Pacific Premier Bancorp in Irvine, Calif., has agreed to buy Opus Bank in Irvine.

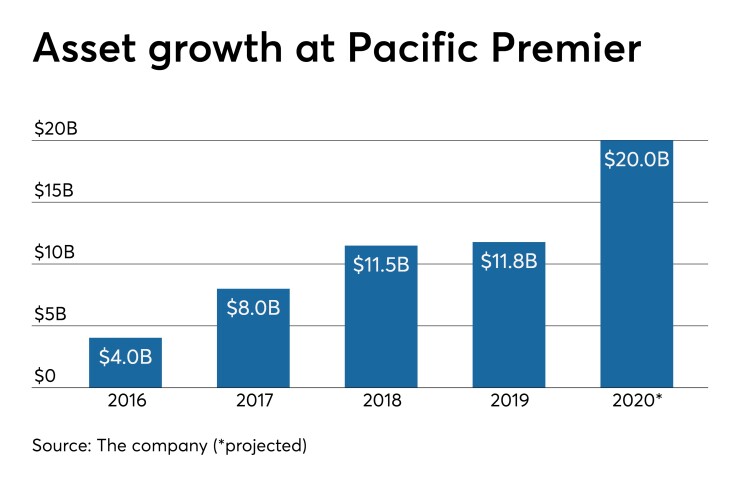

The $11.8 billion-asset Pacific Premier said in a press release Monday that it will pay $1 billion in cash and stock for the $8 billion-asset Opus. The deal, which is expected to close in the second quarter, priced Opus at 138.4% of its tangible book value.

Opus has 46 branches, $5.9 billion in loans and $6.5 billion in deposits in Arizona, California, Oregon and Washington. The acquisition will also allow Pacific Premier to enter Seattle, where Opus has $1.2 billion in deposits.

Pacific Premier said it expects the deal to be 14% accretive to its 2021 earnings per share. It should take nearly two years for Pacific Premier to earn back any dilution to its tangible book value.

Pacific Premier plans to cut about a quarter of Opus’ annual noninterest expenses.

“We are excited to announce this transformative merger that we believe will create one of the premier commercial banks in the western United States,” Steven Gardner, Pacific Premier’s chairman, president and CEO, said in the release.

The acquisition “provides us with a meaningful presence in attractive major metropolitan markets with operational scale, a complementary set of banking products and services, and improved revenue and business diversification,” Gardner added.

For Opus, the sale comes less than a year after it hired

The once highflying Opus had struggled in recent years, reporting multiple quarters of losses from 2016 to 2018. It exited certain businesses and reduced the size of several loan portfolios.

Founding CEO Stephen Gordon

The bank showed signs of recovery in 2019, doubling its net income from a year earlier while booking more loans and reducing bad assets.

D.A. Davidson and Holland & Knight advised Pacific Premier. Piper Sandler and Sullivan & Cromwell advised Opus.