As the last big banking company to report results this earnings season, PNC Financial Services Group Inc. provided a fitting postscript — in red ink.

PNC, one of several in the industry that acquired ailing businesses at the end of last year, gave updates on how it is integrating National City Corp. of Cleveland, whose mounting mortgage portfolio losses forced it to put itself up for sale.

James Rohr, PNC's chairman and chief executive, said the Pittsburgh company continues to evaluate National City's mortgage business, while working to bring down higher interest rates the troubled lender had offered depositors. It is also cutting costs, with plans to reduce its work force by nearly 10% by 2011, and is working through National City's impaired loans, where it said it has made progress.

Though his company's capital position is strong, Mr. Rohr said in a conference call that a lot could "change between now and" April, when the board meets. He declined to commit to preserving PNC's dividend of 66 cents a share, saying it was up to the board to decide on that in April.

Arthur Hogan, chief market analyst at Jefferies & Co., said the good news at PNC is that it appears confident that it will not need to raise capital. On the downside, he said it seems the National City acquisition could end up being costlier than anticipated.

"With National City, we are now again in the mortgage business," Mr. Rohr said during the call. He said it continues to evaluate its risk profile.

PNC, which exited residential mortgages in January 2001, has rehired Sy Naqvi, who headed PNC's mortgage unit from 1995 to 2001, to head PNC's mortgage business, Mr. Rohr said.

"We are looking at how it fits with our desired risk profile in terms of providing adequate risk-adjusted returns and the overall composition of our balance sheet," Mr. Rohr said Tuesday.

The CEO said his company conducted a comprehensive review of the risk of National City's balance sheet after closing the deal. It found $19 billion in impaired loans, which it has priced at "fair value on our balance sheet with a mark of $7.4 billion or 38% of the total." When PNC announced the deal, it said it expected a $11 billion markdown.

Mr. Rohr said executives are also "looking to reduce the high-cost deposits" that came with National City, which brought $104 billion in total deposits to PNC. In acquiring Nat City, PNC entered coveted and growing markets such as Chicago, St. Louis, and Indianapolis and gained a strong position in Ohio (Nat City was the state's largest banking company).

Indeed, PNC's deposits increased by 127% from the third quarter and 133% from a year earlier to $193 billion. Excluding National City, PNC's average deposits rose 3% from the third quarter and 8% from a year earlier to $87.5 billion, PNC said. Brian Goerke, a spokesman for the $291 billion-asset PNC, said it has been trying to lure back National City's depositors through a marketing campaign and by sending relationship managers out to call on National City's former corporate clients. PNC has added $1 billion of deposits in January, some of which came through this effort, he said.

But Mr. Goerke said PNC would move away from Nat City's higher-cost focus on certificates of deposit and try to secure more checking accounts.

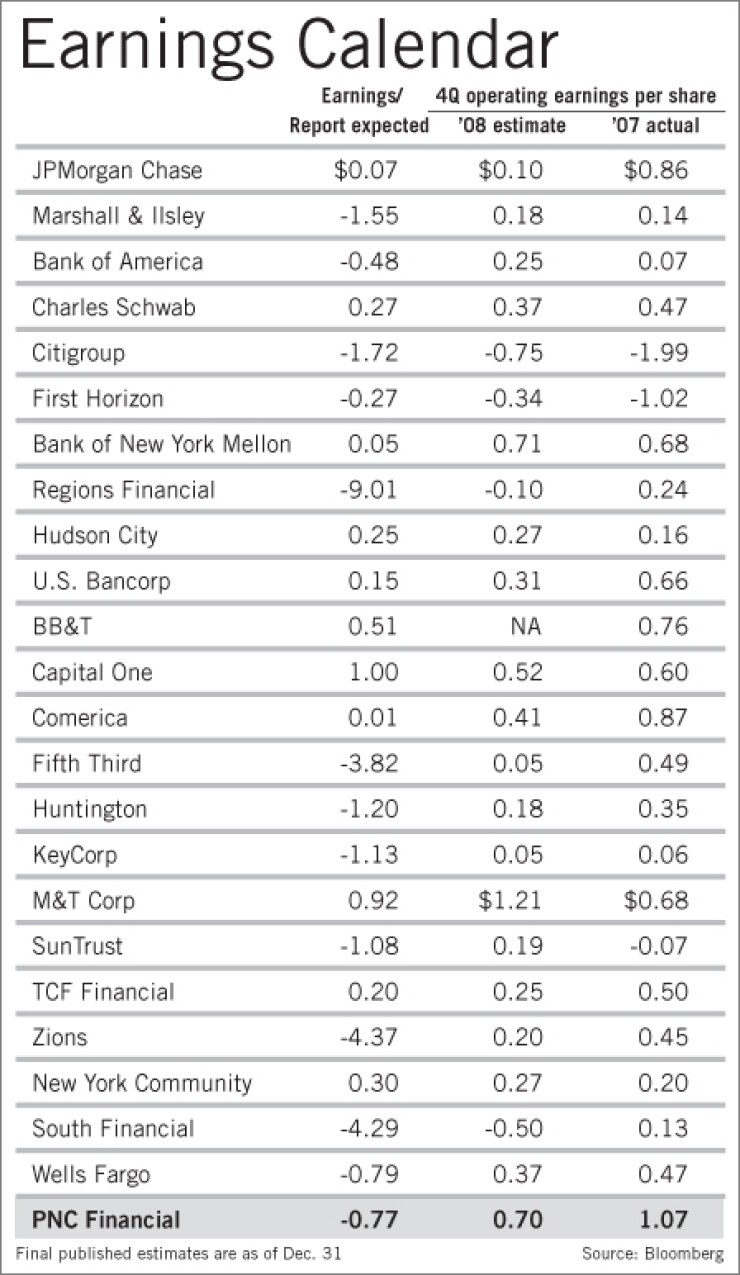

In all, the Nat City acquisition caused PNC to post a loss of $248 million, or 77 cents a share, for the fourth quarter. The average analyst estimate called for per-share earnings of 75 cents, and PNC said it earned 32 cents a share excluding Nat City. For the year-earlier period PNC recorded a profit of $178 million, or 52 cents a share.

Like Wells Fargo & Co., which acquired Wachovia Corp., PNC's loss marked its first in several years. PNC last recorded a loss in fourth quarter of 2001, when it had to restructure its loan portfolio because of accounting issues.

Wells Fargo shares soared last week on the day it reported its fourth-quarter results, which was also a good day for the sector as a whole PNC's shares fell 7.24% Tuesday and the KBW Bank Index shed 5.15%.

Analysts said Tuesday that, though PNC has made progress in integrating National City, it still has a lot of work to do.

Matthew Schultheis, an analyst with Boenning & Scattergood Inc., said he is worried about PNC's exposure to the residential real estate markets in Michigan and northern Ohio. He said the drop in its share price Tuesday underscores those fears, though the decline may have been "somewhat of an overreaction" in the market.

PNC said provisions rose 421% from the third quarter and 427% from a year earlier, to $990 million; it said $504 million of that was related to Nat City. Net chargeoffs were up 79% from the third quarter and rose 149% from a year earlier, to $207 million. PNC attributed the rise in provisions and chargeoffs to its exposure to residential real estate development and commercial real estate, among other things.

PNC ended the year with $2.2 billion of nonperforming assets, including $722 million from the Nat City purchase. That was up 151% increase from the third quarter and 244% from a year earlier.

PNC boosted its allowance for loan and lease losses by 255% from the third quarter and 388% from a year earlier, to $3.9 billion. About $2.2 billion of that allowance was acquired from Nat City, and $504 million was an allowance adjustment for differences between the PNC and National City reserves.

The $3.9 billion reserve does not include the $7.4 billion in fair-value adjustments on $19.3 billion in impaired loans acquired from National City.

Richard Johnson, PNC's chief financial officer, said his company is bracing for more pain in 2009 and will set aside $3 billion in provisions to deal with an anticipated $2 billion to $2.5 billion of chargeoffs. The provisions will be split equally between the Nat City and PNC loan portfolios, he said."We'll still be reserve building through the year," he said.

PNC's Tier 1 capital ratio, bolstered by the $7.6 billion it received in December under the Treasury Department's Capital Purchase Program, was 9.7% in the fourth quarter, up from 8.2% in the third quarter. Its tangible common equity ratio was 2.8%, down from 3.6% in the third quarter.