Many companies still use basic spreadsheet applications to manage their liquid assets in-house, but an increasing number are turning to banks for ways to manage those assets online.

Rising interest rates are prompting corporate treasury managers to seek short-term investments, and regulators are demanding tighter corporate financial controls. Because of those two developments, Internet-based corporate liquidity management services are emerging as a potentially lucrative business for banks.

"Online investing is relatively new in the corporate market," said Kirk D. Black, a vice president at Mellon Financial Corp. of Pittsburgh. But over the last year or so more corporate customers have been "starting to take advantage of the technology that's out there."

Mellon introduced such a service in December 2003 as an enhancement to its online cash management system. As of March 21 it had attracted $5 billion of customer assets from its corporate customers; since then the 90 corporate customers using the service have deposited another $1.5 billion.

Patrick Kilts, a senior vice president at KeyCorp of Cleveland and its institutional sweep investment product manager, said, "I think there's a ton of opportunities" for banks in online liquidity management.

"It's definitely something that the bank industry has missed," Mr. Kilts said.

In the past three years, U.S. banking companies have replaced their PC-based corporate cash management systems, which used software installed on the customers' computers, with Internet-based systems using software hosted on servers at the bank sites. These applications let corporate customers execute payments and keep track of their balances online.

However, Treasury Strategies Inc., a Chicago consulting firm that serves banks, corporations, and other large organizations, says that online investment systems, which would enable these companies to find lucrative places to park their funds, have not kept pace with cash management applications.

About five companies in eight have cash surpluses, the firm said.

A study Treasury Strategies released last week found that 92% of corporate treasurers rely on computer spreadsheets for tracking their company's investments, and only 2% have investment management systems that tie into the enterprise resource planning software that they may use to manage inventory and to track accounts receivable and payable.

The study was based on a survey the firm conducted this year of 663 large and midsize companies, government agencies, and nonprofit groups. The survey, the firm's largest of this type to date, was sponsored by 17 financial companies, including 15 banks.

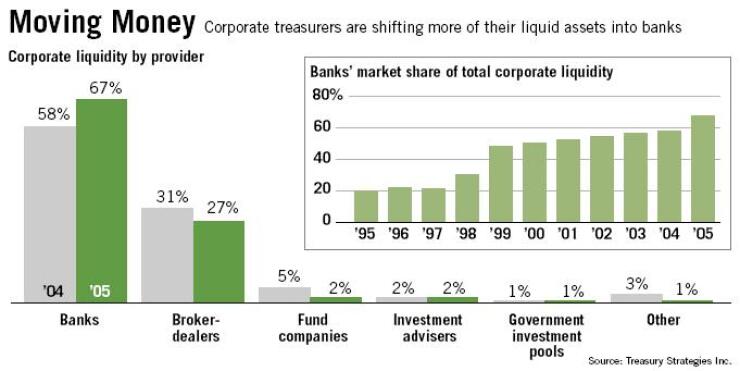

Treasury Strategies estimates that U.S. companies hold $5 trillion of liquid assets - which it defines as cash and various bonds with maturities of less than three years - and that banks control two-thirds of that market. In 1995 that figure was just 20%, and in the past year alone, banks' share of corporate liquid assets increased 9 percentage points, from 58%.

Banks can capture an even greater share of this market, and increase their fee income, by offering services that make it easier for customers to transfer their money from one account to another and from one type of investment to another, Treasury Strategies said.

Corporate cash management is in a time of transition. Sweep accounts, which automatically move demand-account balances into higher-paying investments, have lost their luster in the face of low interest rates. This has provided an opportunity for the banks to offer more aggressive investment management services for customers that still desire higher returns.

Many treasury managers expect interest rates to increase soon and have shortened the maturities of their investments. Treasury Strategies said 57% of corporations' liquid assets are in demand accounts or instruments that mature in less than 30 days, up from 51% a year ago.

Companies are also under growing regulatory pressure from laws such as the Sarbanes-Oxley Act of 2002, which imposed stricter audit and disclosure requirements on publicly held companies, and banks say they can offer more reliable reporting on investments than PC-based spreadsheets.

Michael Hunstad, a senior consultant at Treasury Strategies, said in a conference call with survey participants when the study was released that businesses can improve the returns on their investments by 50 to 80 basis points by focusing on four key areas: investment policies, benchmarking, forecasting, and cash centralization.

The survey found, for instance, that 9% of large companies and 42% of middle-market ones lack basic investment policies for their available cash. Nearly 40% of the survey's participants fail to benchmark their investment results to market yardsticks.

"Every company, regardless of the size of the portfolio, should have an investment policy," Mr. Hunstad said.

Mr. Kilts of KeyCorp said banks are in a natural position to provide these services, because they already keep the records on corporate transactions. "Especially in the middle-market area, there's an enormous opportunity to deliver a basic solution."

He outlined an integrated system that would combine existing functions, such as account analysis and transaction initiation, with forecasting tools that could be integrated with accounts receivable and payable systems. Such an integrated system in turn would lead to online investing systems offering a variety of choices, from overnight investments to those that mature in six months or even longer, he speculated.

"The middle market can really get some value out of an online solution that is integrated," and such customers might be less price-sensitive than sophisticated, large corporate ones, Mr. Kilts said. "The technology is out there. I don't think it has been deployed as effectively as it could be."