Though banks aggressively built reserves through the downturn, they have not kept pace with the rise in troubled loans.

The result: the industry has scant protection against another dip in the economy or even a prolonged period of sustained losses.

Bearish observers say recent positives including a broad rebound in bank share prices and a return to profitability could be wiped out by yearend if delinquent loans don't stop accumulating, forcing lenders to play catch-up on reserves.

Whether a peak has been reached in reserving "is the most important question hanging over bank earnings," said Richard Bove, an analyst with Rochdale Securities LLC.

If banks must once again start pumping up reserves, earnings will take a hit. If they don't, reserve levels can decline, which in turn will feed the bottom line.

Reserves are among most complicated and controversial issues in banking.

They are essentially a balance sheet item that represents a lenders' best guess of how much money it may lose charging off unrecoverable loans and other assets.Arriving at an accurate number is difficult because banks have to factor in everything from economic trends to the behavior of borrowers.

As the recession deepened in 2008, banks ratcheted up reserves to cover mounting mortgage losses.

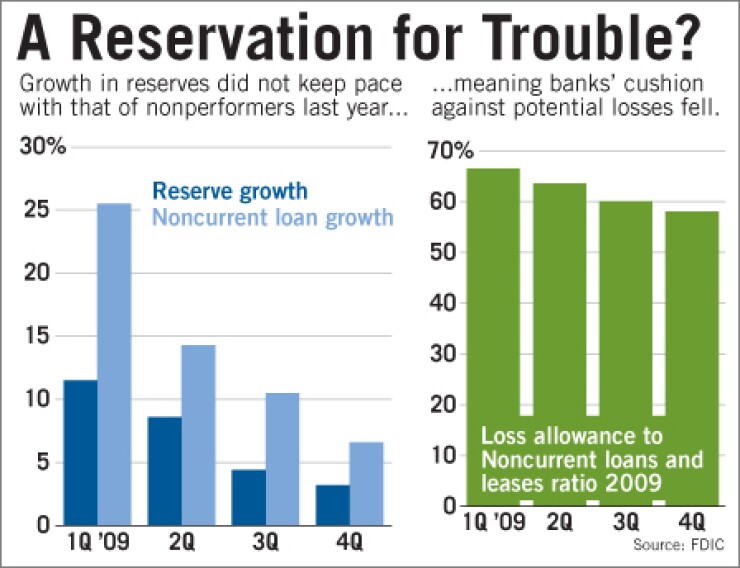

Federal Deposit Insurance Corp. data shows that reserving activity appears to have peaked early last year. Reserves rose 3.2% in the fourth quarter, after rising 4.4%, 8.6% and 11.5% in the three preceding quarters.

Meanwhile, the industry's coverage ratio — reserves to noncurrent loans and leases — is at a 19-year low.

At yearend industry reserves stood at 58% of noncurrent loans, down from 75% at the end of 2008.

The giant banking companies are all well above the average: JPMorgan Chase & Co. at 180%; Citigroup Inc. at 112%; and Bank of America Corp. at 91%.

Companies below the average include Synovus Financial Corp. in Columbus, Ga., at 52%; SunTrust Banks Inc. in Atlanta at 44%; and TCF Financial Corp. in Minneapolis at 45%, according to Barclays.

Charles Bobrinskoy, director of research with Ariel Investments LLC, said that a low reserve ratio gives banks little breathing room to stay profitable if loan losses don't ease or if the commercial real estate market collapses.

"It's possible that reserves will prove to be conservative," he said. "The big wild card is commercial real estate."

Banks perceived as under-reserved are trading below book value, Bobrinskoy said. Examples include Marshall & Ilsley Corp. in Milwaukee, trading at 53% of book value; Synovus at 65%; and SunTrust at 69%.

Jason Goldberg, an analyst with Barclays Capital, said regional banks he covers like M&I, M&T Bank Corp. and Regions Financial Corp. all have reserve ratios under 62%. That isn't entirely alarming, as coverage ratios tend to fall in the later stages of a downturn, Goldberg said.

Reserves could prove adequate, especially with positive trends like stabilizing early-stage delinquencies indicating that the credit cycle may have bottomed, he said.

"Hopefully, we're towards the end of the reserve-building cycle," he said.

"But at the same time, loan losses are going to remain very elevated. It all depends on what the overall economy does."