered mainly on the possibility that the GSEs will pull the plug on a mortgage insurer before they can sell their loans.

But Mr. Brender also said he believes risk tolerance likely plays a larger role than flight to quality in capturing market share. "If you're willing to do declining markets and stuff like that, you could become the largest MI easily."

The field has evolved rapidly, as have the companies' underwriting criteria.

"At certain times everyone has had the most conservative guidelines," Mr. Brender said. "It's not worth trying to figure out, well, who's got the most conservative now, because in a month somebody else will have them."

Nate Purpura, a spokesman for PMI, wrote in an e-mail last month that his company had made a "strategic decision" to shrink its market share.

"To that end, we've been exercising control in the areas of quality and volume by leading the market with several changes in our guidelines and pricing," Mr. Purpura wrote.

He also cited recent actions PMI has taken to shore up its capital position, including deals to sell its mortgage insurance businesses in Australia, New Zealand, and Hong Kong for about $1 billion.

The deals "will add to our liquidity, but we'll continue to evaluate risk and make underwriting decisions based on what we believe is in the best interest of our customers and shareholders, which — at this time — is to write new business that is of high credit quality," Mr. Purpura wrote.

Mr. Brender said shifts in volume could have a lasting impact. "To the extent that someone cut somebody off … and they have a positive experience" with a new insurer, the business could be enduring.

But Mr. Eck said whether that effect will be permanent is a difficult call.

"Most of the large lenders generally have relationships with all the companies, and they may just be shifting their allocations around," he said. Still, "that's a possibility, that the stronger companies will emerge from this cycle in a better position."

S&P announced another round of downgrades for the industry last week. Ratings on the mortgage insurance subsidiaries of Old Republic International Corp. fell one notch, to A-plus. PMI's unit ratings fell two notches, to A-minus, and Radian Group Inc.'s unit ratings fell two notches, to BBB-plus.

The rating agency said that this latest round of downgrades reflected a bleaker outlook on such factors as home prices and unemployment, as well as its view that the sector's "much larger counterparties" — the GSEs and lenders — "have historically been able to implement initiatives that either weaken mortgage insurers' profitability or raise their risk tolerances."