Pacific Capital Bancorp has renewed its focus on serving middle-market customers and high-net-worth individuals, and it is shedding its equipment leasing and indirect auto financing businesses, because they do not jibe with that strategy.

The $7.4 billion-asset Santa Barbara, Calif., company announced late Wednesday that it sold one business line and made a deal to sell the other. The two deals are worth $502 million. Related Link

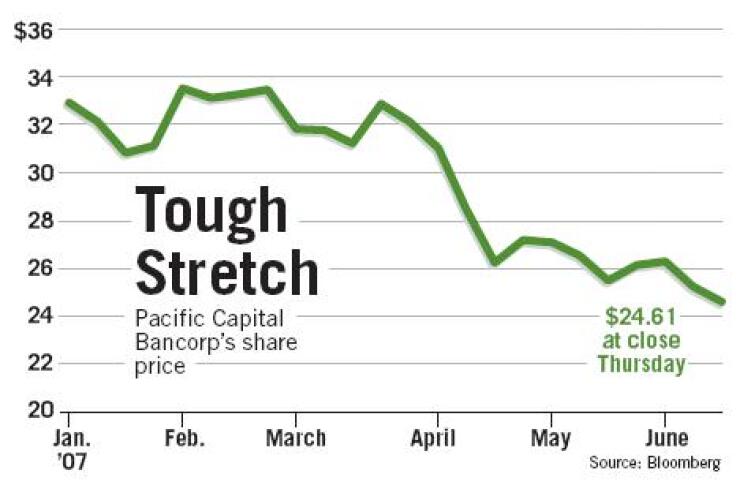

The news of the deals, though, failed to jump-start the company's sputtering stock, which fell to a 52-week low last week and has dropped 26% for the year. On Thursday the stock fell 0.28%, to $24.61 a share.

Analysts attribute the stock decline not to the core banking strategy, but rather to the uncertainty surrounding its other important business line: tax-refund anticipation lending. Congress is considering legislation that would prohibit the Internal Revenue Service from sharing certain debtor information with lenders, and Brett Rabatin, an analyst at First Horizon National Corp.'s FTN Midwest Securities Research Corp. in Nashville, said there is concern that the bill could discourage refund anticipation lending.

For now, though, Mr. Leis stressed that Pacific Capital would not abandon refund anticipation lending while it continues to ramp up in traditional banking. Though the loans can be risky, they historically have contributed a substantial amount to the company's pretax income, he said.

Mr. Leis joined Pacific Capital in March of last year as the executive vice president of its wealth management business lines. Four months later the company bought Morton Capital Management, a registered investment adviser in Calabasas, Calif., adding $1 billion of assets under management.

Since January, Pacific Capital has hired about 15 commercial lenders and private bankers, and it has opened two loan production offices with wealth management services in Los Angeles County, as part of what Mr. Leis called its "adjacent market strategy." Most of its 51 branches are in Santa Barbara and Ventura counties, and he said it plans to open more branches and loan offices in neighboring markets.

John Pancari, an analyst at JPMorgan Securities Inc. in New York, said Pacific Capital was smart to exit indirect auto lending and commercial equipment leasing, which were only marginally profitable.

"Given their focus on the core business, it became increasingly critical to exit these businesses and redeploy the assets, particularly to their adjacent market strategy that they're continuing to implement, including expansion of branch locations and banker hirings," Mr. Pancari said.

In its announcement Wednesday, Pacific Capital said it had a deal to sell its commercial equipment leasing and finance business to Leaf Funding Inc., Leaf Financial Corp., and Leaf Commercial Finance Co. LLC, three units of Resource America Inc., for about $280 million in cash. Pacific Capital would record a $20 million gain on the sale this quarter.

It also said that it had closed its previously announced deal to sell its indirect auto financing portfolio to Wells Fargo & Co. for about $222 million in cash. This quarter Pacific Capital will record a loss of about $900,000 related to that sale.

Its renewed focus on commercial banking and wealth management offset a first-quarter drop in the refund anticipation loan business.

Excluding the refund loans, first-quarter interest income rose 18% from a year earlier, to $122.4 million, as the loan book rose 14.3%, to $5.39 billion. Noninterest income, excluding the refund loans, rose 17.2%, to $16.8 million, mainly because of the Morton Capital acquisition.