-

The U.S. island territory is on the verge of having only six banks left, but executives there welcome consolidation and appear more open to change than their mainland peers.

July 3

First BanCorp (FBP) has traveled a bumpy road to recovery but top management hopes a clear strategy will help the San Juan, Puerto Rico, company complete its turnaround.

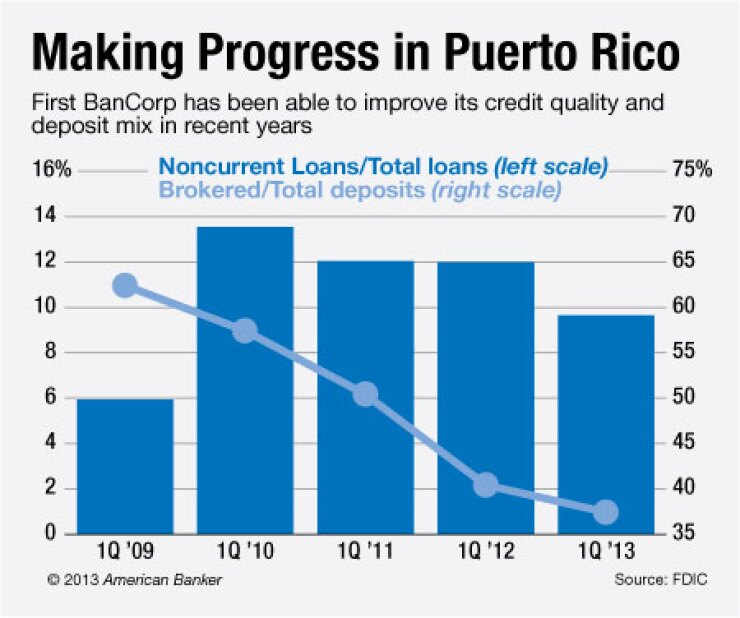

In recent years, the $13 billion-asset company has struggled with capital and credit issues that prompted a recapitalization and shifts in its loan and deposit mixes. Management continues to focus on improving credit quality while looking for more lending opportunities.

"The strategy for this year is continuing to clean up the balance sheet," says Aurelio Alemán-Bermúdez, First BanCorp's president and chief executive. "After we achieve that, we would consider any additional opportunities to enhance shareholder value."

When Alemán-Bermúdez become CEO in 2009, management outlined "four pillars" recapitalizing the bank, managing the balance sheet, retaining franchise value and enhancing risk management. So far, First BanCorp has been able to improve the bank's performance, he says.

First BanCorp in 2011

After bolstering its capital ratios, First BanCorp turned its attention to nonperforming assets. In the first quarter, the company

At March 31, nonperforming assets made up 8.35% of total assets, down from 10.18% a year earlier. Nonperforming assets have declined for 12 straight quarters.

More bulk sales could take place, especially for soured residential loans, says Alexander Twerdahl, an analyst at Sandler O'Neill. Such loans tend to be smaller so "resolving those individually compared with what you can get in a bulk sale may not be worth it," he adds.

Many of First BanCorp's remaining problem commercial loans tend to be larger so the company may be less inclined to sell those at a steep discount and could instead opt to work with its borrowers, Twerdahl says.

First BanCorp has also worked to retool its deposit base to lower its funding costs. The company used to rely on wholesale funding, so it didn't invest in deposit products, Alemán-Bermúdez says. In recent years, First BanCorp increased core deposits while lowering its cost of funds. It also began offering services such as electronic and mobile banking, e-statements and cash management products.

The shift should help lift the company's net interest margin, particularly as more brokered CDs mature, Todd Hagerman, an analyst at Sterne Agee, wrote in a recent note to clients. Hagerman, who raised his rating on the company to "buy" from "neutral," estimated that the margin will expand by 30 to 40 basis points this year, to roughly 4%.

First BanCorp has also expanded its mortgage originations, improved its commercial lending operations in Florida and

The company is also aiming to take advantage of recent market disruption in Puerto Rico. When Oriental Financial Group (OFG) in San Juan

First BanCorp is hoping that it can take advantage of the disruption and regain market share. The company held 13% of the island's deposits last summer, down from 21% two years earlier, according to data from the Federal Deposit Insurance Corp.

First BanCorp still has challenges. The Puerto Rican economy has recovered slower than that of the mainland United States. The island's 14% unemployment rate in April compares to 7.5% nationally, according to the U.S. Bureau of Labor Statistics.

The company has also struggled to produce consistent earnings. Last year, First BanCorp earned $29.8 million after losing $82.2 million a year earlier. The company spilled more red ink in this year's first quarter, losing $72.6 million, largely due to the bulk loan sales.

First BanCorp has a deferred-tax asset valuation allowance of roughly $363 million, but inconsistent earnings remain a hurdle to the timing and amount that it can recapture, Hagerman wrote in his note. It is likely that the company will regain at least a portion of its DTA next year, he added.

Despite these hurdles, Alemán-Bermúdez says he is optimistic about First BanCorp's future. He says the company should clear up a significant portion of its credit issues this year. Its stock price has also risen by 45% this year.

"We had to put in a lot of time and effort," Alemán-Bermúdez says. "Dedication and commitment were not optional. We needed perseverance, consistency and a clear plan and strategy. It's not something I would like to do again."