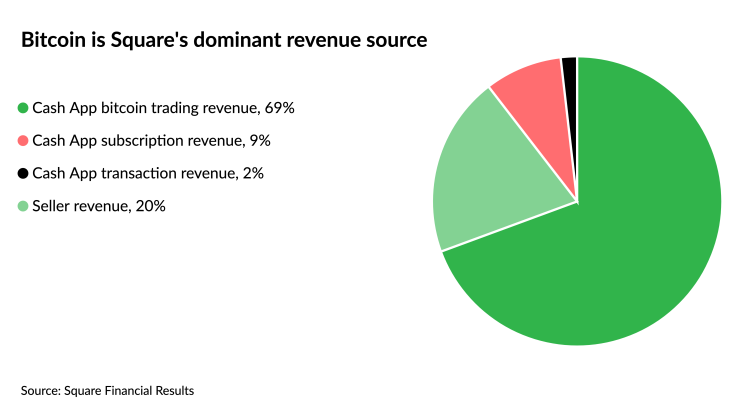

Square's bet on crypto keeps paying off: The Cash App business, fueled by bitcoin trading, generated the bulk of the company’s revenue in the first quarter.

Meanwhile, the makeup of Square's seller ecosystem — the payment acceptance business the company is best known for — is transforming, with less emphasis on small merchants. In the first quarter, companies with payment volume of less than $125,000 a year accounted for only 39% of the total Seller ecosystem’s $29.8 billion in activity, down from 48% in the same quarter one year earlier.

The Cash App ecosystem generated approximately 80% of Square's $5.06 billion in revenue for the quarter, with bitcoin trading contributing $3.5 billion, or 70% of the total. This was a substantial increase from the

“We see bitcoin as the internet’s potential to have a native currency and we want to further that as much as we can,” Jack Dorsey, Square's CEO, said Thursday in an earnings call. “A lot of our work really lines up to that.”

Dorsey emphasized that Square's long-term focus is supporting bitcoin's role as a native currency for the internet. “It removes a bunch of friction for our business and we believe fully that it creates more opportunities for the economic empowerment around the world," he said.

Overall, Square ‘s gross payment volume grew to $33 billion for the quarter, up 29% from $25.7 billion in the same quarter one year earlier. Cash App generated $3.4 billion of that GPV, up 227% year over year, while the Seller ecosystem processed $29.8 billion in GPV, up 20% year over year.

The Seller ecosystem generated $1.02 billion in revenue and $468 million of gross profit, up 19% and 32% year over year, respectively. Despite this performance, it’s clear that Seller is being overshadowed by growth in the Cash App — and crypto specifically — to the point that merchant acceptance is looking like a side business for Square.

Dorsey also highlighted the company's acquisition of

Aside from bitcoin, the Cash App overall holds strong potential as the company continues to groom it with new features. Square’s Cash App stands at the forefront of a growing number of "

Square reported total revenue for the fourth quarter of $5.06 billion, up from $1.38 billion in the year-earlier quarter. The company reported net income of $39 million for the quarter after reporting a net loss of $106 million for the year-earlier period.