-

At least three serial consolidators are positioning themselves for more deals should the right opportunity arise. SCBT and Iberiabank filed shelf registrations this month, while Wintrust raised $127 million.

March 26 -

Prices fell and the pace of dealmaking slowed last month, but March started off strong with another big deal in Texas.

March 9 -

If 2010 was the year buyers came back to the table, 2011 may be the year they'll have earnest sellers sitting across from them.

April 1 -

2011 was the slowest year for bank M&A in two or three decades, depending on whose count you use. Don't expect a big wave next year, though pressure on small banks to sell will intensify.

December 23

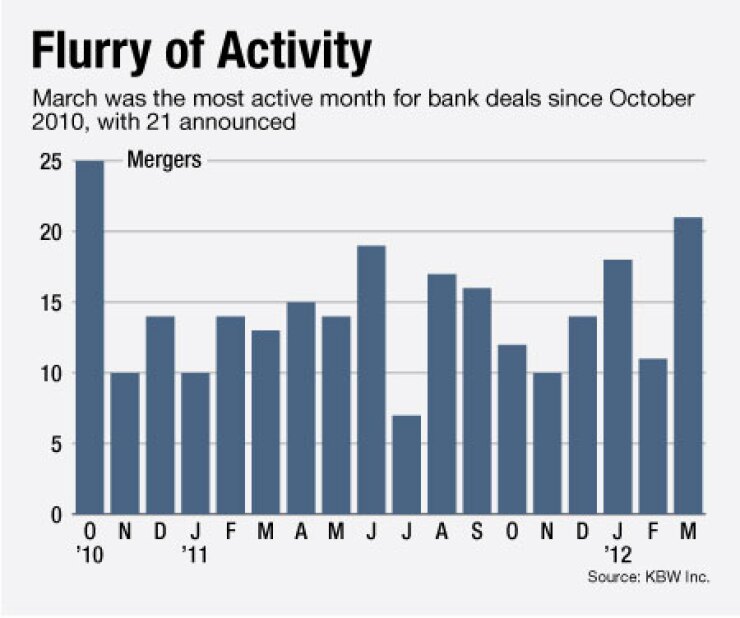

March's deal activity suggests the long-awaited wave of bank consolidation might be nigh.

Banks announced 21 deals last month, based on data from KBW, the strongest month for mergers since October 2010. The first quarter, which started strong in January

"It certainly seems like things are picking up on both the buy and sell side," says C.K. Lee, a managing director at Commerce Street Capital, an investment bank in Dallas. "There's much less reluctance than what there was six months ago. I think people are getting more comfortable with credit and the economic recovery."

The market for acquisitions has moved in fits and starts the past few years, along with the economy. Strong months have often given way to complete duds. But now investment bankers are guardedly optimistic that the industry has finally hit an inflection point, with consolidation in full swing by next year.

"I think we are establishing a clear trend that some of the pent-up demand is starting to resolve itself," Lee says.

To be fair, 'pent-up demand' has been the catch phrase for several years now, with small community banks 'contemplating their futures' and advisors opining about the 'impending consolidation.'

Last spring, several observers were predicting that 2011

It wasn't;

Economic uncertainty, which ticked up last year, was a factor, but potential buyers and sellers were also not quite ready, says Brian R. Sterling, a principal and co-head of investment banking at Sandler O'Neill.

The realities of the post-crisis banking environment had not manifested themselves enough for sellers, while the buyers were still making sure they were truly ready to take on another bank, he says.

Sandler O'Neill has been particularly active in helping banks pair up — the firm was involved in 11 of the 50 deals announced in the first quarter.

"For the sellers, the changes and pressures are not near term or cataclysmic," Sterling says.

"For the buyers,

Several deal advisors said acquisitions are no longer being unwound by unexpected credit issues on either side of the table.

"I'm not sure there are more conversations happening. But when the negotiations begin, we are now more likely to see a deal executed," says Wesley A. Brown, a managing partner at St. Charles Capital, an investment bank in Denver.

"That's the greatest difference. There was a lengthy period of time when every deal we worked on fell apart because either the buyer or the seller blew up."

The recent up-tick in deal announcements, observers say, reflects a considerable amount of elbow grease. Only now, the work is yielding better results.

Jeffrey C. Gerrish, a partner at Gerrish McCreary Smith, says that the deal volume is just a small reflection of all the talk he is hearing from his clients daily.

"It is just the tip of the iceberg. There is a lot percolating around. Banks are initiating negotiations and getting under confidentiality agreements."

Still, Gerrish tempers his comments. "We'll have to see how much of that will come to fruition, but it seems to be picking up."

While more acquisitions are getting inked, deals are still difficult to strike and will continue to take a great amount of flexibility and open-mindedness, Gerrish wrote in a newsletter issued last month to his firm's clients.

"The half a dozen or so transactions we currently have in the office are collectively exhibiting some significant creativity. None of these transactions involve really 'unhealthy/impaired' banks," Gerrish wrote.

"All of them involve some banks with some modest amount of 'hair' on them, however. Because of that, the purchaser must figure a way to mitigate the risks," he added.

"If you are looking to acquire another community bank, be prepared for the need for some creativity and the additional time that may take in connection with the transactions. It appears 'simple' transactions are a thing of the past."

Gerrish says such creativity could mean hold-backs on part of the purchase price or significant indemnifications from the seller. Deals could also include other alternatives, such as having some pool of assets for liquidation as part of the purchase price.

But Lee says the "simple deal" should return as the tide of consolidation rises.

"For every simple [one], there are a couple that require a tremendous amount of work," Lee says.

"As momentum picks up, I think there will be less of a need for creativity."