It’s more than just giant reserve releases that boosted banks’ first-quarter profits: Higher fees from credit and debit cards and other sources also helped to offset declines in net interest income.

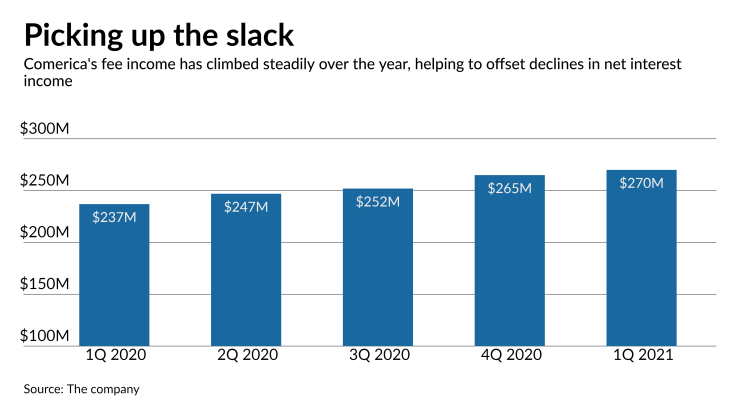

Comerica Bank in Dallas reported $270 million in noninterest income in the first quarter, up 14% year over year and above the $253 million expected by analysts. The boost came from higher card fees tied to increased spending after consumers received their stimulus checks. Meanwhile, more energy borrowers hedged prices of oil and gas, pushing more fees to the $86.2 billion-asset bank for derivative trades.

On a call with analysts Tuesday, Chairman and CEO Curt Farmer said credit card fees are likely to continue increasing as the economy improves.

Synovus Financial in Columbus, Ga., reported $112.9 million in fee revenue for the first quarter, well above consensus analyst estimate of $103.3 million, according to a research note from Piper Sandler. The $55.1 billion-asset company reported a 13.7% increase in fees from the same period last year due to higher mortgage banking income and fees from brokerage activity.

Kevin Blair, the president and chief operating officer who will take over as CEO later this week, said on an earnings call with analysts Tuesday that there has been “a concerted strategy to accelerate the growth in our fee income generation businesses.”

Still, reserve releases are driving earnings growth for most banks, including Comerica and Synovus.

Synovus reported $178 million in net income in the first quarter, up from only a $30 million gain during the same period last year, when it set aside $158.7 million for potential loan losses at the outset of the coronavirus pandemic. In this year’s first quarter, it released $18.6 million from its loan-loss reserves, citing an improved economic outlook.

Comerica was able to release $189 million from reserves after setting aside $411 million in preparation for losses tied to the pandemic in the first quarter of last year. Comerica reported net income of $350 million in the first quarter, up from a $59 million loss during the same period last year.

Reserve releases and the pickup in fee revenue helped make up for a 13.6% year-over-year decline in net interest income for the first quarter.

Total loans of about $50.5 billion were flat from three months earlier and up just 2% from the same period last year.

“The year is off to a strong start," Farmer said.

At Synovus, net interest income of $373.9 million was flat compared with last year’s first quarter and down 3% from the fourth quarter. Total loans increased just 1.4% year over year to $38.8 billion.

Blair said he expects loans to increase by 2% and 4% this year.