Sovereign Bancorp Inc. expects to generate $556 million of excess capital this year. The question is, does that put it in the running to buy Riggs National Corp.?

The Philadelphia company was widely rumored to be the most avid bidder for Riggs last summer. Some sources said it offered to pay more than the eventual winner, PNC Financial Services Group Inc.

When the PNC deal collapsed Monday, some investors fingered Sovereign as the likely new buyer. That sent Sovereign's stock price down 2.5%.

But in an interview Tuesday, Sovereign chief financial officer James D. Hogan said talk that his company is "back in the hunt" for the Washington-based Riggs National "is absolutely wild speculation."

Mr. Hogan said Sovereign is focusing on organic growth this year and that it will do fill-in deals as opportunities present themselves. He declined to discuss Riggs.

"We want to maintain solid capital ratios," Mr. Hogan said -tangible capital of at least 5% and Tier 1 capital of 7%. At yearend the $54.5 billion-asset company's tangible capital ration was 5.25%, and Tier 1 stood at 7.05%.

"We won't do anything to prevent us from being at these ratios," Mr. Hogan said.

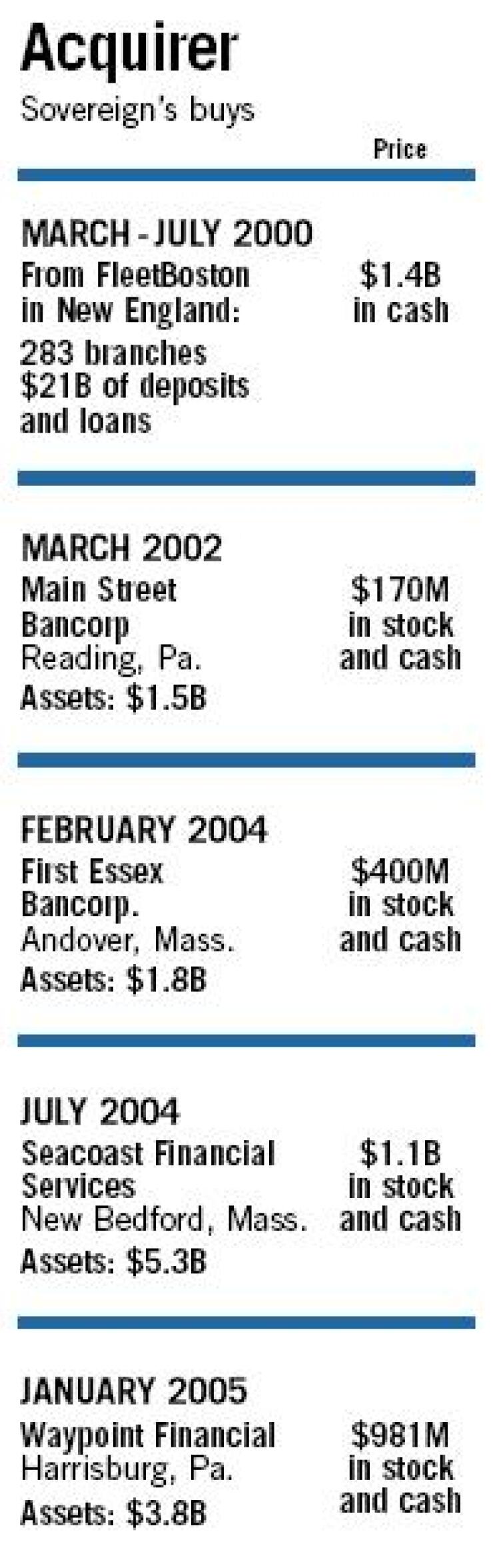

Sovereign has come a long way since its capital levels took a serious hit after its $1.4 billion all-cash deal to buy more than 280 branches in New England from FleetBoston Financial Corp. in 2000. A $25 billion-asset company at the time, Sovereign struggled to come up with the cash and eventually bought the branches in staggered payments over a period of months in 2000.

Its debt was later downgraded to junk, and it took until January 2004 for Moody's Investors Services to upgrade Sovereign back to investment-grade.

In 2003 speculation that Sovereign was looking to sell itself drove its stock price up almost 70%. When no deal emerged its shares lost some of their luster, but Sovereign still had more currency with which to pursue acquisitions.

And it did. Sovereign bought two Massachusetts companies last year, the $5.3 billion-asset Seacoast Financial Services Corp. of New Bedford, for $1.1 billion and the $1.8 billion-asset First Essex Bancorp in Andover for $400 million.

Last month Sovereign completed a $981 million acquisition of the $5.4 billion-asset Waypoint Financial Corp. of Harrisburg, Pa. As with Seacoast and First Essex, it paid mostly with stock.

But some analysts say Sovereign's stock, which fell 5% last year, has become less attractive to potential sellers. This year the stock is up 2.6%.

However, Sovereign's executives have said repeatedly that acquisitions are not the only way to deploy capital.

On Tuesday Mr. Hogan said that the company's first choice in using excess capital would be to buy back its own stock. Listing the company's order of preference for deploying capital, he said, "M&A is last, and dividends and reinvestment in our various lines of business are in the middle."

Sovereign's chairman, Jay Sidhu, gave a similar order of preference during the company's fourth-quarter earnings conference call but said that down the road "it could be different."

Sovereign has not been active in stock buybacks. In October its board of directors authorized the repurchase of up to 15 million shares, in addition to 5 million still outstanding from a program announced in May 2003.

A spokesman said Wednesday that no shares have been repurchased under either program, but analysts are hopeful that will change soon.

Laurie Hunsicker of Friedman, Billings, Ramsey & Co. in Arlington, Va., said this "will be the year of the buyback, not the year of the deal." Bold and risky acquisitions are unlikely, she added.

In March the company raised its quarterly dividend by 20%, to 12 cents per share, but its 0.5% dividend yield is lower than its peers'. "We realized that in our peer group our dividend is as low as anybody, really, and I think the board is going to have to look at the dividend this year or next year," Mr. Hogan said.

John Kline of Sandler O'Neill & Partners LP said share buybacks make more sense for Sovereign, since increasing the dividend yield to the level of other banking companies would require a massive increase.

Sandler advised PNC on the Riggs deal, so Mr. Kline declined to comment specifically on it. But he said that when it comes to acquisitions, Sovereign "does not send the most consistent message" to investors.

Whether Sovereign ends up buying Riggs is anybody's guess. Riggs' problems are well documented, but Claire M. Percarpio of Janney Montgomery Scott LLC said Mr. Sidhu gained a reputation as a risk-taker with the Fleet branch deal.