FirstCapital Bancshares of Texas has aspirations of going public in the next couple of years and it’s counting on the resources and expertise of private equity backer Castle Creek Capital to help it realize that goal.

Castle Creek, which owns stakes in roughly two dozen banks, injected an undisclosed amount of capital into Midland, Texas-based FirstCapital earlier this year to help fund the bank’s acquisition of the $500 million-asset FB Bancshares in Wichita Falls, Texas. Some Castle Creek principals also sit on the board of the $1.7 billion-asset FirstCapital, providing crucial counsel to senior leaders as they eye an initial public offering.

“Having those board members on there helps … if we decide to go public down the road,” said Don Cosby, FirstCapital's president. “Those potential investors see that as an additive, that we do have some expertise.”

Tapping the public equity markets has long been tried-and-true growth strategy for expansion-minded banks, but this year, deals like the one between Castle Creek and FirstCapital have been few and far between.

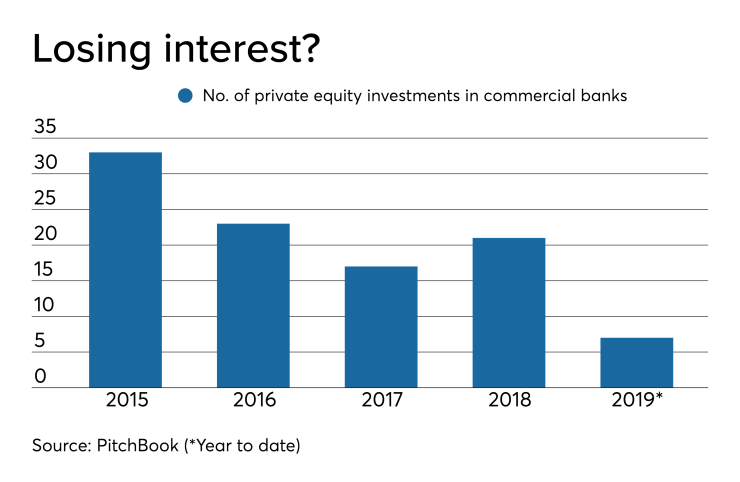

It was one of just seven bank-private equity deals to be completed in 2019, compared with 21 last year and 33 three years ago, according to data collected by Pitchbook, a Seattle-based financial data company that tracks investments in the private equity and venture capital industries.

One explanation for decline is that most banks are well capitalized and simply don't need the money.

But industry experts say that some private equity investors could also be souring a bit on the banking sector, amid concern that profits are being squeezed by persistently low interest rates and intense competition for loans and deposits.

There’s also the view that fintechs have more upside. In the third quarter alone, private equity, venture capital and other investors plowed some $12.3 billion into fintechs, according to data compiled by CB Insights.

Compare that to just $337 million private equity and venture capital funds have invested in the banking sector for all of 2019.

The challenging environment “has reduced private equity appetite in commercial banking,” Cosby said. “The more exciting area is some of the technology: fintech-type solutions as the market continues to change.”

The biggest private equity deal in banking this year was completed by Grasshopper Bancorp in New York. Grasshopper raised $116.2 million on the back of a $15 million seed funding round to open its newly chartered Grasshopper Bank.

Grasshopper pieced together the fundraising from several firms. One of those investors was Patriot Financial Partners, one of the biggest private equity firms left and one that is actively investing in banks.

Kirk Wycoff, managing partner at Patriot, said a small population of private equity firms are focusing on smaller, community banks where they can find them.

“It’s become more of a boutique market, which has caused the bigger players who write checks of $50 million or more to move on,” he said.

Patriot still plans to maintain a pace of investing roughly $100 million a year over five or six transactions, Wycoff said. But the firm has begun shifting toward buying asset management companies to supplement its bank deals.

Another private equity firm left investing in banks is adopting new strategies, too, because of what it sees as a dearth opportunities for traditional deals. EJF Capital in Arlington, Va., said in a note to clients in March that it was turning attention to buying distressed assets from regional and community banks. This market has been big for large banks looking to offload problem loans, but EJF noted there could be opportunity to pick off portfolios from smaller banks that have fewer connections to capital markets.

Still, if the economy weakens and banks’ loan losses start to mount, it’s a good bet that private equity investors will come to their rescue, as they did during the financial crisis a decade ago.

According to research published by the Federal Reserve Bank of Boston in 2018, researchers tracked about 79 deals between 2004 and 2016 and found an average 12.7% rate of return for private equity investors over the life of their deals. This exceeded returns in other areas like broad stock market indexes.

“It may be on a somewhat reduced level, but there will always be the perceived opportunity if this expansion does not go on forever,” Cosby said. “If there is stress within the system, I think they will return.”