The banking industry is a long way from fully implementing new climate risk tools, with most large and regional institutions still in the early stages of conducting the analyses that regulators are poised to recommend.

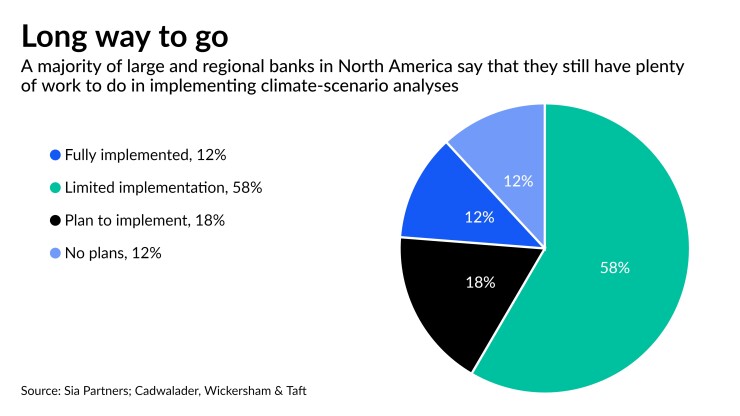

That’s according to a new survey, which found that only 12% of the North American banks polled were already running so-called “scenario analyses” on climate risk.

More than three-quarters of the banks surveyed are either starting to run such analyses or planning to do so soon, according to the survey from the consulting firm Sia Partners and the law firm Cadwalader, Wickersham & Taft.

Many banks are waiting for details from regulators about the types of tests they will be expected to run, the survey found. Banks are also facing data hurdles as a result of significant data gaps in climate-related disclosures.

“Once that infrastructure is developed, I think you’ll see a lot more progress for U.S. banks,” said Brendan Moriarty, senior manager at Sia Partners.

Moriarty said that European banks are ahead of their American counterparts, partly due to a push among Continental regulators and the industry to develop standardized data on climate risks.

The survey, which was conducted in recent months, drew responses from more than 70 banks and other financial firms globally. About a quarter of them were U.S. and Canadian banks.

Particularly in the last year, North American financial regulators have been gearing up for climate-related actions. The Bank of Canada last month released the

In the U.S., regulators are planning to implement scenario analyses for larger banks, with Federal Reserve Chairman Jerome Powell saying at a congressional hearing last month that climate stress scenarios would likely be a “key tool going forward.”

In December, the Office of the Comptroller of the Currency

The Financial Stability Oversight Council, an interagency group led by Treasury Secretary Janet Yellen, has

Bankers appear to be eager for such cross-border efforts, with 95% of the survey’s respondents favoring an international framework to ensure that various countries’ climate finance regulations become less fragmented.

In the meantime, banks have been working to implement recommendations issued by the Task Force on Climate-Related Financial Disclosures, a group established in 2015 by the Financial Stability Board, which makes recommendations on the global financial system.

Wall Street banks have published reports detailing climate-related risks, as recommended by the task force. And in recent months, some regional banks, including Regions Financial in Birmingham, Alabama, PNC Financial Services Group in Pittsburgh and Truist Financial in Charlotte, North Carolina,

Some banks have also started to weigh climate risks in their loans and underwriting documents, according to the survey by Sia Partners and Cadwalader.

About 87% of globally focused banks, a group that includes some firms based in the United States, consider climate risk in their lending decisions, but less than half of U.S. regional banks do so, the survey found.

Globally focused banks have moved faster because they have a bigger presence in Europe and the United Kingdom, where regulators have been quicker to adopt climate-related rules, said Brandon Sutcliffe, a consultant at Ernst & Young.

In a study conducted last year, Ernst & Young and the Risk Management Association found that banks were in the “early stages of embedding climate risk” into their risk appetite frameworks, which they use to determine whether to approve particular loans. About one-third of the banks the firms surveyed said they had not started embedding climate risk into those risk frameworks.

“Completing this work will be essential in truly embedding climate risks in day-to-day decision-making,” the report by Ernst & Young and the Risk Management Association stated.

The remaining banks, which have made progress in adding climate risk to their risk appetite frameworks, have mostly focused on the physical risks from climate change, such as the impact of hurricanes and wildfires, the report said. Physical risks differ from so-called transition risks tied to climate change, which include the impact on banks’ loans if fossil fuel prices fall rapidly.