Despite Citigroup Inc.'s assurances this week that the New York company has a strong capital base and a vote of confidence Thursday from a major stakeholder, observers say the company may be running out of options.

One of the starkest signs of how quickly perception on Citi has changed is that just days ago, as it announced a new round of layoffs, observers still viewed the acquisition of a large U.S. depository institution as a likely next step. However, in a fast-paced and panicked market environment the company's shares have been severely punished in recent days, reducing its market cap; cutting into its deal currency; and planting the idea, once unimaginable, that a sale of the company could be on the table.

With no clear road map for how it plans to reinvent itself after four straight quarterly losses, market observers saw little prospect of a rebound soon.

"There is nothing in their arsenal right now to restore investor confidence," Joseph Battipaglia, the chief investment officer at Stifel Financial Corp.'s Ryan Beck & Co. Inc., said Thursday.

Gary B. Townsend, the chief executive of Hill-Townsend Capital LLC, cited market rumors Thursday that Citi might sell all or part of itself to Goldman Sachs Group Inc. or potentially another bank holding company perceived to have strong management, such as U.S. Bancorp in Minneapolis.

"Aside from a sale, Citi needs more common equity, but it [is] very hard to raise capital with a stock trading around four or five bucks," Mr. Townsend said. "So do you split it up or merge it into another company? That's much more of a possibility than it was in the very recent past."

Steven Brown, the chairman of Banc Investment Group in San Francisco, said Thursday: "From where I sit, I still think there is some good value in Citi, but right now fear is feeding on fear. And against that fear, I assume all options are on the table, including a sale."

U.S. Bancorp on Wednesday leapfrogged Citi to become the nation's fourth-largest banking company by market value, despite having only about one-eighth the assets of the $2.1 trillion-asset Citi.

U.S. Bancorp and Goldman declined to comment. Citi did not respond to calls Thursday.

Mr. Battipaglia has a grimmer outlook for the company. "The only possible investor in the game right now is the government, and that doesn't speak well to Citi's options."

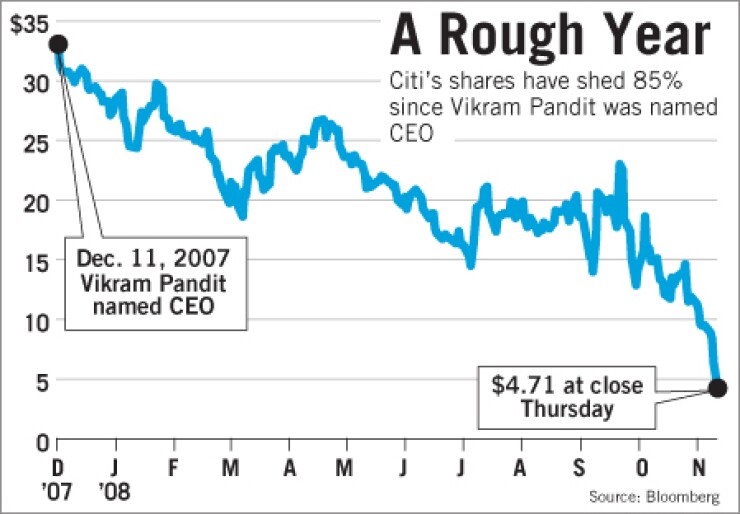

Citi chief executive Vikram Pandit, in a presentation to employees Monday, said the company was working in haste to bolster efficiency and return to profitability through job cuts, divestitures, and reorganization. And in a show of confidence, he and five other top Citi executives bought $17 million of the company's shares last week, according to regulatory filings.

On Thursday, Saudi Arabia's Prince Alwaleed bin Talal, Citi's biggest individual shareholder, said he plans to increase his stake in the company by more than one-fifth, to 5%. He said Citi's shares are undervalued and also noted that he fully supports Mr. Pandit.

Critics, however, said that Mr. Pandit has been stingy with details, declining to specify where job cuts and divestitures would be focused. Some observers said Citi has the wherewithal to survive the downturn, if only because of its sheer size and the government's thinly veiled signal that it views Citi as too big to fail.

Mark Fitzgibbon, the director of research at Sandler O'Neill & Partners LP, said in an interview Thursday that, after the Treasury Department chose Citi to be among the first large banks to participate in its capital purchase program, "it essentially anointed Citi as among the banks that must survive." However, given the dire lack of investor confidence, Citi may need a second government injection to stay afloat in 2009, he said. And he and other analysts noted that many thought Wachovia Corp. too big to fail until anxious investors pummeled its shares and forced it into the arms of Wells Fargo & Co. to avoid failure last month.

Citi had put in a losing bid for Wachovia, and analysts said that it now lacks a clear vision of how to move beyond that — other than sweeping job cuts. Citi insiders, in interviews last month, said the purchase of Wachovia's $400 billion in deposits would have tripled Citi's U.S. deposit base, bolstered its capital levels, and positioned it for a return to profitability. They never addressed how to make up for failing to get those deposits.

Among the top five U.S. banking companies, only Citi has operated in the red throughout 2008. It has lost more than $20 billion in the past four quarters.

The loss of Wachovia created another pressing issue for Citi: It missed out on the initial wave of mergers encouraged by regulators and watched Wells, Bank of America Corp., and JPMorgan Chase & Co. pass it by. JPMorgan Chase this year bought the investment bank Bear Stearns Cos. and the banking operations of Washington Mutual Inc. B of A bought the mortgage giant Countrywide Financial Corp. and Merrill Lynch & Co. Once Wells closes its deal for Wachovia next month, it will join B of A and JPMorgan Chase as the only banks with more than $600 billion in U.S. deposits. Citi, meanwhile, has about $200 billion in U.S. deposits.

A source familiar with Citi executives' latest plans said this week that it would try to buy a large deposit-taking company in the next two or three years. But in the midst of a rapid bank-sector overhaul, looking out two or more years is fruitless, analysts said, given that the landscape is changing so quickly.

Regardless, they said, domestic growth alone would not be enough. Few expect Citi to abandon its global model, but some analysts said that Citi, which since May has divested about $100 billion of its target for $400 billion of divestitures by 2012, needs to accelerate these sales this quarter, focusing on markets in Europe and Asia where recession is bound to stunt growth — as well as on some emerging markets such as India, where Citi itself has warned of mounting slumps.

But David Trone, an analyst at Fox-Pitt Kelton Cochran Caronia Waller, wrote in a note Wednesday that, though the sale of more assets is crucial to "fortify the capital base," it is unclear whether Citi "will be able to continue to find buyers."

For years, skeptics have said it is all but impossible to manage a banking company spread across dozens of countries, given that regulations and customer needs vary widely.

Citi "is a big, sprawling organization, and the question has long been, can such a huge organization be well-managed?" Lawrence White, a professor at New York University's Stern School of Business, said in an interview Wednesday. "So far, I think, the verdict is 'no.' "

Mr. Pandit, in his presentation to Citi employees Monday, took an optimistic tone, saying, "We will be the long-term winner in this industry." He pointed to the company's shedding of troubled assets and its effort to get "fit" through cuts.

More cuts are likely, said a source familiar with Citi's plans, but how and where remains to be seen. "When you get into re-engineering" — Citi's term for cost-cutting — "you don't stop," the source said. This uncertainty contributed to investors' unease this week and punctuated worries that Mr. Pandit might not get his arms around Citi's vast operations in time to save the company.

"There's no denying that, of the major banks, they are in the weakest financial condition," Prof. White said. Mr. Pandit "has huge challenges."

Citi's shares fell 26% Thursday, to $4.71, after falling 23% on Wednesday.