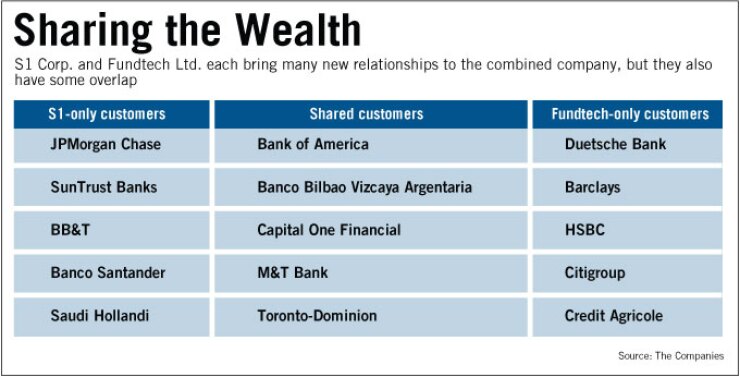

S1 Corp. and Fundtech Ltd. have not competed directly, but they have sold to many of the same customers. As such, a merger of the two companies would substantially boost the power of each one's sales team as they pursued new markets and deepened existing customer relationships.

That scenario now has a chance of happening. S1 and Fundtech on Monday announced a deal valued at $700 million based on the companies' closing stock prices on Friday.

Johann Dreyer, S1's chief executive who would become the CEO of the combined company, said in an interview Monday that the companies' product lines are "complementary, yet we sell to the same profile of customers."

"Where we overlap, our sales forces will be strengthened," Dreyer said.

S1's focus has been on consumer payments with its card and online banking platforms. Fundtech's specialty is wholesale or commercial payments, with offerings for automated clearing house payments, wire transfers and related activities.

When the companies combine, "we'll be like one big airplane with two engines," said Reuven BenMenachem, Fundtech's CEO. BenMenachem will be executive chairman of the post-merger company and responsible for international markets.

Under the deal, Fundtech shareholders will receive 2.72 shares of S1 common stock for each Fundtech share they own.

The merger, which is subject to shareholder and regulatory approval and not expected to close until the fourth quarter, would result in the combined company operating under the Fundtech name with its headquarters in Atlanta, where S1 is based. Clal Industries and Investments Ltd., an Israeli investment firm that owns 58% of Fundtech, has agreed with S1 to vote in favor of the merger.

S1 has about 3,000 bank clients in 75 countries. Fundtech, of Jersey City, N.J., has about 1,000 bank clients, including Bank of America Corp., HSBC Holdings PLC, Citigroup Inc. and Barclays PLC, in 70 countries.

If S1 and Fundtech successfully meld their product lines, banks may be able to consolidate more of their vendor relationships with one provider, analysts said.

"Most bank [chief information officers] we speak with are looking for best-of-breed [technology], so they're willing to deal with multiple vendors to get to best of breed," said George Sutton, a senior research analyst with Craig-Hallum Capital Group LLC in Minneapolis. "What S1 and Fundtech are trying to do here are to put those best-of-breed capabilities together for you and to have more efficient distribution."

The companies have some geographic overlap, though S1 has a larger presence in Latin America and Africa and Fundtech has developed a strong presence in India and Western Europe, the companies said.

The combined company would generate 61% of its revenue in the U.S. and 39% outside the U.S. In the future, international sales will be a bigger portion of its business, Dreyer said on a conference call with analysts on Monday.

"By combining these two entities we can effectively increase the depth in the markets that we currently serve as well as increase the width of the markets that we can reach," Dreyer said on the call.

S1 had revenue of $209.1 million in 2010, while Fundtech had $141.9 million.

Analysts said Fundtech could attract other offers. The company earlier this month said it was exploring "potential transactions," including a merger with a U.S. company. Fundtech also said it had been approached by a "multinational corporation" interested in acquiring it.