-

JPMorgan Chase and Wells Fargo reported surprisingly strong revenue growth on Friday, reversing the slumps of recent quarters. A pickup in mortgage banking returns helped.

April 13 -

The rebound of credit card lending is having nasty side effects for Capital One Financial Corp. and American Express Co., which are increasingly spending more to compete for the most credit-worthy customers.

January 20 -

Click on individual bank names in the table below to access American Banker's coverage of each company's earnings report. Links to relevant coverage, filings, releases, and bank benchmark profile data can be found in the Related Links area of each article.

April 24

Be it through acquisitions, marketing or customer service, you've got to spend money to make money.

At least that's what Capital One Financial (COF) and American Express (AXP) have been telling investors and analysts this week, as both companies reported first quarter earnings.

The two credit card specialists posted strong earnings, but analysts say both companies will need to spend and invest wisely, so that revenue gains

"You do have many different fronts doing well, and that affords them the luxury to invest in the business," says Sanjay Sakhrani, an analyst with Keefe, Bruyette & Woods.

Improving loss rates have helped both companies, but to the extent that the benefit from that credit improvement "abates later this year, you could have them dial back a little on marketing or maybe allocate resources differently," Sakhrani says.

Capital One on Thursday said that marketing costs rose 16% to $321 million from $276 million a year earlier, as it competes with companies including American Express and JPMorgan Chase (JPM) for wealthy, high-spending consumers.

"I think it has to catch everyone's attention that everywhere you turn there's another big investment going on by somebody. Particularly AmEx, Chase and ourselves are going very hard right at that heavy spender part of the marketplace," Capital One Chief Executive Officer Richard Fairbank said on a Thursday evening call with analysts.

"Look, it is fiercely competitive. These are by far the most expensive accounts to book of anything that we originate," he added. "The nice thing is, these are wonderful annuities that have low attrition and fabulous return dynamics….I think real value's getting created there."

The McLean, Va., bank's first-quarter profits jumped 38% to $1.4 billion from $1.02 billion a year earlier. Excluding the impact of a bargain purchase gain related to its acquisition of ING Direct, Capital One earned $809 million in the quarter.

Total revenue rose 21% to $4.94 billion, and the total net charge-off rate fell to 2.04% from 3.66% a year prior. The bank also reported a 16% rise in operating expenses to $2.2 billion from $1.9 billion a year earlier, thanks in part to $86 million in merger-related expenses.

"There's a fair amount of uncertainty" in terms of how high integration costs will climb, says Moshe Orenbach, an analyst at Credit Suisse.

But analysts also say that the

"Ultimately I do think they're on the right track" with those purchases, says Sakhrani. "The positive aspect of yesterday's earnings for Cap One is we now have ING in their financial statement and a preliminary look at what it's going to look like," though he noted that it "introduced a lot of noise" with some one-time items due to the merger.

American Express said Wednesday that its first-quarter profit rose 7% from a year earlier, to $1.26 billion. Losses on its cards continued to fall, as net charge-offs on principal only were down to 2.3% from 3.7% a year earlier.

But while the New York company saw revenue rise 8% from a year earlier to $7.61 billion, that growth was outpaced by that of its operating expenses, which grew 13% to $3.1 billion from a year earlier. Expense growth was 5% after adjusting for litigation settlement proceeds that offset some expenses in the first quarter of 2011.

"Amex has had the advantage of having faster revenue [growth] than the typical bank. But at the same time it's been slowing somewhat," says Orenbach.

"As credit turns to be a drag instead of a positive, as they run out of ability to draw down reserve, they're going to have to cut even more expenses," he adds.

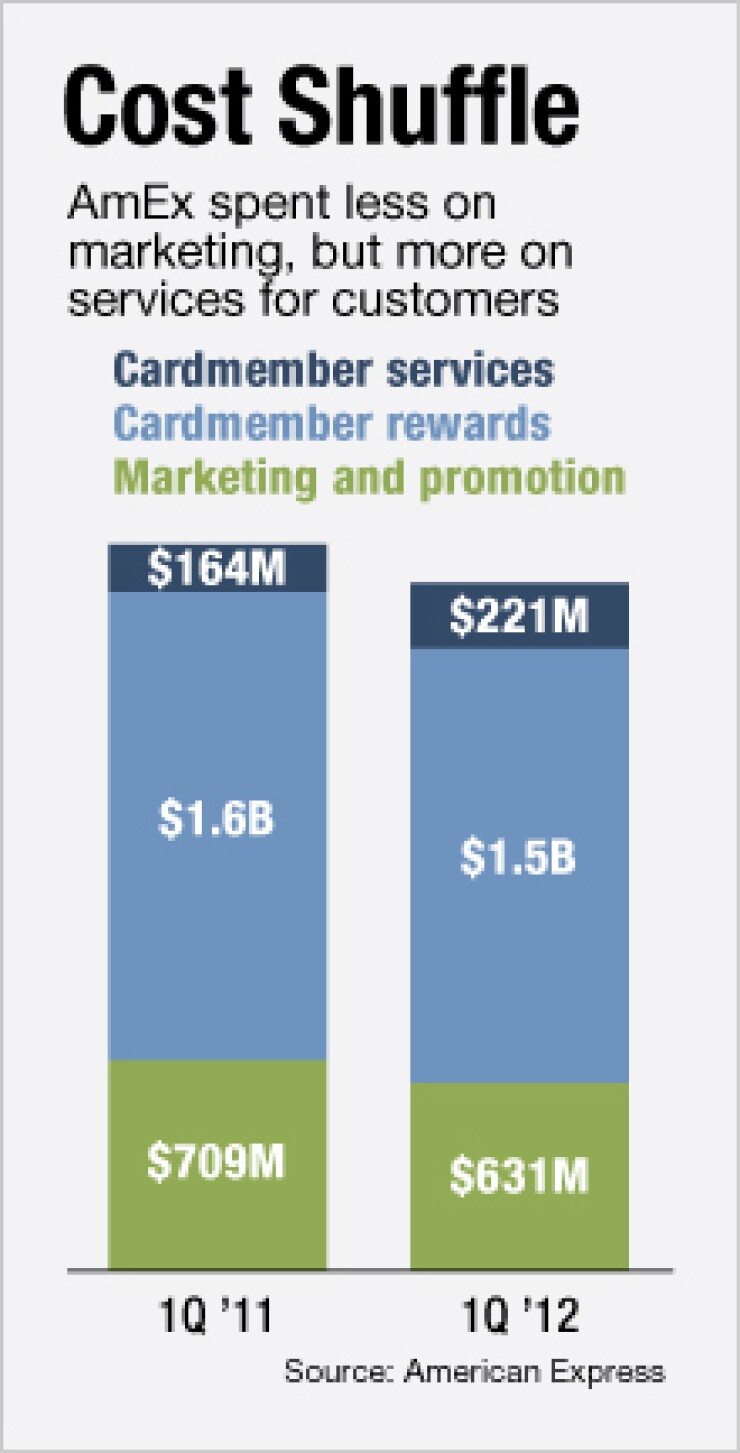

American Express cut back some of its spending on marketing and rewards, but its spending levels on services for its cardholders jumped 35% year-over-year.

Chief Financial Officer Dan Henry defended the company's cost-cutting efforts on Wednesday, saying that cost containment has been a prominent focus for American Express over the past several quarters.

"So we knew all along that … we were spending at higher levels in 2010 and 2011 and that was helping to drive growth. But at the operating expense level that we have, which is higher than we had in the beginning of 2010 or the first quarter in 2011, at this level we think we have sufficient resources to drive growth going forward," Henry told analysts on a conference call Wednesday evening.

The company's expense-to-revenue ratio fell to 71% in the first quarter, from 77% last year. But that is still well above levels seen in 2009 and earlier, when the ratio hovered in the mid-60s.

American Express has been focused on reducing that ratio for several quarters. But Henry acknowledged that it remains to be seen whether any further declines will come from cost cuts or from revenue gains.

"We can get there through very good containment of expenses, and we can also get there by good revenue growth; and to the extent we get good revenue growth, then we actually have more flexibility in terms of the level of operating expenses that we have," Henry added on the call.