Ever dream about taking over your bank from the longtime boss?

You might think twice about it after reviewing Ira Robbins’ checklist at Valley National Bancorp in Wayne, N.J.: replace the nearly 30-year face of the franchise in less than two months, complete its biggest acquisition in a decade and prepare to make some tough calls about the direction of the $23.9 billion-asset company.

“The company’s risk profile is second to none,” Hovde Group analyst Joseph Fenech said in praising the leadership of Gerald Lipkin, who will step down as CEO at the end of the year after holding the job since 1989. “But the performance in recent years has stagnated, and profitability sits below their peers. Investors will be inclined to view [Robbins] as a fresh start.”

Robbins, 43, who joined Valley National in 1996 and became president of its banking unit in January, will have to decide whether to concentrate growth efforts in its traditional or new geographic markets, where to focus technology investments and how to improve efficiency.

Robbins gave some hint of his thinking in an interview Friday,

“There is a tremendous organic growth that we should be focusing on,” Robbins said.

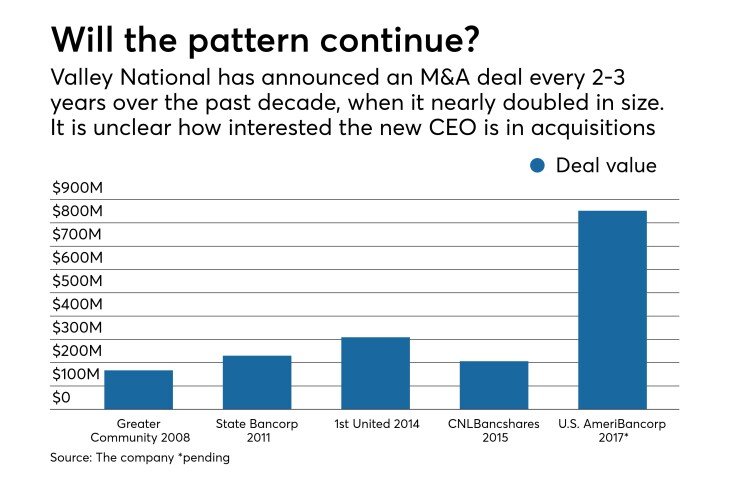

Valley National had $1.4 billion of assets and 22 offices when Lipkin became CEO. Now it is the on the cusp of becoming a $28 billion-asset institution with almost 240 offices across four states. It has grown through M&A, with a focus on Florida in recent years. Once the USAmeriBank deal closes, Valley National will have bought three banks in the state since 2014.

Management saw Florida as a natural extension of its New Jersey and New York markets where it was already operating, said Frank Schiraldi, an analyst at Sandler O’Neill. Many people still retire from that area to Florida, and there is extensive travel between the Sunshine State and the Northeast.

“The growth profile was attractive to them at a time when growth was stagnate in their markets, particularly New Jersey,” Schiraldi said. “But I think there will be a renewed focus on the Northeast. They have done enough in Florida to make it a viable operation down there.”

With the retirement of Lipkin, 77, and Rudy Schupp, president of the holding company and chief banking officer, it’s possible that Robbins will focus less on that state, experts said. Schupp had joined Valley National after it bought his bank, 1st United Bancorp in Boca Raton, Fla., in 2014.

“Rudy was their guy in Florida. … The original reason to go to Florida was Lipkin,” Fenech said. “With those two guys retired, will they be as committed to Florida as they were before? Ira has been a big part of the M&A strategy, so there probably won’t be a radical change.”

The retirement of a longtime CEO can allow for new management to shake up the company’s operations and implement changes that previous executives would have resisted.

Currently Valley National is going through a companywide earnings initiative called LIFT. The process has included a review of its business practices with the goal of improving efficiency and dedicating resources to activities that add value. Valley National’s return on average assets of 0.67% is less than the median of 0.98% for its peers. Its efficiency ratio of 63.12% is also worse than its peer median of 57.5%, according to Valley National’s website.

The initial phase was completed in July, and management is aiming to reach $22 million through cost cuts (including reductions in employee headcount) and revenue enhancements. The implementation of the plan is underway and is expected to be completed by July 2019.

Robbins said in the interview that he would like to step up digital banking efforts. Although Lipkin has championed digital previously, Valley National has “a $50 million technology road map” dedicated to streamlining operations, Robbins said.

“How do we expand the operating leverage of the organization?” Robbins said in explaining the driving force.

Valley National has also been ramping up its mortgage origination business by hiring lenders, but there have been questions about whether this operation would undercut the efficiency program, said Erik Zwick, an analyst at Stephens. Generally mortgage businesses have an efficiency ratio that runs in the 80% range while Valley National has set a goal to reach a rate in the mid-50s, Zwick said.

“There are a lot of changes and work that needs to be done over the next 12 months,” Zwick said. “[Robbins] has been part of the planning so the transition will be smooth, and he will be able to lean on [Lipkin] for any questions or extra insights. But there is certainly a lot to handle for an incoming CEO.”

Lipkin will remain as chairman of the company but won’t be involved in daily operations. He said he was confident that he won’t be tempted to provide unwanted suggestions or help. Robbins said Lipkin has always been good at delegating to other executives and has allowed him to be involved in strategic decisions over the years.

“You are only as good as the people who work with you,” Lipkin said. “You need to make sure you have quality staff and you let them know you appreciate them. You are the guy who gets to take all the bows for the good work of the people behind, but recognizing that is a critical factor for any CEO.”