First-quarter results for regional and superregional banking companies may not look much different than those from the nation's largest, but the regionals get there in different ways.

While both large and midsize banking companies suffer from the flat - and at times inverted - yield curve, the big banks are getting a boost from their humming capital markets businesses and the improved credit quality in their card portfolios.

But many large companies have also had to deal with the changes in accounting for stock options and other share-based payments to executives, an issue that Andrew Collins of Piper Jaffray & Co. said may shave 6% to 9% off the large-cap companies' earnings growth.

Those changes probably cost regionals only 2% to 3%, Mr. Collins said, because they pay fewer executives in such ways.

First-quarter reports are expected to show that earnings growth at regional banking companies slowed for the third consecutive quarter.

Having tweaked balance sheets and shaved loan-loss provisions, bankers may finally be out of levers to boost earnings growth. But analysts said there is little evidence any bank fell off an earnings cliff during the first quarter.

"I call it coping and hoping," Anthony Davis of BankAtlantic Bancorp Inc.'s Ryan Beck & Co. Inc. said about the current operating environment. This year few bankers have warned Wall Street about a major shortfall between earnings and estimates, he said.

Many observers said they expect regionals to report earnings growth of 7% to 8% from a year earlier, a slowdown from the fourth-quarter rate of 10%, which in turn was lower than the third-quarter rate of 11%.

Merrill Lynch & Co. said in a March 23 report that it expected first-quarter earnings to be flat from the fourth. But analysts and investors said they expect to see little deterioration - or improvement - in the lines of businesses that make up the company's results.

Double-digit commercial loan growth should help offset slower growth in consumer loans, and credit quality is still solid, analysts said. Mark W. Batty, an analyst with PNC Advisors, said he expects first-quarter loan growth of 5% to 6%. That growth, he said, would lead to "reasonably good" earnings.

Regional banking companies are not in bad shape, despite the yield curve headache. Expense control will help offset pressure on net interest income, double-digit commercial loan growth should help offset slower growth in consumer loans, and credit quality is still solid, analysts said.

Mr. Batty said he expects first-quarter loan growth of 5% to 6%. That growth, he said, would lead to "reasonably good" earnings.

Thrifts, however, likely had a harder time.

Last week Jeff K. Davis of First Horizon National Corp.'s FTN Midwest Research Securities Corp., cut his stock ratings on Astoria Financial Corp., Dime Community Bancshares Inc., and New York Community Bancorp Inc. to "sell," from "neutral," and cut his earnings estimates for the three companies.

Adjustable-rate mortgage lenders and multifamily lenders "are getting crushed" by the yield curve, Mr. Davis said. Traditional thrift companies could report that their net interest margin fell as much as 5 basis points in the first quarter from the fourth, he said.

Mr. Batty said Golden West Financial Corp. may not suffer as badly as other thrift companies. The nation's second-largest savings and loan may get more competition for option ARMs, which it invented, but its low-cost base makes it hard for other mortgage lenders to beat the Oakland company's earnings power, he said.

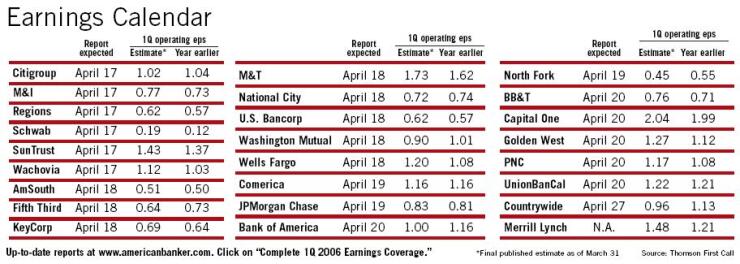

The average analyst estimate has Golden West reporting a 2.4% earnings increase from the fourth quarter, to $1.27 a share.

Earnings warnings have become commonplace in recent years, and Francois Trahan, the chief strategist at Bear, Stearns & Co. Inc., warned investors last week that "confession season" had begun.

"Investors should expect increased volatility in equities in the coming weeks," he wrote in a research report.

But among large regional banking companies, only TD Banknorth Inc. has telegraphed concerns about first-quarter results.

"Somebody's got to say it, and I guess it's me. … I started off the year thinking we were going to earn 60 cents [a share] for the quarter," chairman, president, and chief executive William J. Ryan told investors last month during a conference sponsored by Cohen Bros. & Co. "And I was fairly optimistic we could do that with loan growth of 8% and deposit growth of 4% or 5%. After two months into the quarter, I have to tell you I'm not as optimistic."

Mr. Ryan said his company's earnings would likely come in closer to 55 cents a share. Wall Street quickly adjusted its forecasts but still expects TD Banknorth to beat the lower estimate. According to Thomson Financial, the average estimate is 56 cents.

Some bankers may give investors a positive surprise.

Keefe Bruyette expects Greater Bay Bancorp. of East Palo Alto, Calif., to beat the average analyst estimate by 2 cents and First Republic Bank of San Francisco to beat the average estimate by 4 cents. According to Thomson Financial, the average estimate is 41 cents for Greater Bay and 59 cents for First Republic.

Analysts disagree about TCF Financial Corp. Keefe Bruyette said it expects the Wayzata, Minn., company to report earnings of 42 cents a share, 2 cents short of the average analyst estimate, and an 8-basis-point drop in its net interest margin. But Mr. Collins of Piper Jaffray expects TCF to report earnings of 46 cents and a margin contraction of only 6 basis points.

Many bankers worked hard last year to keep expenses in check, and those efforts may well have paid off in the first quarter. Mr. Batty said he expects revenue and expense growth to mirror each other, though some companies may achieve slightly positive operating leverage. Keefe Bruyette said organic revenue growth should be 7%, and expenses, excluding acquisitions, should also come in at 7%.

Mr. Batty said that M&T Bank Corp. may even beat analyst estimates, because last year it started to focus on cutting costs and improving efficiencies. The average analyst estimate for the Buffalo company is $1.73, but Mr. Batty expects it to report $1.75.

Over all, analysts expect little margin compression, if any, for the regional banking companies, but Keefe Bruyette said individual results will vary.

George A. Schaefer Jr., the president and CEO of Fifth Third Bancorp in Cincinnati, which has been plagued by several quarters of severe margin compression, has been optimistic of late. "Flat curves don't last forever, funding costs will level off, and the margin is very nearly stable," he said in February at a conference sponsored by Citigroup Inc.

In a midquarter earnings update issued March 15, Fifth Third said its margins would not erode further in the first quarter.

Keefe Bruyette said it expects KeyCorp to report that its margin expanded 3 basis points from the fourth quarter, to 3.73%, and to meet the average earnings estimate of 69 cents.

Frank J. Barkocy, the executive vice president and director of research at Keefe Managers Inc., said the Cleveland company "could look decent" this quarter. "They have done a lot on the cost side."

And Keefe Bruyette has Comerica Inc. beating the average analyst estimate of $1.16 by 7 cents. The report said that the Detroit company's net interest margin likely rose 5 basis points from the fourth quarter, and its efficiency ratio likely improved to 55.9% from 61%.

But for many midwestern companies, a slow-growing economy and deterioration in the automobile industry may still be stymieing earnings growth, some analysts said.

"Midwestern banks are accustomed to shifts in the local economies. They plan for it. However, they do not avoid it," Richard X. Bove of Punk, Ziegel & Co. wrote in a report issued last week. "Their loan losses rise. Their earnings tumble, and their stock prices are impacted. It will happen again. … It seems clear that economic and financial power is moving to the east."