Bank of America Corp. and JPMorgan Chase & Co. each cast its plans to buy a stake in SLM Corp. as a financial investment that would not affect existing student lending businesses. But that didn't stop observers from pointing out the deal's obvious strategic potential for the three companies.

Analysts noted that SLM, better known as Sallie Mae, brings to the table 10 million student loan servicing customers to whom B of A and JPMorgan could cross-sell credit cards and other financial products. Their student lending businesses could also tap the scale, wealth of underwriting data, and relationships with schools that Sallie enjoys as the leader in the field, analysts said. Related Link

Bradley Ball, an analyst with Citigroup Inc., said the deal combines the strengths of all three companies, citing in a note Monday the value produced by "reworking existing outsourcing arrangements, tapping prospective new investment opportunities, and managing political risks."

Christopher Whalen, managing director of Lord, Whalen LLC's Institutional Risk Analytics, agreed, saying, "Part of the cost … is going to be for the new owners and management team to really put the Kevlar on and go into battle in Washington."

Robert Stickler, a B of A spokesman, said the company made its investment fully aware of the political risks. "We're aware, obviously about all the talk in Washington about student lending, so I wouldn't say we are naive about it," he said Monday. "We are aware of all the proposals, and even given all the factors we think this was an attractive transaction."

Under the terms revealed Monday, B of A and JPMorgan Chase would each pay $2.2 billion; each would get a 24.9% stake in the Reston, Va., student lending giant. The private-equity firms J.C. Flowers & Co. and Friedman, Fleischer & Lowe would pay a combined $8.8 billion for the remaining 50.2%. The two banking companies arranged debt financing for the balance of the $25 billion purchase price.

Bank of America and JPMorgan insisted that Sallie Mae would operate independently of their student lending businesses.

By financing a private-equity bid, B of A and JPMorgan Chase could be trying to prevent other financial institutions from acquiring Sallie.

"I think it's a reaction of two entrenched players who have bought as much student lending businesses as they can practically," Mr. Whalen said. "The market is saturated and it has matured to a point where you see existing players taking each other out."

Tom Kelly, a spokesman for JPMorgan, said: "We told our sales force today we are competing against Sallie Mae just as we were on Friday. … We are not going to put the businesses together in any way. It's an investment, it's not a purchase."

The four investment partners are not permitted to sell their stake in Sallie to one another, Mr. Kelly said.

Mr. Stickler said that "the attraction for us is that we get to participate in what we consider to be a growing market."

"Sallie Mae is the best-positioned company in the industry — they have scale, they have brand recognition, etc., etc. — and the other element for us is that we, as part of the agreement, get some capital markets business," he said. "So it just has a number of attractions."

Matthew Park, an analyst at Prudential Equity Group LLC, said the deal may have been designed to avoid antitrust concerns that could have emerged if Sallie were fully integrated into B of A or JPMorgan. As structured, it was a "smart move for everybody," he said.

Sameer Gokhale, an analyst with KBW Inc.'s Keefe, Bruyette and Woods Inc., said he expects Sallie eventually to share some of its strengths, such as underwriting data, with JPM or B of A.

Sallie Mae's relationships with universities "could be very important affinity partnerships" for the banking companies as well, he said.

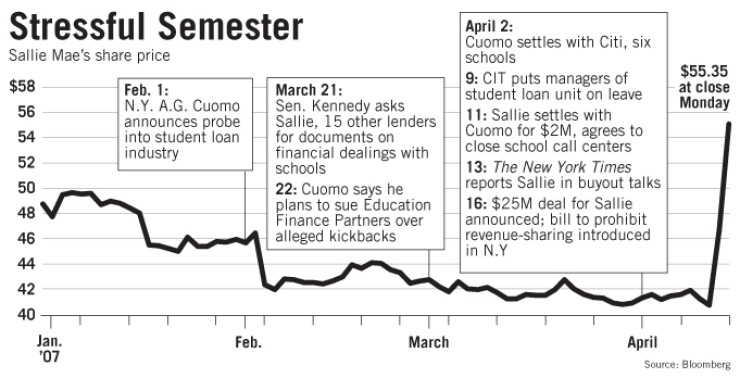

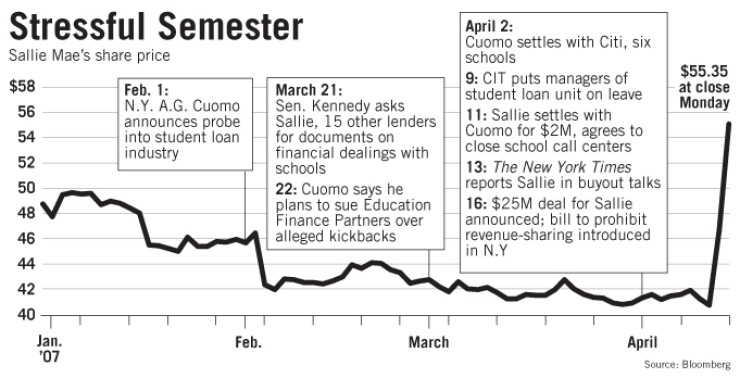

Such relationships have been the focus of an investigation by New York Attorney General Andrew Cuomo, who reached a $2 million settlement with Sallie last week, with Sallie agreeing to end marketing incentives with universities that Mr. Cuomo called "kickbacks."

Sallie's stock had steadily fallen since February, when Mr. Cuomo began probing the industry. "I think given all the legal concerns out there, it may have pushed Sallie into the arms of these buyers," Mr. Gokhale said.

Those same concerns may help explain the way B of A and JPMorgan Chase have framed their investments.

"Given all the sensitivity about marketing practices," Mr. Park said, it is "to everybody's advantage not to talk about integration."

One industry participant dealt a sharp blow by the deal announcement was First Marblehead Corp., an outsourcer of student loan services.

In the fiscal year that ended June 30, First Marblehead derived 42% of its revenue from Bank of America and JPMorgan Chase.

Shares of First Marblehead fell 22% Monday as investors feared that B of A and JPMorgan Chase would divert more of their business to Sallie Mae.

Both banking companies said they intended to complete their contracts with First Marblehead.

First Marblehead chief executive Jack Kopnisky said in an interview that investors had overreacted and that his company had "solid, long-term relationships" with JPMorgan and B of A.

According to Mr. Kopnisky, First Marblehead's contract with JPMorgan Chase runs through May 2010. The lender's contract with Bank of America ends in June 2008 but can be modified in June 2007.

Also Monday, Education Finance Partners of San Francisco said it had agreed with Mr. Cuomo not to create new revenue-sharing relationships with universities and to donate $2.5 million to a fund created by the attorney general. Mr. Cuomo also said Monday that subpoenas had been sent to five banking companies on Friday, including Regions Financial Corp. and SunTrust Banks Inc. Additionally, requests for information on student lending practices were sent to eight banks, including Wells Fargo & Co., Wachovia Corp., and Bank of America.