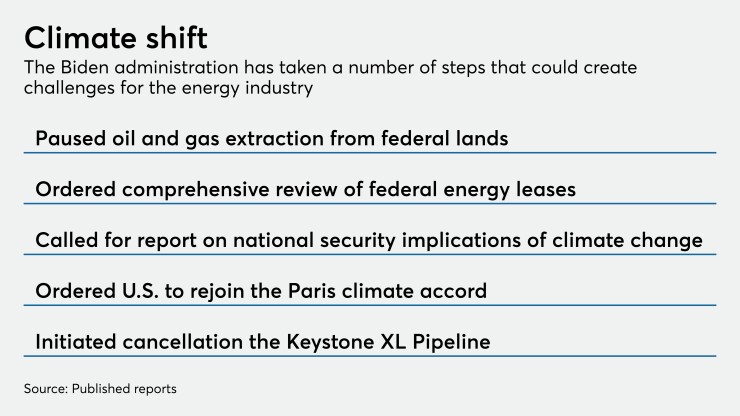

Conditions are improving for energy companies and their lenders, but a series of proposals from the Biden administration to combat climate change is creating uncertainty about the future.

Loan-loss provisions tied to oil and gas companies fell sharply in the fourth quarter as more banks reported improved conditions with criticized loans as

While most energy lenders predict a relatively strong 2021, a series of moves by President Biden designed to curb pollution — including the suspension of new oil and gas leases on federal lands and an effort to stop the Keystone XL Pipeline — could pressure revenue.

The decisions could be the first in a series of actions to restrain fossil fuel production and hasten a shift to renewable energy sources, industry observers said. And banks will eventually need to evaluate how far out they want to look when it comes to lending to companies dependent on fossil fuels.

Changes to the federal leasing program “would profoundly affect oil and gas development in the United States,” said Andy Weissman, an energy analyst at EBW Analytics Group. He said roadblocks could scare away investors and make it harder for energy producers to pay their loans, while the potential for higher taxes on those companies could create more pressure.

“The future is pretty uncertain” despite recent improvement among energy firms, said Mike Matousek, a trader at U.S. Global Investors in Texas. “With all the change expected with the new administration, I don’t think anyone is predicting a long-term boom in oil and gas.”

Most banks have remained committed to energy lending, though some are pressing pause when it comes to making new loans.

First Horizon in Memphis, Tenn., is one of the lenders preaching caution despite improved fundamentals in its energy book. Executives at the $84 billion-asset company said their clients may have withstood the worst hits from the pandemic, predicting a potential rebound in coming months.

“But we expect very little new business for now,” Chief Financial Officer B.J. Losch said in a recent interview, though he said First Horizon remains committed to the energy sector. “We are still actually bringing the portfolio down in size some.”

To be sure, major policy shifts take years to develop, so industry observers do not expect a sudden demise for oil and gas. It could, as Matousek said, be a story that gradually unfolds over the course of a decade.

Still, the near-term outlook is gradually brightening.

Oil prices for much of January hovered above $50 a barrel, a big improvement from $20 a barrel last spring and a level where energy companies can at least break even and make their loan payments. Natural gas prices have also bounced back from lows they had earlier in 2020.

“The industry is getting back to a normal operations mode,” said Artem Abramov, an analyst at Rystad Energy.

The improvements are finding its way into banks’ credit metrics.

Cadence Bancorp. in Houston reported that its fourth-quarter provision declined to $2.8 million from $33 million a quarter earlier.

“We saw broad-based improvement in credit migration … as many businesses recover, and our portfolios continue to de-risk,” Paul Murphy Jr., the $18.7 billion-asset company’s chairman and CEO, said during a conference call to discuss quarterly results.

Cadence said its pool of criticized loans shrunk by about 20% to $872 million, driven in large part by

On the energy front, many borrowers that were behind on loan payments, or vulnerable to falling behind,

Several other banks with energy exposure, including Texas Capital Bancshares in Dallas and BOK Financial in Tulsa, Okla., also reported notable improvements in energy credit quality and their 2021 outlooks. Those banks, which set aside millions of dollars last year to cover potential issues, are now releasing reserves.

BOK Financial released $6.5 million of reserves in the fourth quarter, noting easing pressure on its energy portfolio. The $46.7 billion-asset company reported a $1.8 million decline in energy nonaccruals during the fourth quarter, following an even larger decline in the third quarter.

Energy borrowers’ finances have largely stabilized and many clients are paying down debts, executives at BOK Financial said.

“Not only were we able to release a portion of the loan-loss reserve, but we also saw significant credit quality improvement in our energy portfolio,” Executive Vice President Stacy Kymes said during the company’s earnings call. “The rebound in near-term stability in commodity prices resulted in reduced criticized and potential problem loan numbers, along with our needed reserve allocation to energy loans.”

Fourth-quarter charge-offs fell by 25% to $16.7 million.

“There’s still a lot of uncertainty in the current environment, so it remains difficult to predict too far out,” Kymes said. “That said, based on what we know today, we believe that in 2021 net charge-offs will remain on the lower end of the range of our historical average of 30 to 50 basis points.”

Texas Capital said its nonperforming assets fell by 25% to $122 million, reflecting charge-offs of long-troubled credits and improved conditions for other energy clients. Nonaccrual energy loans decreased by 30% to $51.7 million, or 42% of total nonperforming assets.

“Certainly, the overall book is more stable,” Julie Anderson, Texas Capital’s chief financial officer, said during the company’s earnings call.