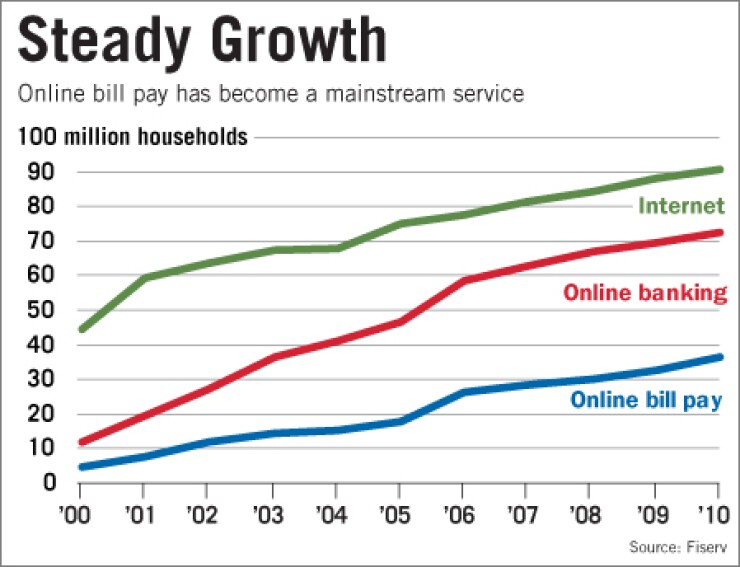

Four out of five U.S. households with Internet access now bank online, according to Fiserv Inc.

Not only has the use of online bill payment and electronic bills grown steadily over the years, it is also changed significantly, said Geoff Knapp, the banking technology vendor's vice president for online banking and consumer insights.

Nearly 72.5 million U.S. households with Internet access, or 80% of total households, bank online, up 4% from February 2009, when Fiserv conducted its previous trends survey. Nearly 36.4 million households pay bills online, up 11.7%.

Women have edged out men as the primary payers of bills online. In 2002, 61% of bill payers online were men, and they were the majority in 2009. This year, women made up 51% of online bill payers.

Online bill payment has moved into the mainstream and is not used just by young or tech-savvy consumers, Fiserv said. This year people 21 to 34 make up 28% of online bill payers, those 35 to 54 make up 48%, and those older than 55 make up 24%. In 2002, more than 50% of online bill payers were between 35 and 54.

Fiserv, of Brookfield, Wis., surveyed 3,029 online consumers in January for its Consumer Billing and Payment Trends study, which was released May 25.

The survey also found a decline in the use of paper checks and growth in electronic bills. Consumers now use paper checks to pay 26% of their bills; in 2000, checks represented 61% of all bill payments.

Consumers also now pay 45% of their bills online, up from 12% in 2000, according to the study. And the percentage of consumers who receive bills electronically has increased to 33% from 24% in 2009.

The evolution of online banking and bill payment also has produced deeper relationships between banks and customers because consumers who use the services tend to use more of the bank's offerings, Knapp said.

Consumers who bank and pay bills online generate more revenue for financial companies because they use more services and products, are more deeply tied to the company and are less likely to leave, according to Fiserv.

This year, 13% of consumers who use online banking are more likely than the average customer to have a savings account at the same bank, up from the 8% who were in 2005. And nearly half of respondents who pay bills online said they were less likely to switch banks because of their positive experience with the service.

Fiserv's survey also looked at the growth in such new areas as mobile banking and person-to-person payments. This year, 30% of respondents with mobile phones conducted one or more banking services by phone, up from 23% who did so in 2008. The percentage of mobile-banking users who receive or pay bills using their phones jumped to 30% this year, from 18% in 2008, primarily because more consumers have smart phones, Fiserv says.

More than half of respondents who sent funds to friends, family or others used an online payment service, the survey found. No comparative data were available.