-

Educational lenders, led by Sallie Mae, are feeling a bit of a tailwind from the economy. But the industry remains on fragile footing.

February 14 -

Policymakers who stood by and watched the mortgage bubble inflate, and then explode, ought to pay attention to what's happening in the student loan market. The parallels may not be precise, but they are pretty darn scary.

November 9

The government's student lending model is built on the idea that everyone should pay the same interest rate. That's true whether the borrower attends Harvard,

That mismatch offers a seeming opportunity for banks, since they can offer lower rates to many of the safest borrowers. So far banks haven't done so — likely because of the public-relations hit they would take if they offered students at elite schools a better deal than their counterparts at less selective institutions.

But now a nonbank startup,

These are people like Kevin Crosby, a first-year business school student at the University of Michigan who hopes one day to work in venture capital. He's using SoFi both to refinance debt from his undergraduate years and to finance his MBA, where his estimated annual costs, including tuition and living expenses, are around $70,000.

While the federal government would charge 7.9% for much of his borrowing, SoFi offers fixed-rate loans of 6.49%. Crosby is also saving on origination fees.

"Students are trying to find the best rate that they can get," he says.

SoFi hopes that another wrinkle in its business model will help ensure that its default rate stays low. The company is using funds invested by wealthy alumni of the universities where it operates to establish loan pools at each school, and then seeking to foster connections between the borrowers and lenders.

The idea is that borrowers who have a deep connection to their lenders will be more likely to repay. "If I borrow from my community, and I default, my default is transparent to the community," says Chief Executive Mike Cagney.

SoFi, which was founded in the fall of 2011, has yet to make a significant impact on the nation's student loan market. Last year the company originated about $100 million in loans, just one-tenth of 1% of the nation's student lending.

But the firm has bigger ambitions. This year it is aiming to originate about $1 billion in loans by taking advantage in what it perceives as a demand for more risk-based pricing.

"Student loans are a trillion dollar industry, but a completely broken industry," Cagney says.

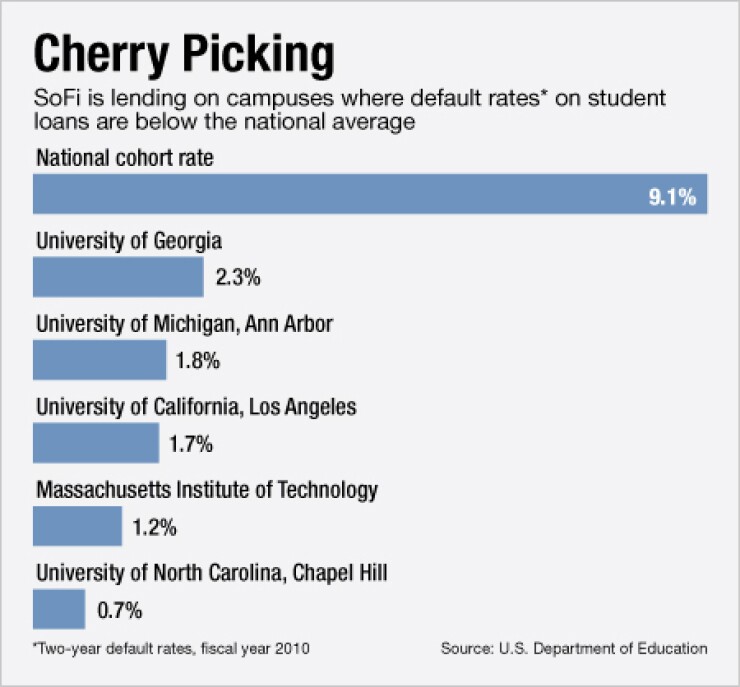

Currently, SoFi is offering loans on 78 campuses across the country, Cagney says. The list includes elite private universities such as Harvard, Massachusetts Institute of Technology, Yale and Stanford, as well as major public research universities, including the University of North Carolina and the University of Virginia.

The default rates on student loans at these schools are typically far below the national average. SoFi gets additional security by making many of its loans to folks who have completed their degrees, have good jobs, and are looking to refinance existing debt.

"By only refinancing for students who graduated, and moreover students who graduated from these elite programs, they really are minimizing the risk," says Andrew Gillen, research director at Education Sector, an independent think tank.

On its website, SoFi boasts that it has yet to have a single default, though Cagney acknowledges that it is too early to gauge the strength of the company's portfolio, given the short life span of the firm's loans.

The peer-to-peer component is a key element SoFi's strategy. Apart from providing funding, alumni are also encouraged to provide borrowers with career advice and the networking opportunities that could enhances the borrower's job prospects -- and make him more likely to repay.

In another example of how SoFi is seeking to foster community, it has established an entrepreneur program. SoFi borrowers who are looking to start their own businesses can pitch their ideas to a board of the company's investors. If the idea gets approved, the borrower gets a six-month reprieve on repayment.

"So you don't have the pressure to pay your debt right away," says Pete Hartigan, SoFi's chief community officer. "And you have a six-month period to incubate your idea."

For prospective investors, part of the company's pitch is about helping today's students at their alma maters.

Former NFL star Ronnie Lott, who is serving as an advisor to SoFi, says the company could also help low-income students attend top universities like the University of Southern California, where he starred as a defensive back.

"You look at students that are able to hopefully go to USC and hopefully have a chance to have a loan," Lott says. "Because of finances, they might not have a chance to be in that environment."

But SoFi does not want to be defined as an organization with a social mission. The company is offering investors a 5% return, with the opportunities to reach the low double digits if leverage is applied, according to Cagney.

It remains to be seen whether SoFi's peer-to-peer lending model can grow to a larger scale.

At this stage, the company's interest rates are often attractive to graduate students in business, law and medicine - since much of their borrowing exceeds the limits allowed in the federal government's lower interest-rate loan programs. For many other students, the government offers a better deal than SoFi does.

But SoFi calculates that 14% of student borrowers nationwide are currently paying higher rates than the default rates at their schools suggest they should.

Last year those students borrowed about $15 billion. "That's our market," Cagney says.

Still, if the market for refinancing the safest federal student loans grows significantly, it could undermine the risk sharing that's built into the government programs, says Daniel Garrett, research associate at the Center for the College Affordability and Productivity.

Garrett acknowledges that the potentially highest earners at top schools are overpaying on a "risk-adjusted basis."

But rates could go up for everyone if the most creditworthy borrowers are removed from the government pool, he says. "That's where you'd see the adverse selection problem."