Wachovia Corp.’s retirement unit is meeting with 401(k) clients one-on-one and accumulating assets in its mutual fund wrap accounts.

Wachovia Retirement Services’ AdviceTrack has increased participation from 2% of plan participants in October 2003 to 6.5% at the end of this October. Keith Sykes, a defined contribution product manager in the retirement unit of the Charlotte, N.C., banking company, said participation tripled because Wachovia used one-on-one meetings to persuade customers to invest in the product.

Mr. Sykes said he expects participation will reach 20% within five years.

“This growth is attainable, and we can go a lot higher,” Mr. Sykes said. “The adoption rate is as high as 37.5% in one plan. We have to focus on connecting with individuals and tweaking this one-on-one model to drive this adoption rate higher.”

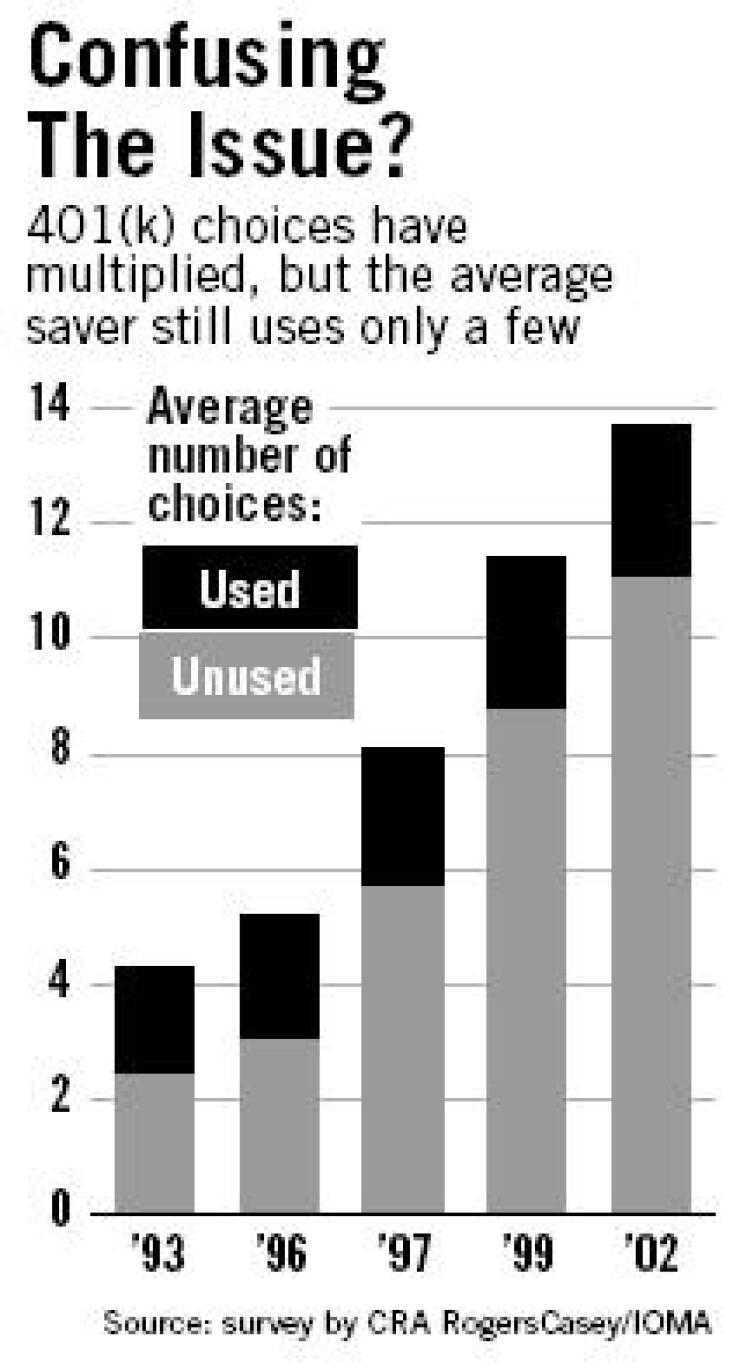

The number of investment options is increasing, Mr. Sykes said, and choices are become more and more knotty for investors. A 2003 CRA RogersCasey/IOMA defined contribution survey found that the average number of investment options had increased from 4.3 in 1993 to 13.7 in 2002. The average number of options that customers used, however, grew only from 1.8 to 2.6.

Mr. Sykes said companies must learn to keep it simple. A mutual fund wrap program like AdviceTrack can do this, he said. AdviceTrack is offered to plan sponsors as an option in addition to the array of mutual funds customers can choose. A Wachovia investment manager then diversifies the investor’s assets across 12 mutual funds and adjusts the allocations based on the person’s risk profile and age.

“If you make a program complicated, you are not going to see high levels of adoption,” Mr. Sykes said. “When we first launched Internet advice to customers, only 1% were using it. That is pretty telling.”

“Keeping things simple but comprehensive is just very difficult,” he added.

Don Salama, the managing director of marketing and sales at NYLIM Retirement Plan Services, a division of New York Life Investment Management, said that managed accounts have gained importance as 401(k) plans have proven “broadly ineffective” in getting more plan participants to save for retirement.

Companies that have begun offering mutual fund wrap programs or similar managed accounts in their 401(k) plans include Fidelity Investments, Vanguard Group, and NYLIM.

Fidelity launched its program, Fidelity Retirement Plan Manager, in March 2003. Jennifer Engle, a spokeswoman, said Fidelity has 32 plans using Retirement Plan Manager, with just more than 1,400 participants enrolled and $230 million of assets under management. At the end of May, only seven plans used the program.

Vanguard, which started its program Oct. 1, has no specific sales goal but says it expects no fewer than 10% of plan participants to be interested. Wachovia has 294 plans signed up to its platform and says it expects 800 within five years. Mr. Sykes said the industry in general has lagged behind Wachovia with this product because most companies are not going directly to individual investors.

“Making an announcement wasn’t enough, the call center wasn’t enough, we had to get in front of investors because these people are uninvolved by nature,” Mr. Sykes said.

About 14.8% of people who met one-on-one with Wachovia representatives have signed up for AdviceTrack, he said.

Kevin Daniels, a Boston analyst, agreed that managed accounts and mutual fund wrap programs can succeed in association with 401(k) plans. However, most providers cannot be as aggressive as Wachovia because one-on-one meetings can be very costly, he said.

“You are talking about talking to thousands of customers or, actually, just potential customers,” he said. “Some firms have to carefully allot their resources in order to build a profit.”

Mr. Sykes said the cost associated with these meetings is one Wachovia is willing to absorb.

“We are willing to take on the cost because we are building a strong downstream effect here,” Mr. Sykes said. “The economics work for us because we have such a large distribution network.”

“We are going to benefit from the increased participation, even if this does cost us,” he added.

Mr. Sykes said Wachovia is working on using AdviceTrack to help it maintain these customer relationships after retirement or departure from the 401(k) plan. The company is using the same methodology to roll 401(k) account balances into IRAs.