New York Community Bancorp sidestepped many of the problems that plagued other banks in the second quarter. The question is whether the Westbury company can keep producing strong results.

The $54 billion-asset company’s net interest margin expanded and its loan-loss provision was smaller than it was a quarter earlier. Loans held for investment, which excluded originations under the Paycheck Protection Program, rose slightly at a time when many lenders reported decreases.

While other bankers have been preparing investors for more challenges, New York Community’s executives told analysts on Wednesday they expect continued loan growth and a wider net interest margin. Still, they cautioned that things can always change.

“There's a lot of flexibility right now because we're still in a black swan event, a pandemic that's being supported by the government as well as the regulators,” Chief Financial Officer Thomas Cangemi said during a Wednesday conference call to discuss quarterly results.

Government stimulus remains a factor. Coronavirus trends are being closely watched, along with the status of loans under forbearance.

New York Community has been offering borrowers initial six-month deferrals. About 12% of the company’s multifamily book, which makes up three-fourths of its $42 billion loan portfolio, was in deferral on June 30.

About 96% of borrowers are poised to exit the deferral program in October and November, President and CEO Joseph Ficalora said during Wednesday’s conference call.

While it is possible conditions could worsen in the next few months, executives said they have been encouraged by discussions with borrowers.

“The conversations we're having with our customers is [focused on] getting out of the program,” Cangemi said. “They're ready to pay. So we haven't had any adverse discussions about people … looking for an extension. But it's too early to tell.”

Improvements in rent collections, combined with state rent subsidies and the reopening of New York City, are “having a positive impact on our borrowers’ cash flow,” Ficalora said. “We remain optimistic that as we get deeper into [reopening] and business and economic activity in our market begins to increase, the number of borrowers in deferral will decline dramatically.”

It is “highly likely” the government will extend forbearance programs for banks, said Piper Sandler analyst Mark Fitzgibbon, which would let banks accrue interest and give borrowers more time to resume making payments. He said New York Community might be fine without that extension.

“I think New York Community is better positioned than most banks because they underwrote these loans at extremely low loan-to-value ratios,” Fitzgibbon said. “I think they’re in a better position than someone who’s extending on inventory and cash flow.”

While generally viewed as a stable asset, there are some concerns that multifamily loans

While the company participated in the PPP, it classified $103 million of loans made under the program as held for sale on June 30, indicating that the company plans to find a buyer for the originations.

New York Community reported a host of metrics that diverged from the general trends witnessed in the second quarter. Net income rose, including dividends paid on preferred stock, rose by 5.4% from a quarter earlier, to $97.1 million.

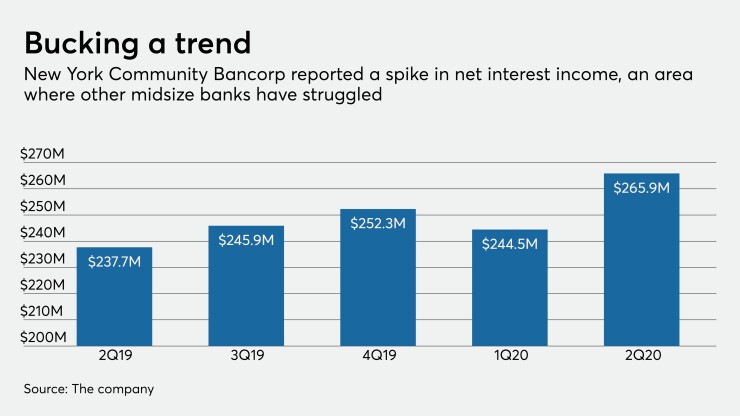

While its 2.18% net interest margin remains well below that of banks with $30 billion to $70 billion in assets, it expanded by 18 basis points from March 31.

“I think it’s a very contrarian story,” Fitzgibbon said. “They’re bucking the industry margin compression trends. Only a handful of companies are positioned the way they are to capitalize on low absolute level of interest rates.”

The low margin reflects the company’s conservative underwriting, which is a positive under current conditions, Fitzgibbon said. To that end, New York Community’s provision fell 15% from a quarter earlier, to $17.6 million.

But nothing is a given under the current circumstances.

“We believe there'll be some further guidance as we move along throughout the year,” Cangemi said. “Our customers are just midway through their deferral program.”